21 Aug 2018

How do investors use Expert Networks for due diligence work?

Clients use expert networks to obtain deep content expertise, on demand.

When I was in consulting, I enjoyed doing commercial due diligence (“CDD”, or just “DD”) work, mapping out the attractiveness of an industry niche and the relative strengths of the companies operating in it. My affiliation with the Strategy & Corporate Finance (S&CF) service line meant that I got to do my fair share of this work. I think DDs have an unfairly poor reputation: managed right and with good leadership on the team, they can be rather satisfying with large components of fact-based research and analysis.

Expert Networks have become central to DD work. The experts that they supply provide deep content insights, especially helpful for forward-looking time perspectives like when you estimate future revenues and cash flows.

In a Due Diligence, you may or may not get data from the target company itself. You would typically get it when helping a company to get sold (i.e. a vendor due diligence, “VDD”) or in a later-stage buy-side DD, when the target company opens its books to a few select bidders.

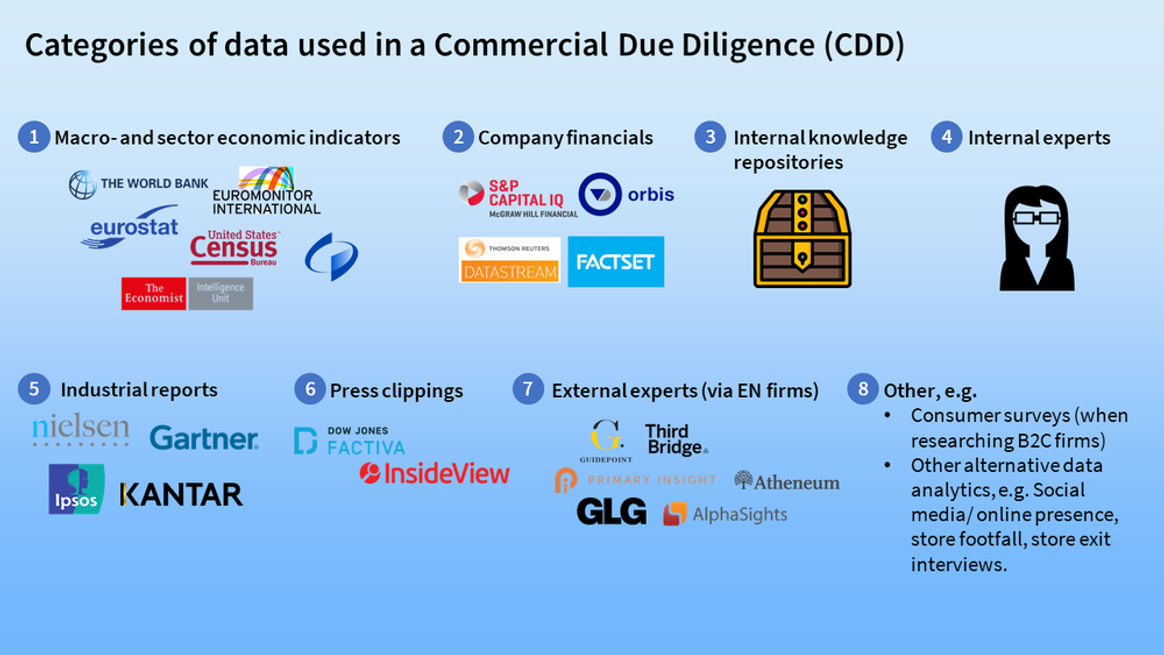

In addition to this target-internal data, there are eight categories of data that I would always use (If there are any additional categories, please comment. That might explain why I’m not partner in a consulting firm by now… ;).

Eight categories of data used in a CDD

Macro- and sector economic indicators. These are used to describe underlying macro trends that might affect an industry.

Example: The demand for dishwashers depends partly on the amount of new homes built. Hence both demographic forecasts and construction data can help inform your market forecast for the dishwasher market.Company financials. The hard numbers in financial reports from the target company, its competitors and customers (let’s call these “TCCs”) are central in all valuation exercises.

Example: You access financial reports for your dishwasher manufacturer, its competitors, key component suppliers and main customers (e.g. large property developers) to assess the relative strength and performance of players in the value chain.Industry reports are published by research firms, industry associations and government agencies, some of which are even free to access. In addition to being a digest of relevant public information, they often include components of custom data collected for the report.

Press clippings. Considering all relevant press on the TCCs are a “hygiene factor” to every serious Due Diligence. There are multiple services that aggregate all published articles, by keywords.

Internal knowledge repositories. Certain consulting firms have over time accumulated significant internal databases. These will help you to approach different markets and industries, based on previous projects or original research that the firm has done. Although sanitized from confidential/client-specific data, these guides can be tremendously helpful in understanding e.g. value-chain dynamics or niche technical solutions.

Internal experts. Similar to the knowledge documented in internal repositories, firms also employ specialists that can be called upon to help in DD projects. This holds true for consulting firms, but also for larger investment firms and corporates.

Example: Our dishwasher manufacturer is expanding from Germany to Spain, Japan and the USA. You reach out to your colleagues in each country, to get a quick overview of the main competitors and trends in their respective market.External experts via Expert Networks. Since it’s not feasible to employ an infinite number of experts of all trades around the world, leading investment research firms contact external experts for short consultations. These experts typically help with forward-looking insights, commenting on technical and regulatory trends, key purchasing criteria (KPCs) and trajectories of market competitors.

Example: You call 10 experts each in Spain, Japan and the USA, who have been working as either sales directors of dishwasher manufacturers, procurement managers at major customers. You ask these experts about the top players in each market, how they score on customers’ KPC:s, and what they think of trends affecting the market (topline and margins) in the next five years.Other. Depending on the industry of the target company, you may use additional types of data from e.g. exit interviews, consumer surveys, social media comments etc. In my experience, these are most valuable when the target company is selling to consumers (“B2C”).

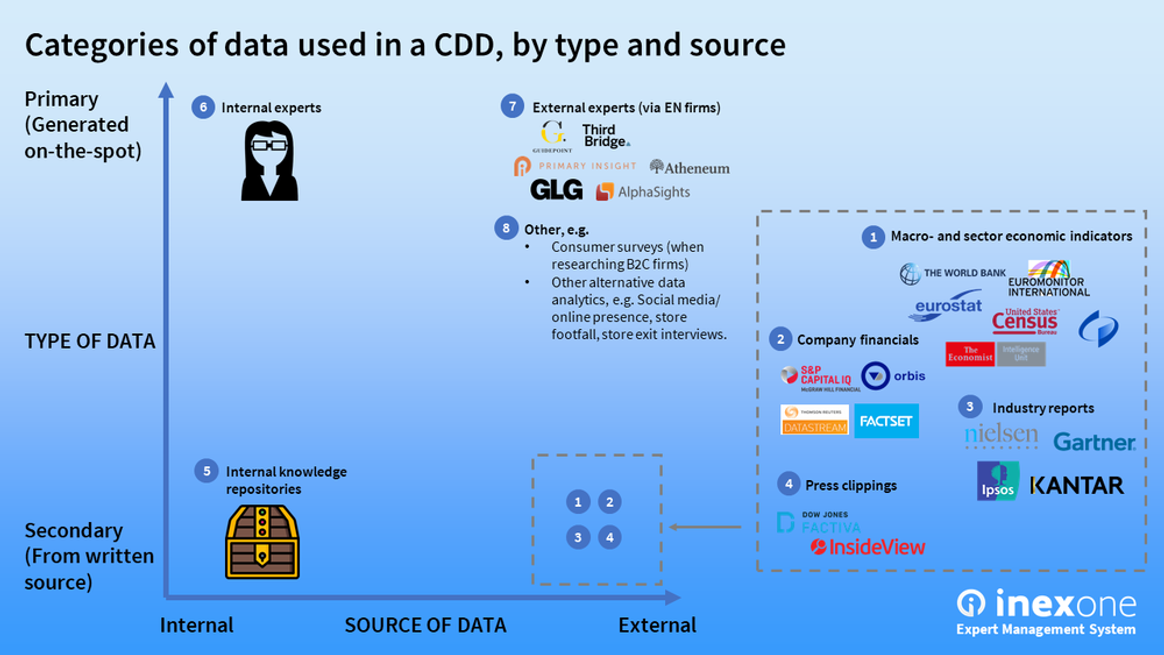

Below I plot all eight data categories based on how to obtain them (internal v. external sources) and whether they are primary or secondary sources. This illustrates how the categories differ – and that great internally curated data can be a source of competitive advantage in investment research.

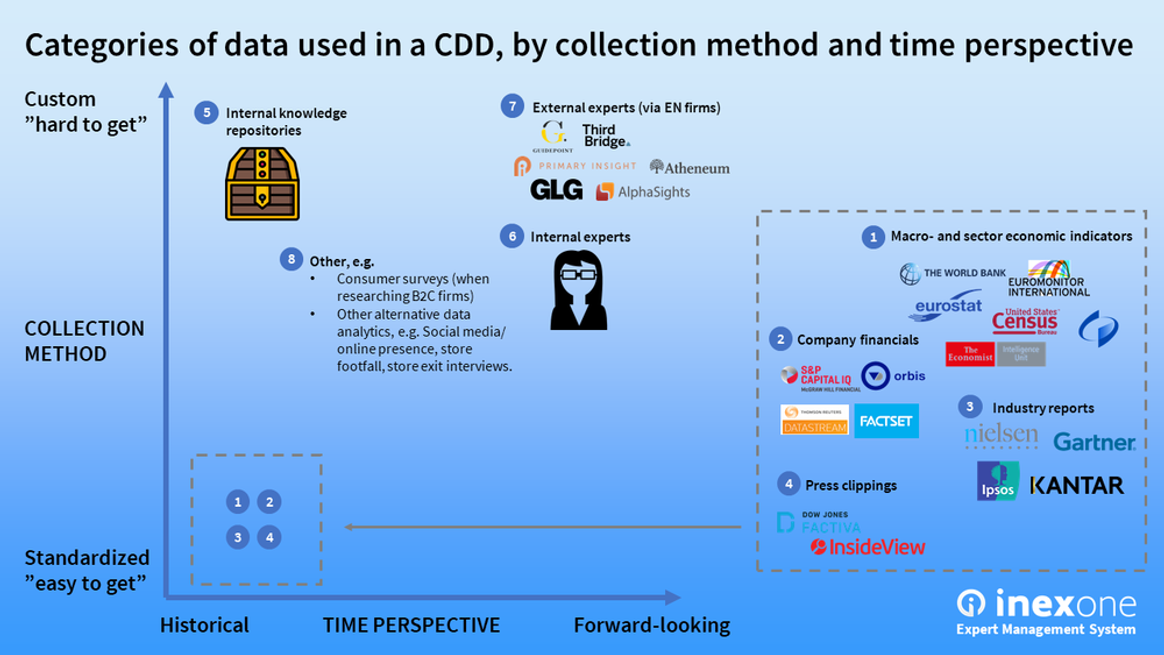

Another way of looking at the categories is the collection method and time perspective, which I’ve plotted below.

Categories 1-5 will show you different angles of what has already happened. Since most valuation exercises include a component of discounting future cash flows, you’ll need a perspective on those too. I would extrapolate historic trends as a start, and then use data from categories 6 and 7 (expert calls) to add insight to my forecast. (Category 8 – “Other” – is a catch-all bucket here. In my experience it’s mostly historical and customized data, putting it mostly in the top left corner).

This means that some data categories are “must-have basics”, whereas others are used to get an edge in investment research. In a DD, professional bidders will have access to the standardized/historical data categories. To get an edge in your investment research, you top up with insights with custom/forward-looking data. The main source for this is experts. If you happen to have them all internally – congratulations! – otherwise, turn to the expert networks.

How do I get the most out of Expert Networks?

As a consultant, I activated expert networks at the start of each Due Diligence project, often reaching out to 4-5 of them at once. Although it was a bit tedious to keep them all updated, the expert networks always came up with different experts. This meant that the more expert networks we engaged, the larger the pool of available experts that we could choose from.

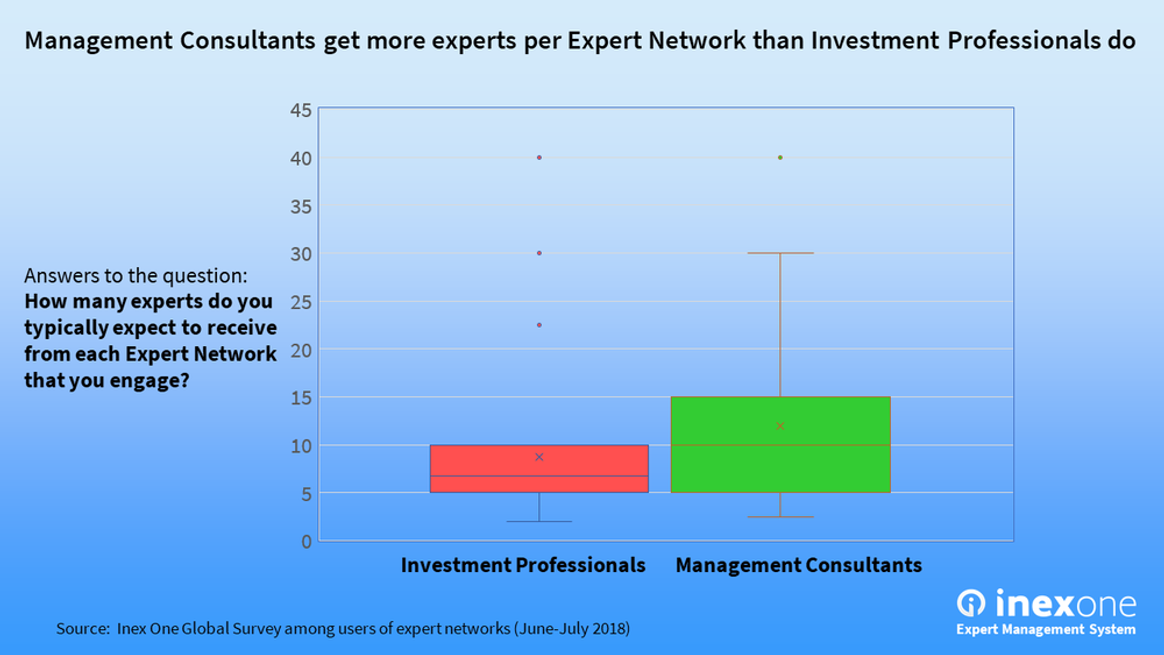

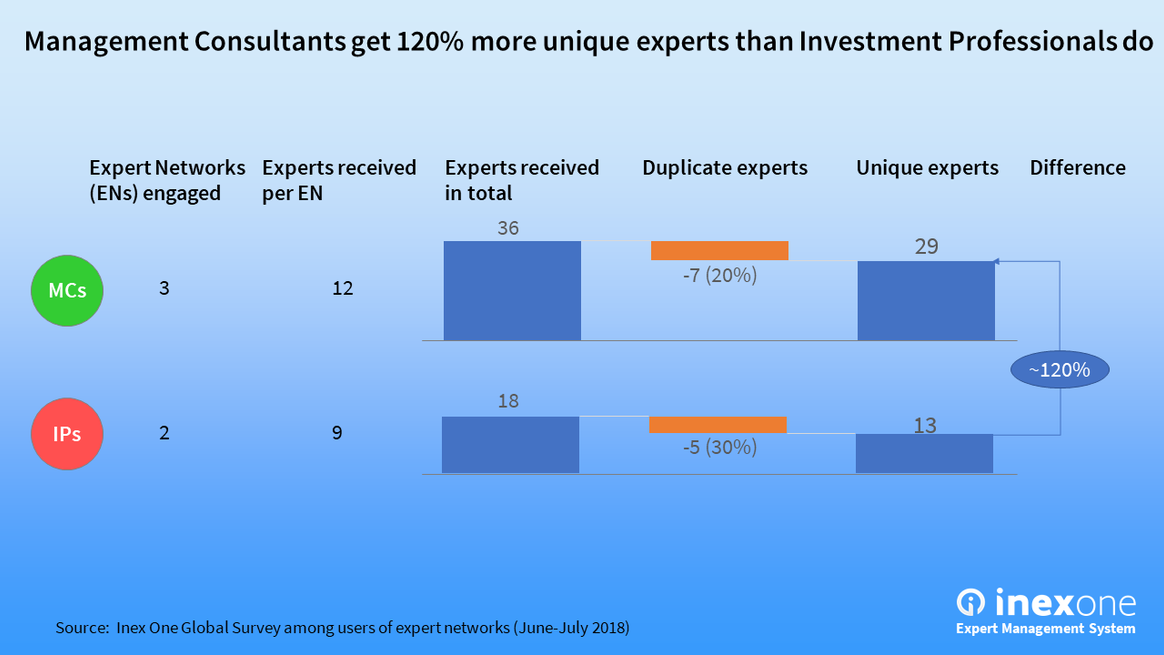

Our recent survey on expert networks users yielded some interesting insights on this. Management consultants engaged on average 3 expert networks in a typical project, whereas investment analysts averaged 2. From each network, they would expect to receive anywhere between 0-40 experts suggested. On average, management consultants (MCs) expect to get 12 experts presented from each network that they engage, whereas the average Investment professional (IPs) would expect to get 9 experts suggested per network.

This finding was consistent across the board: MCs seem to receive more experts from expert networks than IPs do. This may have to do with the nature of their projects, or their frame agreements, or their level of spending – I don’t know the answer.

Unique experts for alpha

We took it one step further, and asked respondents what share of expert profiles received were duplicates, meaning they were received from more than one expert network. MCs saw median 20% duplicates (22% avg.), whereas IPs saw median 30% duplicates (29% avg.). If the sample is representative, it means that MCs get way more unique experts for their projects than IPs do.

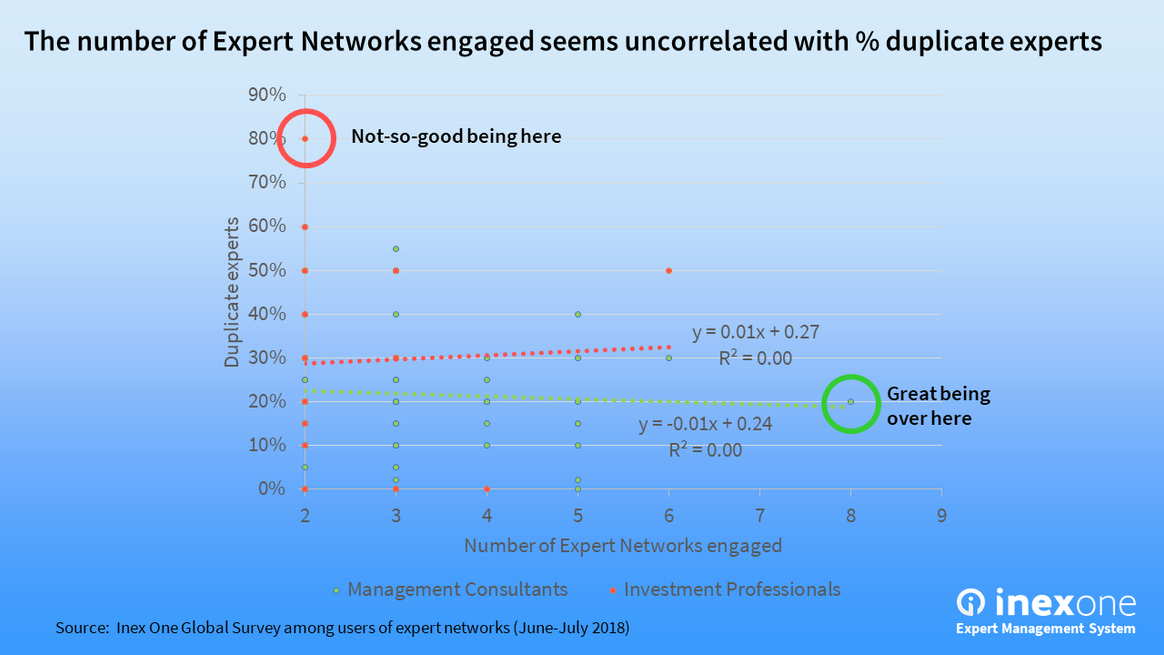

Getting duplicate experts obviously requires that you use more than 1 expert network to start with. Therefore, respondents who reported only using one expert network have not been included in the above calculations. However, the share of duplicates does not seem to increase strictly with the number of expert networks engaged. Among the 91 respondents who reported engaging more than one expert network, there is no correlation between the number they engaged, and the share of duplicate experts received.

How can I get more unique experts for my DD?

The short and obvious answer is: engage more expert networks. Given the low reported share of duplicates (the world is big!), each incremental expert network will add unique experts.

However if you’re already engaging a handful of expert networks, we do not know why some users seem to get more unique experts than others. It may however have to do with which expert networks they engage. MCs reported using niche expert networks to a larger extent than did IPs (who mostly reported using only the major networks). Back when we ran the niche expert network Previro, customers often mentioned that we suggested experts that were different from what the large networks had. Perhaps adding a couple of niche networks is the key to getting more unique experts for your Due Diligence?

Inex One helps clients engage as many Expert Networks as they desire, making it easy to coordinate the communication, lists of experts, and billing in one dashboard. Interested to know more? Contact us.

Icons from Flaticon, under the Creative Commons.