04 May 2021

How Do Expert Networks Manage Compliance?

Compliance in the expert network industry

Compliance has been a major focus for expert networks and their clients for 10+ years.

Understanding what is truly important and how to achieve compliance can be a daunting task.

Ultimately, the main requirement of compliance is an error proof process with limited manual review - current processes are mostly manual and prone to errors.

By leveraging software, compliance standards can be scaled across networks, while providing more security than even the most developed compliance processes at large expert networks.

Expert Network Compliance

Expert network compliance has been front and center for firms over the last 10+ years.

Starting in the late 2000’s with high profile insider trading cases - the risks associated with unfettered expert access were laid bare.

Expert networks began expanding internal compliance teams to act as an interface with client compliance teams and implement their controls. An expert network lacking an internal compliance team could be cut off from serving entire client groups - such as hedge funds and mutual funds.

Full fledged compliance programs at the expert networks became a standard and bare minimum requirement to play in the arena.

And of course, networks soon began competing on who had the “best” and most reliable compliance programs. This kicked off a period in which compliance began to take on a mystical quality - a mysterious force that only certain firms can summon the full power of.

What Does Compliance Actually Mean?

Compliance is a very serious matter and deserves buy-in from the highest levels of both clients and expert networks. Although despite the high-minded talk, expert network compliance is quite simple and should not be a mystery.

Here are the key objectives of compliance for pretty much every firm:

Do not access material non-public information (MNPI) that could lead to insider trading.

Do not speak with anyone that has a conflict of interest, or with blacklisted companies/individuals.

Keep a record of all calls and individuals involved - the expert’s signed terms and conditions as well as affirmations that they understand the requirements before a call takes place.

Ensure that an expert is who they say they are.

Above all else, a reliable compliance program requires a standardized process that eliminates the chance of human error or mistakes.

That’s it. There are some outlier situations, but this covers 99% of scenarios.

How Do You Achieve Compliance Standards?

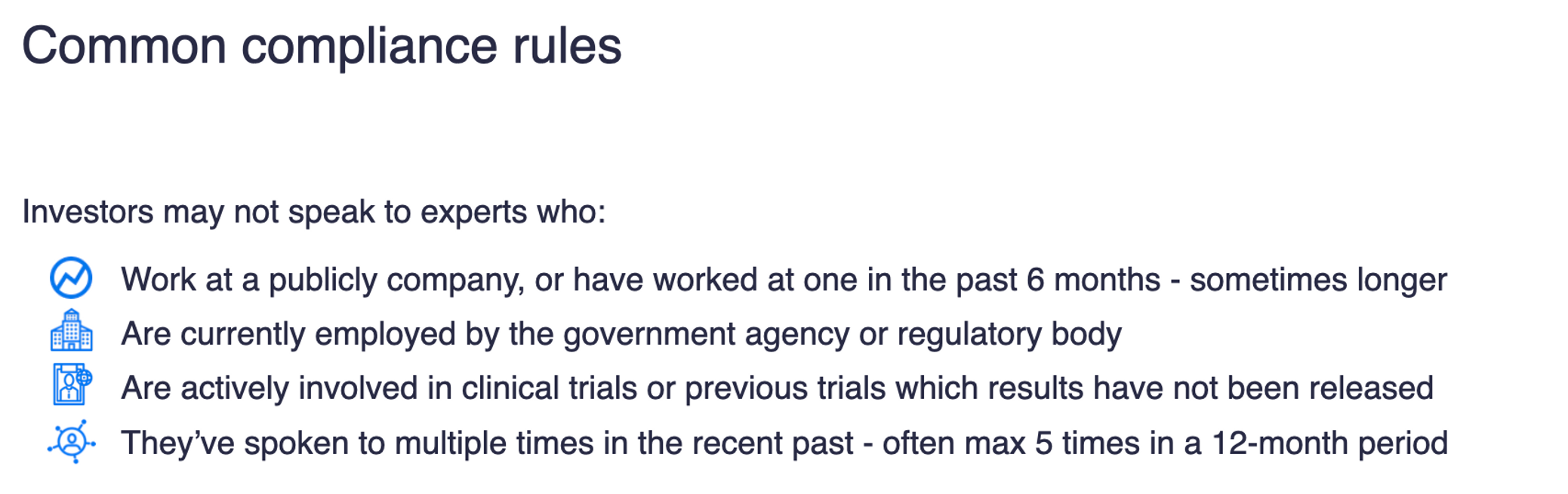

Now the way that firms - especially those trading public equities - protect against this risk is by requiring certain restrictions to be employed during expert recruitment in order for an expert call to take place. Here are the most common ones:

Do not speak to experts currently work at a public company, or have within the last six months - sometimes longer.

Do not speak to experts currently employed by the government or a governmental/regulatory agency.

Do not speak to experts actively involved in clinical trials - or in trials whose results have not yet been released.

Limitations on the # of calls with an individual expert each year - for example maximum of 5 calls with an expert in any given year.

If these rules are followed and the expert’s sign the T&C’s - the risk of a damaging compliance breach is at it’s absolute minimum.

As you can see, it all comes down to execution.

Common expert network compliance rules

What Comes Next?

The biggest risk in compliance is the introduction of manual processes that create the potential for oversights, errors or documentation gaps.

If you are a hedge fund, then you are likely working with 2-5 different expert networks and their compliance teams. Keeping track of the separate compliance processes in email or separate compliance portals across the firms is a pain and requires chasing down and confirming information constantly.

Inex One has seen our hedge fund clients simplify and derisk their compliance process by implementing a single interface solution that enforces a standardization of compliance and a central data node across all their networks.

By employing software that forms to their specific compliance process, all networks comply as part of their standard workflow. Experts' bios, signed terms and conditions and approval history are in ONE place for the hedge fund compliance officer to review and approve in real time.

If any network does not follow the process or skips a step, it is flagged and raised to the compliance officer immediately.

Inex One has fully a customizable compliance software to give teams a real time view of activity - approve calls, audit and drop in on live calls to ensure they are up to standard.

A new era in compliance controls has arrived - reach out to give the tool a try at your firm.