17 May 2021

The bright future of expert networks

Expert networks have become commoditized. That is bad for all parties involved: the clients, the experts and the employees at expert network firms. On the flip side, this is a unique chance for networks to become the specialized thought-partners that their clients need and their employees deserve to work at.

In this three-part series, we assess how to optimize for user experience in our industry, improving value for clients, experts and expert networks themselves.

Once upon a time, in a skyscraper far away...

2000s - The first expert networks started out some 20+ years ago, as specialized thought partners to mostly US-based hedge funds. The experts were taken care of as, well, real experts would expect to be treated.

2010s - Over the next decade, expert network usage exploded. Far beyond niche hedge funds, now private equity consulting and corporate strategy teams are using them to access expertise. To keep up, expert networks recruited armies of young graduates to serve as generalist recruiters.

2020s - We cover the expert network industry of today in a three-part series:

Part 1: Situation. LinkedIn eroded the entry barriers. The industry is booming - and fragmenting.

Part 2: Complication. The expert network industry is suboptimized for user experience.

Part 3: Resolution. There’s a way for expert networks to add more value to their clients, while developing defensible moats.

We analyze all components below and share our thoughts on what comes next.

Part 1: Situation

1.1. LinkedIn eroded the value of internal expert databases

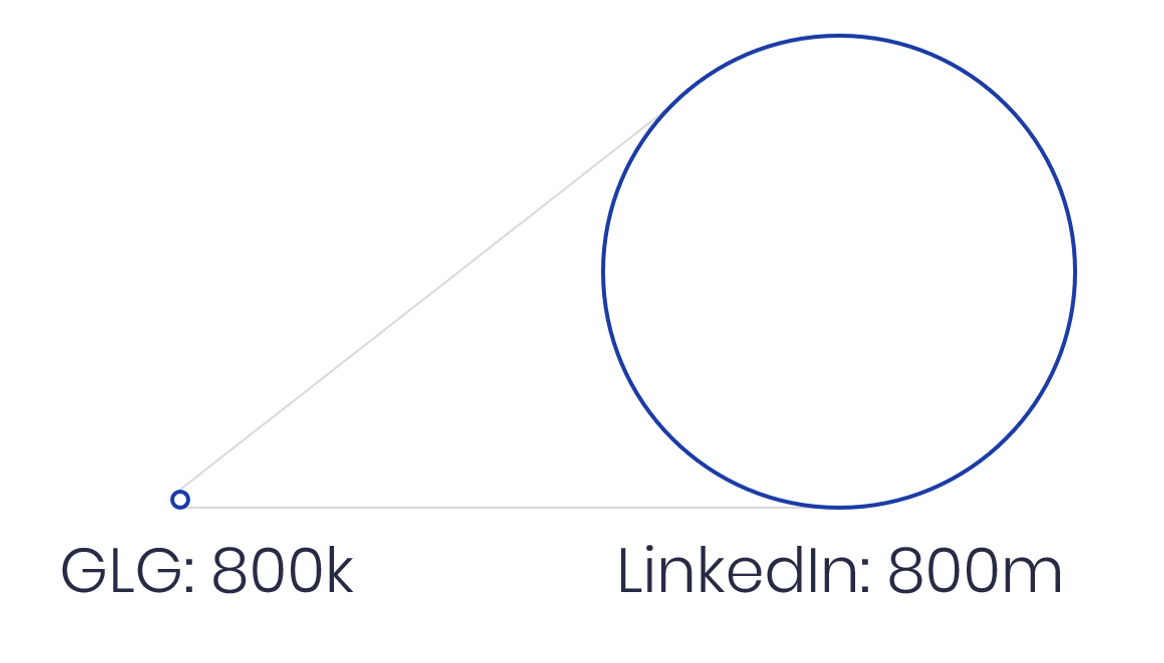

Size of GLG's profile database compared with LinkedIn's database

In the early 2000s, the first expert networks built internal databases of experts.

In the 2020s, modern expert networks recruit bespoke experts on the web.

The largest expert networks today (firms like GLG, Guidepoint), have databases of some 800k profiles, accumulated over 20 years. (This means some of those 800k experts were relevant back when people still had flip phones and watched Mission Impossible III in cinemas 🙃).

At the same time, LinkedIn alone has grown to 800 million profiles

This means that the database isn't worth much any longer. As we've seen before, nothing is older than yesterday's news: internal expert databases quickly grow stale, while profiles on the internet stay fresh. That, in turn, explains why...

1.2. The industry is booming - and fragmenting

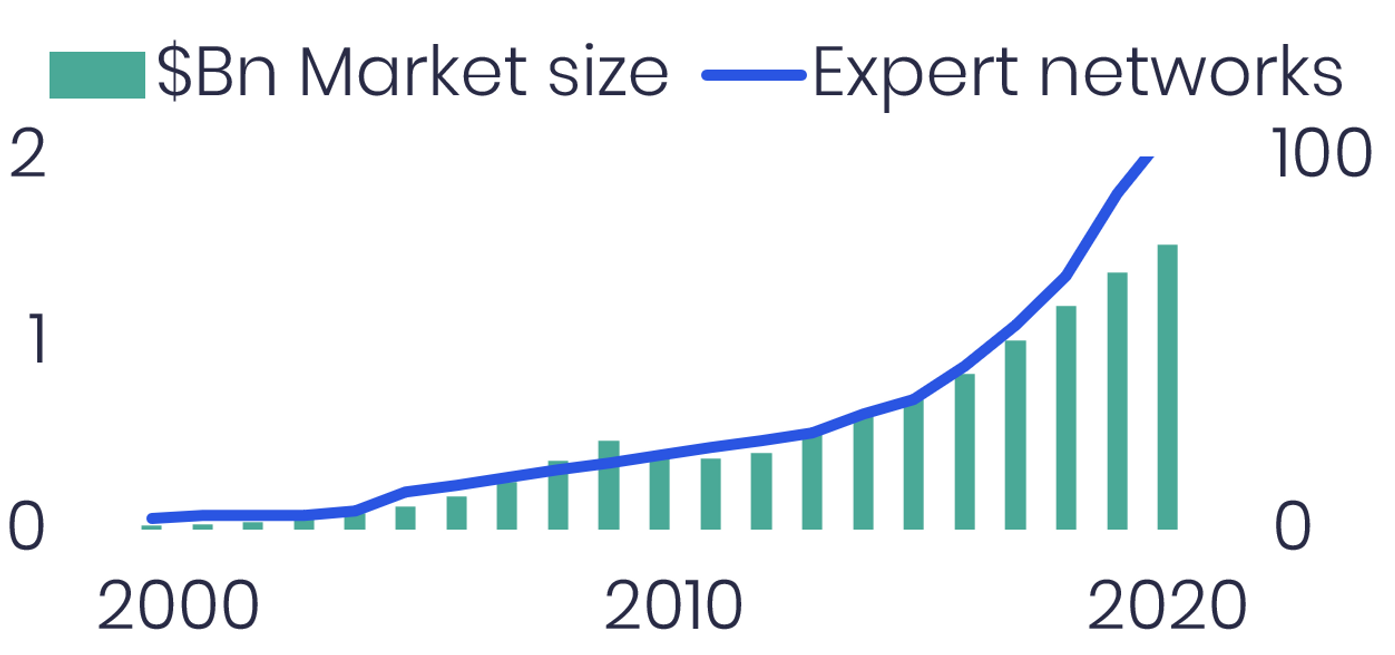

The expert network industry is booming and fragmenting

The expert network industry is increasingly fragmenting, as new players enter the market with specialized offerings. Since we discussed fragmentation v. consolidation in 2019, the industry fragmentation has continued. This is best illustrated by the >$50m of venture money going into young expert networks, in the last year alone! 🤯

Now, there are apparent risks in flooding the market with expert networks. We cover this and more in the next part of our series, published in the next few weeks.

Part 2: Complication. The expert network industry is suboptimized for user experience.

Part 3: Resolution. There’s a way for expert networks to add more value to their clients, while developing defensible moats.

In the meantime, take a sneak-peek into the future here.