23 Sep 2018

What is the market size, growth and margins of Expert Networks?

At Inex One, we asked this question and realized that we would have to obtain the answer ourselves. The only reports available are behind paywalls and somewhat outdated. Now, we happen to be fond of investment research, so we took it on as if it were a due diligence project (minus the slide deck!). Let’s break down the question into smaller parts:

1. What is the market size for Expert Networks?

NB: For an updated answer to this, check out our latest expert network market sizing.

The publicly available answer to this is $1 Bn, from a research firm named Integrity Research. Their findings have been quoted many times (e.g. Bloomberg, and Civic), but no one offers details behind that number. Now we did the analysis ourselves, and here are the details:

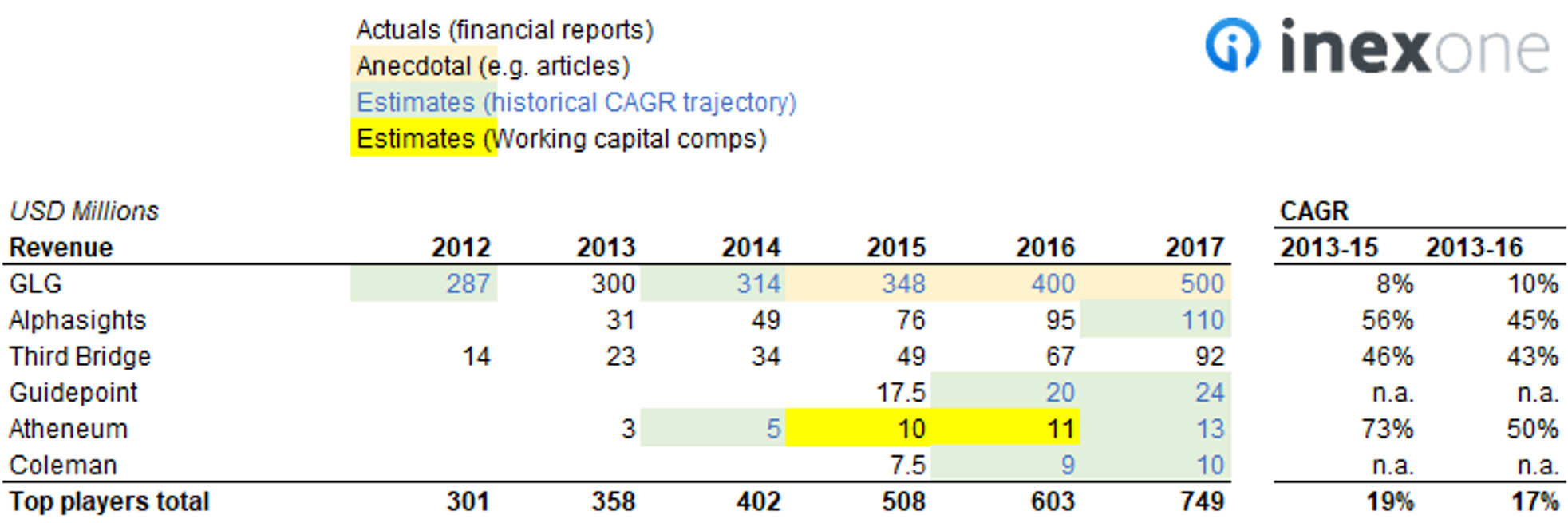

What is the market size for Expert Networks? Approximately $1Bn in 2016. Green numbers from financial reports. 2020 update: The image shows an excerpt from the dataset we compiled for 2016. Our data has developed a lot in our 2020 market sizing (link).

The analysis requires approximation: most Expert Networks are private and smallish and do not publish detailed financial data. Consequently, we’ve added up financial reports with comparables, calculated CAGR trajectories, and the companies’ press/news statements on growth. As many numbers are approximated, it is reasonable to talk about the sizing with the range of 648-1254 MUSD in revenues for 2016. If the market continues to grow at the historical 20%, even the lower bound would reach the $1 Bn this year.

Sense-checking the $1 Bn

At $1,000 per expert call, that means that approx. 1 million expert calls are being made in a year. That’s 200 calls per year, arranged by each of the 5,000 people supposedly working in expert networks (according to Owler). 200 calls per year means arranging 4/week, or <1 call per workday. Now, everything isn’t calls as expert networks also offer surveys etc., but the $1 Bn market size still feels reasonable.

2. What is the growth of Expert Networks?

Recent growth was 20%. We get to the growth numbers in a way similar to the market sizing, only looking at it over time. The same limitations as above apply, meaning that also many of these numbers are approximate. GLG clearly is the behemoth in the market, and its recent growth numbers are only anecdotal:

– “GLG has grown fast and forecasts that its revenues will rise by 15 per cent this year to $400m” – Financial Times article, June 2016

– “The privately held New York company had revenues of about $500 million in 2017, according to published estimates.”

– Report financed by GLG, May 2018

What is the growth of Expert Networks? Approximately 20% in recent years (when also considering the many recently started networks).

3. What are the profit margins of Expert Networks?

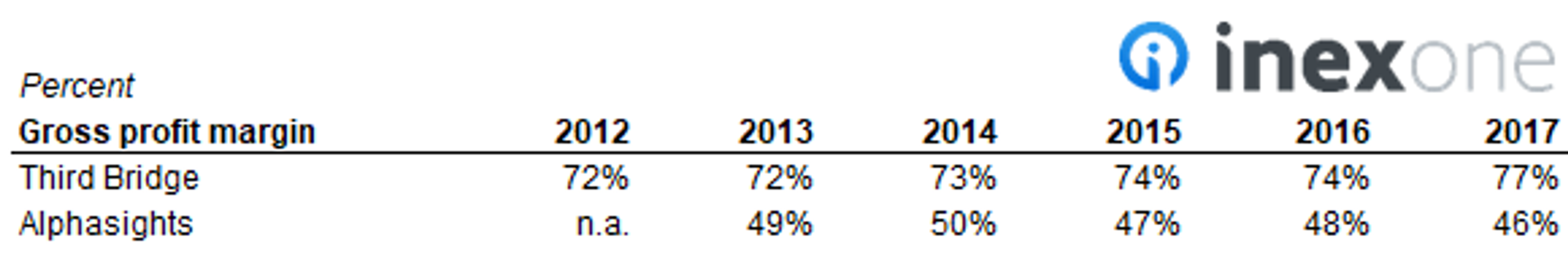

Expert Networks enjoy 70% gross margins. We have access to recent financial reports of Third Bridge and Alphasights. Over the 4-year period 2013-17, Third Bridge’s average gross margin was 73%, and Alphasights’ was 60%, when adjusting for the salary costs (OpEx) that they report as part of their COGS. Put together, these two companies make up ~20% of total market revenue and had a 66% weighted average gross margin in 2013-17 (including the OpEx/COGS adjustment).

Now are these two companies representative of the market? They might be, given the similarity in operating models and services sold. I will leave that for you to assess.

All the other expert networks are either in jurisdictions where reports are not made public (e.g. GLG, Guidepoint), or too small to report their full P&L (e.g. Dialectica and NKP only publish abbreviated reports).

Reported profit margin (not adjusting for AlphaSight’s OpEx/COGS reporting)

So call me maybe

So what do you do when data is scarce? Call an expert. Over the last months, I’ve spoken to about 30 former executives at different expert networks. They collectively indicate that gross profits are rather 70-80%. Because of this, I apply a higher weight to Third Bridge’s reporting, and estimate that industry gross profits are 70% on average.

Now what does this all mean?

Expert networks are successful because they add value to their customers. They offer something tremendously helpful – expertise-on-demand – by setting up telephone conversations between experts and organizations that seek expertise. In many cases, expert networks recruit people that did not even know that they are experts at something.

The Inex One Expert Management System helps organizations capture more of the value on offer, by making it easier for you to work with expert networks.

Interested in a demo? Get started here.