09 Feb 2026

Expert network market size in 2025: The $3Bn Market Overview

TL;DR

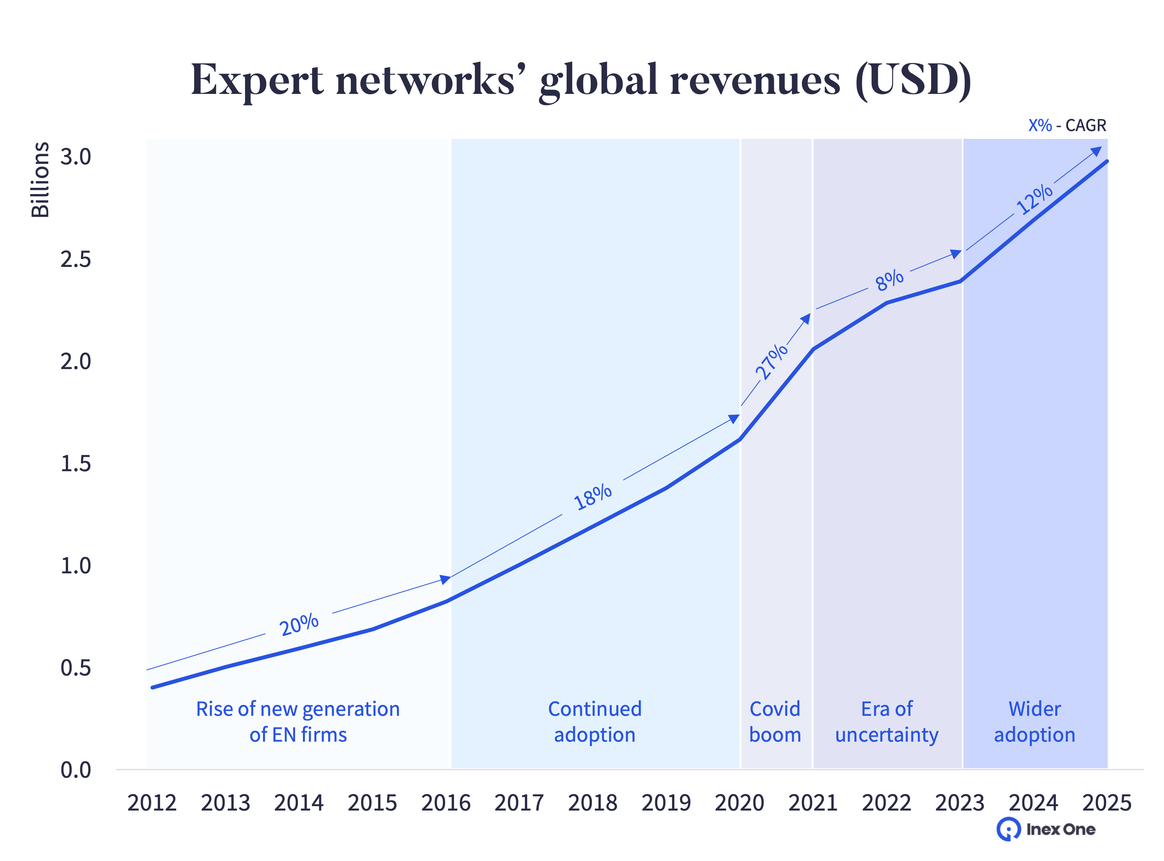

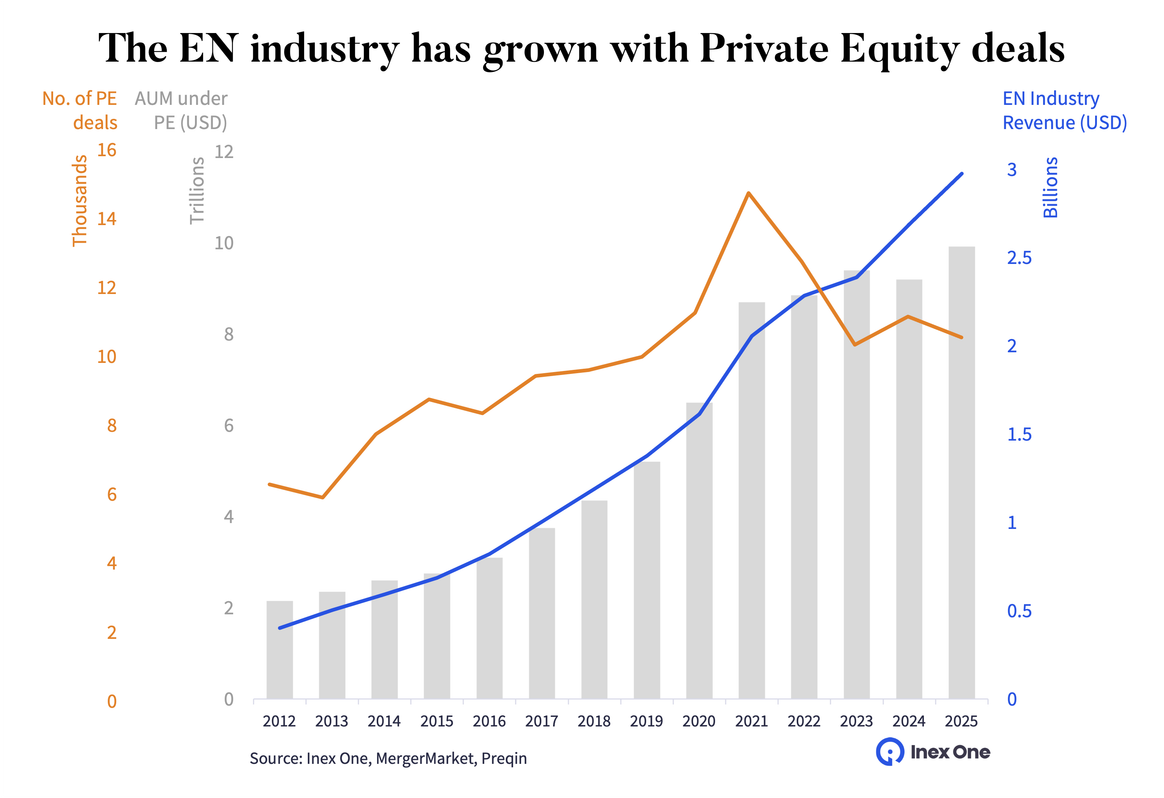

The expert market network hit ~$3Bn in 2025, growing ~12% annually (2023-25) after a quieter stretch (2021-23).

Growth is back, but service diversification and intensifying competition are set to reshape the industry in 2026.

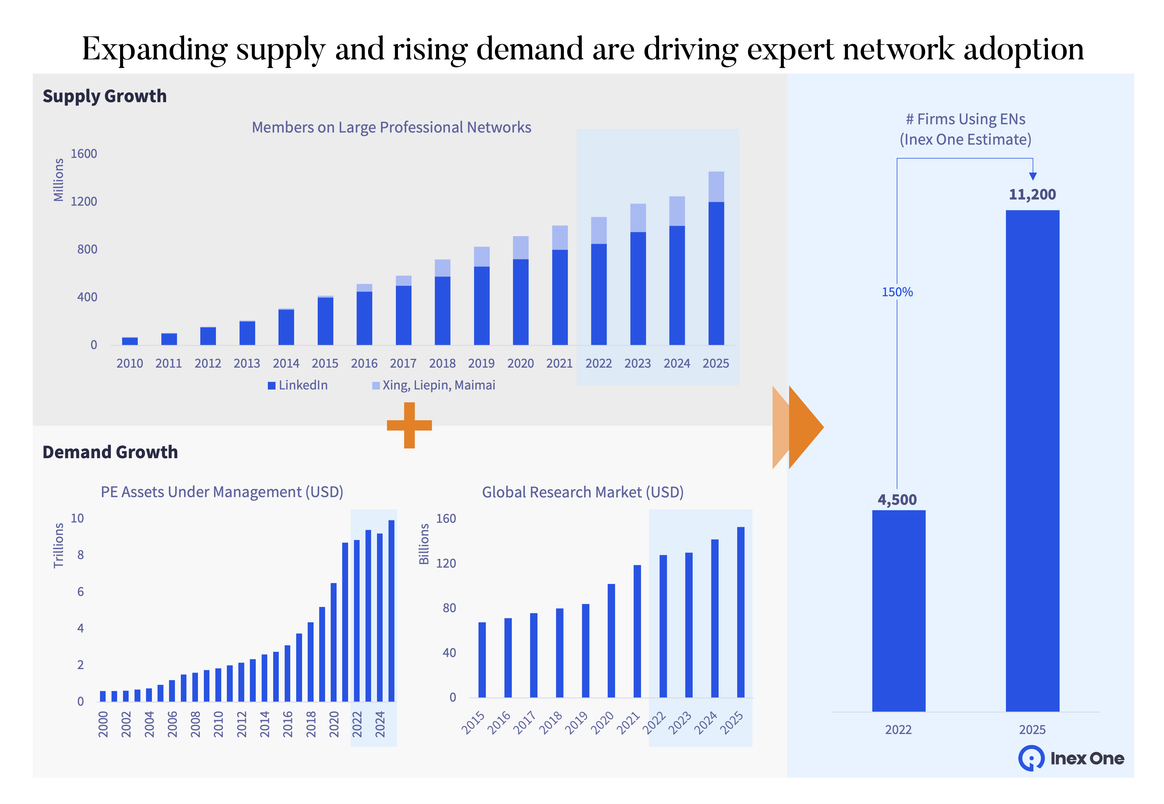

Supply and demand are both expanding: more experts, continued PE-driven research needs, and broader corporate adoption helped increase the number of firms using expert networks by ~150% (2022-25).

Consulting remains the spending engine (~50% industry spend), while Corporates are now the adoption engine (~45% clients by number).

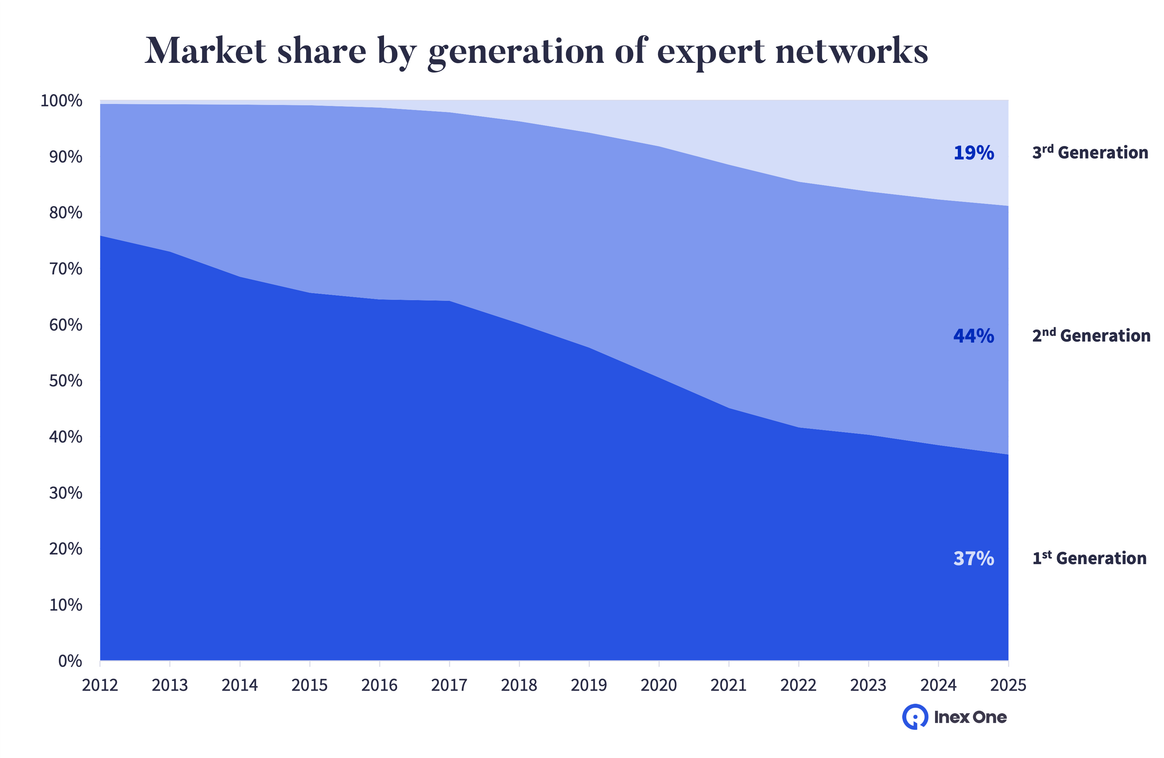

Legacy players continue to lose market share to newer generations of firms: 1st gen share 37% vs 44% for 2nd gen firms.

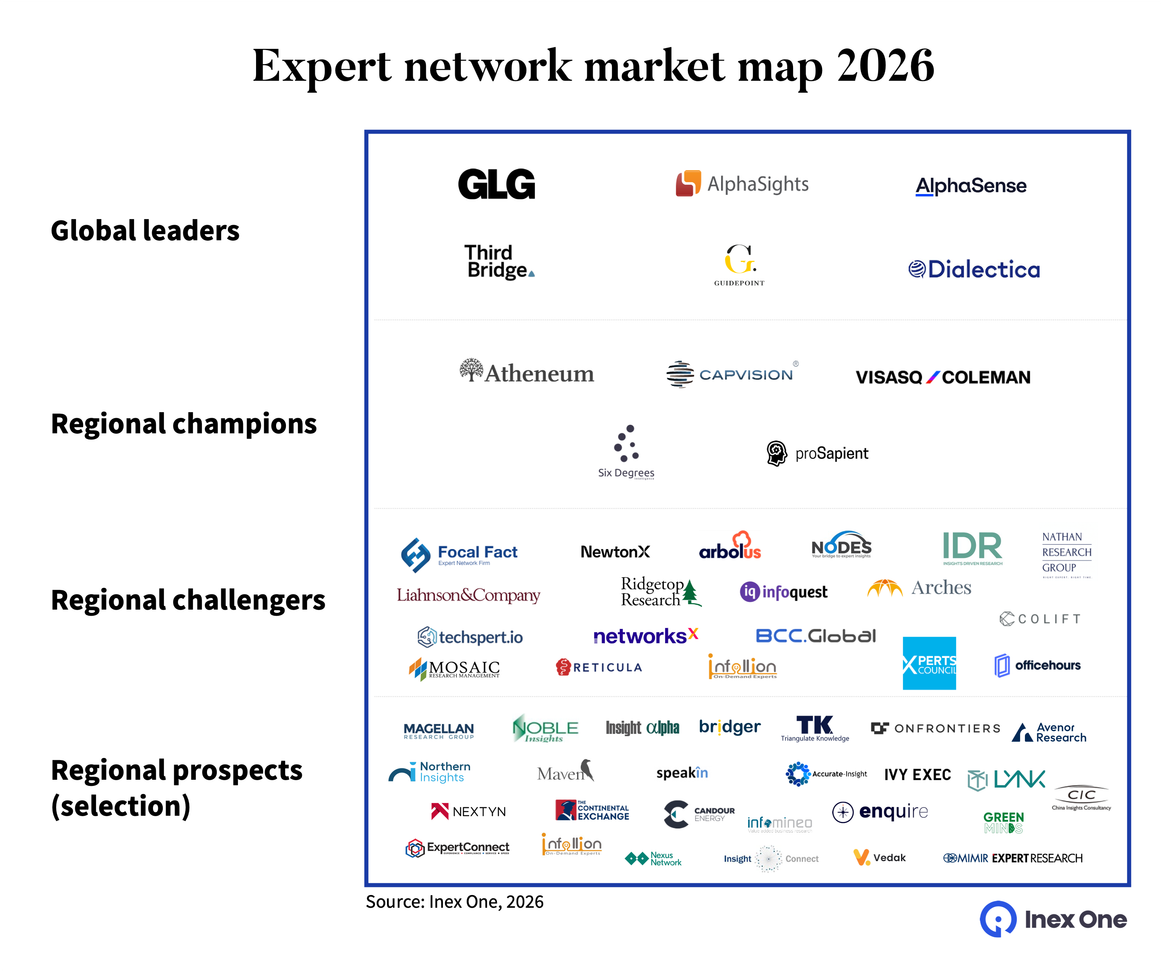

The market is global at the top, but fragmented underneath: only a handful players compete worldwide, while newer firms win by specializing in regions, verticals, or new models.

The trend in 2026 and beyond next era looks tech-first and more efficient: platforms like Inex One are making the market more competitive by routing demand towards agile networks.

The Expert Network industry is back! We estimate the Expert Network industry reached ~$3Bn in 2025, growing 12% annually between 2023-25 after a quieter stretch. The past year had parallel storylines, with growth, service diversification, and intensifying competition. In this report, we look at the evolution of different ‘generations’ of players, from first generation giants to younger, tech-driven challengers, and share our take on who is winning and what trends actually matter in 2026.

The industry has seen around 16% compound annual growth over the last decade. This growth is primarily driven by widespread adoption of expert networks in the growing private equity industry and the strategy consultants they engage. But in recent years, we see corporate strategy and market research teams who had never used the service before becoming regular customers. They now make up ~45% of the clients by numbers! Strategy consultants and private market professionals transitioning to corporate teams and bringing their favourite tools along has inevitably helped as well.

The slump and the rebound

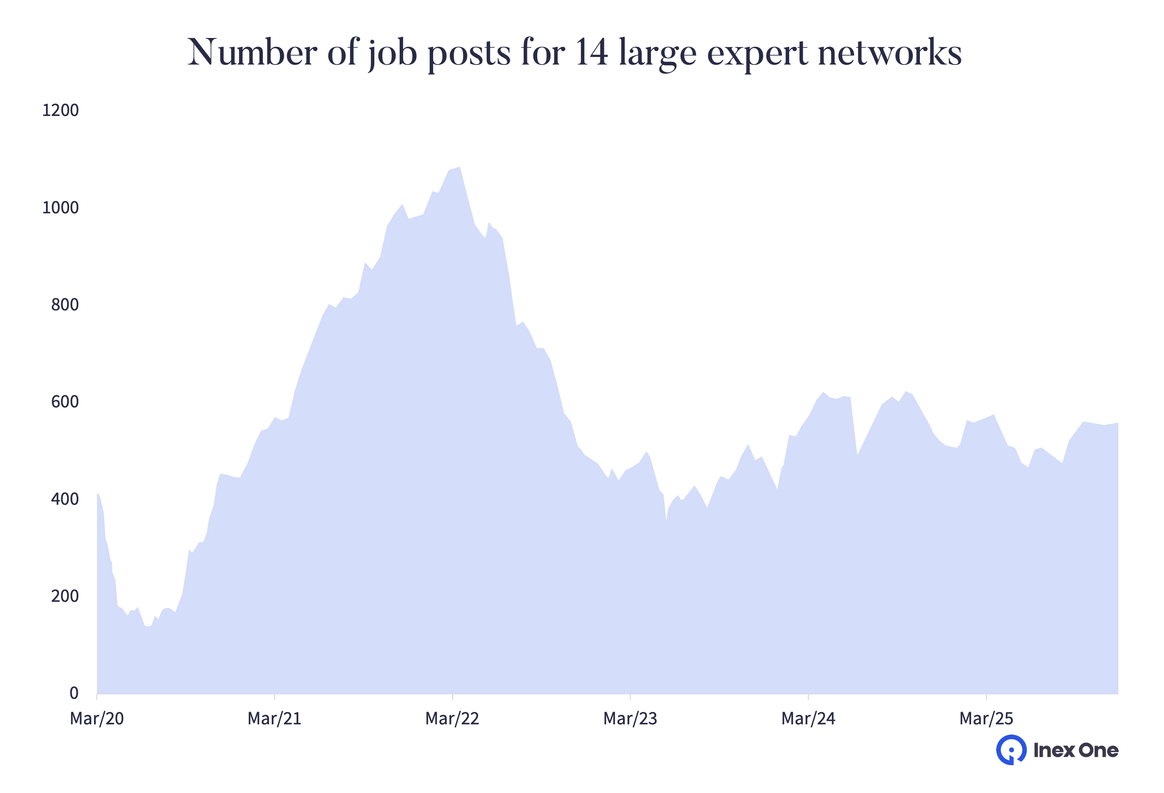

The last five years have been a roller coaster:

Covid slump: Deals ground to a halt in early 2020, only to continue as a…

Covid boom: The expert network industry expanded rapidly during 2020-22, fueled by low interest rates and frenzied dealmaking.

Era of Uncertainty: Growth slumped in 2022-23 as private equity deal volumes dropped, deal “auctions” and related consulting CDDs dried up, and corporate budgets were reined in due to higher interest rates and geopolitical instability.

Continued adoption: The industry found its footing again in 2024, despite continued macro instability. Expert networks continued their march onto main street, as regular corporations adopt the service for both strategy and product/ user research, and consulting firms find ever new reasons to tap experts for knowledge. By 2025, the industry built momentum and grew by a healthy 11%.

Expert networks are no longer a luxury for high-stakes deals in high finance; their services are increasingly considered table stakes when running any serious B2B market research.

2025 retrospective: Top trends

B2B Survey Sampling: ENs are increasingly being used for reliable, high-quality B2B surveys leveraging their expertise to source professionals and right decision makers for all niche requirements.

AI-led Interviews: Scaling fast in B2C as the segment relies on quantity rather than quality of individual responses - imperfect responses still produce meaningful patterns at scale. Slower adoption in B2B as the segment focuses on small-sample, high-stakes calls. AI as co-pilot to create questionnaires, take notes, and summarizing the conversations may be the way ahead.

AI Training/ Labelling: Few ENs working in complex and regulated sectors (e.g., Office Hours in Healthcare) have started recruiting experts for data labelling and expert annotations for AI training. As AI companies focus on data quality, few niche players are evolving into an ‘infrastructure layer’ offering expert-verified datasets.

Looking to start using an expert network? Try these resources:

The evolution of Expert Networks: From rolodexes to high-velocity recruitment

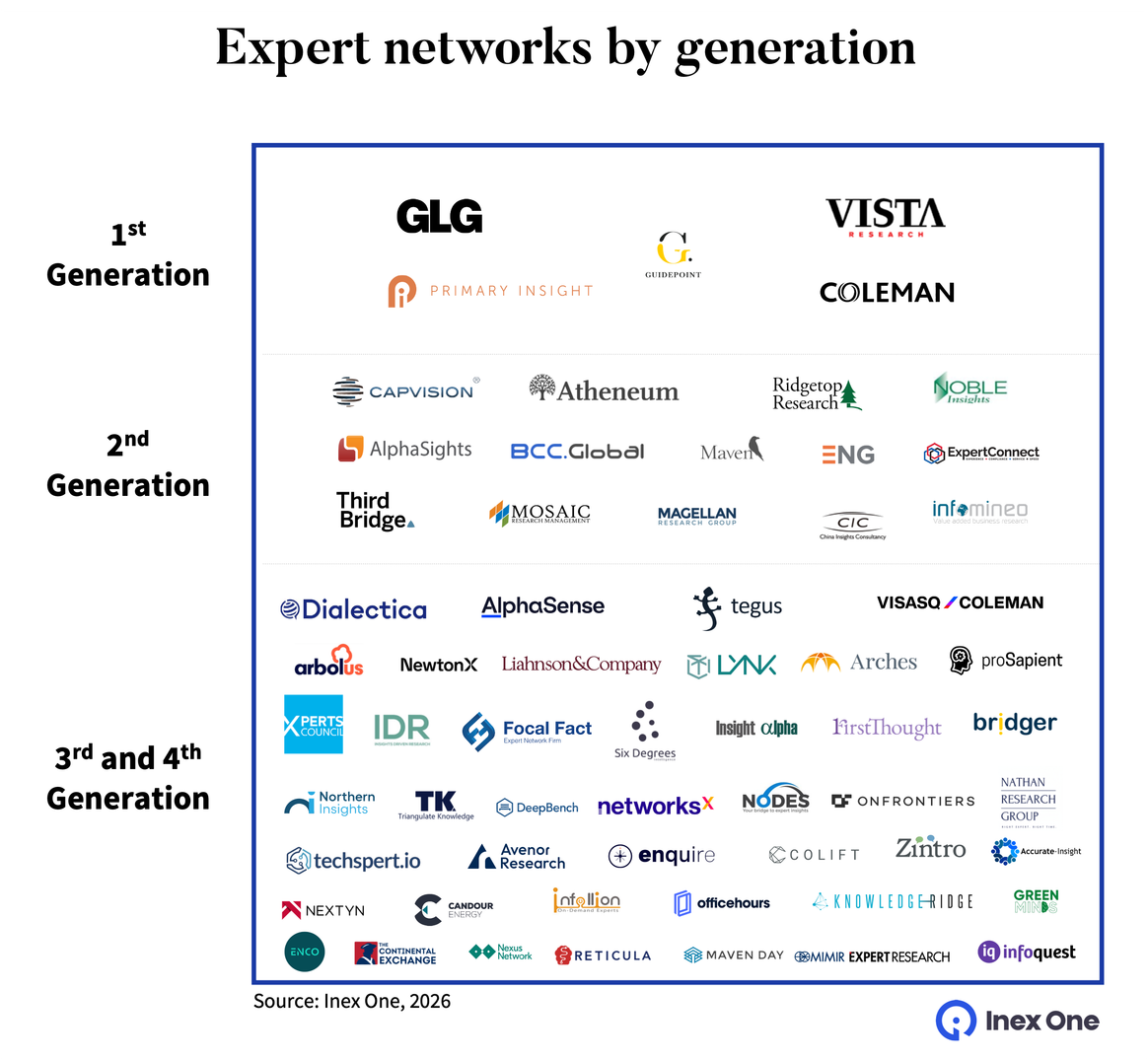

Over the past 25 years, four broad generations of expert networks have emerged. Each generation has built on previous generations’ successes, while altering the operating model and/or focusing on under-served client segments.

1st generation expert networks: The trailblazers

The first expert networks were all founded around the turn of the century. These included GLG (1998), Vista Research (2001), Coleman (2003), GuidePoint (2003), Primary Insight (2005), and a few more. These trail blazers of the industry were all New York-based, building a proprietary offline rolodex of experts that they would resell to primarily public market investors (hedge funds, asset managers), family offices, and banks/brokers. The founders mostly had a background in hedge funds, banks/brokers, and financial data companies.

2nd generation expert networks: The market expansionists

Seeing the success of early expert networks, a new generation sprung up from 2006 onwards. The founders had often been clients of the 1st-gen networks, e.g. strategy consultants as the founders of Capvision (2006; Bain), Third Bridge (2007; Bain), AlphaSights (2008; Bain, McKinsey), Atheneum (2010; Kaiser Associates, McKinsey), BCC Global (2008; McKinsey), or employees, e.g. Mosaic Research (2010; Vista), Ridgetop (2008; Vista), Maven Research (2008; GLG), Magellan (2014; AlphaSights).

The 2nd-gen expert networks initially struggled to break into the investment clients, as 1st gen networks were already entrenched. So instead, these newer expert networks focused on Private Equity clients, who were starting a decade-long bull run, and the strategy consultants they engaged.

Every client segment behaves differently. While institutional investors had predictable research needs around earnings releases, PEs and Consultants had faster-moving projects that could start “whenever”. They also researched more niche and ever-changing industries, so expert networks had to do more custom-recruiting. 2nd generation expert networks focused on this specific need, excelled, and in turn significantly expanded the market.

3rd generation expert networks: The tech disruptors

A new generation of expert networks sprung up in the mid-2010’s, often founded by former employees at incumbent networks. These firms used modern technology (either internally built or building on top of Inex One), with Tegus and AlphaSense Expert Insights (fka. Stream) going for entirely new operating models. They focused primarily on strategy consultants and the emerging corporate strategy segment. Many of them successfully targeted a niche – be it a region, an industry, or specific client segments.

3rd generation expert networks include Dialectica (2015; ex-AlphaSights), Techspert (2015), Lynk (2015; ex-GLG investor), Liahnson (2015, ex-GLG), NewtonX (2016, ex-McKinsey), ProSapient (2018; ex-Coleman), Tegus (2016; ex-AlphaSights), SixDegrees (2017; ex-Third Bridge), Focal Fact (2018; ex-GLG), Arbolus (2018; ex-AlphaSights), Bridger (2019; ex-GuidePoint), FirstThought (2019, ex-GuidePoint), Nodes (2019; ex-GLG), Arches (2019; ex-Accenture), NetworksX (2020; ex-Third Bridge), Triangulate Knowledge (2020, ex-GLG) IDR (2020, ex-Atheneum), and Colift (2021).

We at Inex One (2018) are also a the 3rd generation. While we're not an expert network ourselves, we solve the same "job to be done" for clients: getting great experts fast, and run B2B surveys. Inex One partners with some of the best expert networks across generations, who sell their expert services on the platform.

4th generation expert networks: The new guard

More recently, we’ve seen additional upstarts, again founded by previous employees of incumbent expert networks. Some firms that we see tremendous potential in are Infoquest (2023; ex-Dialectica), Reticula (2023; ex-Dialectica), ENCO Insights (2023; ex-ProSapient), Northern Insights (2024; ex-GLG) Avenor Research (2024, ex-Bridger), and Continental Exchange (2024, ex-Third Bridge).

Predictably, the new generations of expert networks have chipped away the market share from older firms, often by targeting new operating models and/or client segments. The newer generation firms focus on being agile and responding to custom needs of the expanding market. The industry is seeing what Clayton Christensen would call a ‘Disruptive Innovation’:

See our mapping of all expert networks started out of other firms here.

The global landscape: Who plays where?

As you can see, the industry is getting increasingly crowded. On a global scale, GLG and AlphaSights are tied as the largest players. The former has had a few rough years since its failed IPO 2021, consequently, competitors are chipping away at the previously dominant market share (market share has decreased from 51% to 24% within a decade). The latter, however, is on a phenomenal growth trajectory - alongside other firms.

While most expert networks aspire to have a global coverage, they all have their limitations. Many firms are naturally strongest in the regions where they first started. A few of these firms excelled and have become regional champions - but the challengers are already visible on the rear-view mirror.

We identify GLG, AlphaSights Third Bridge, GuidePoint, Dialectica and AlphaSense as ‘global leaders’. These six giants have scale and infrastructure to provide high-quality service across almost every continent. Beyond these five firms, the market is territorially fragmented.

“Regional champions” are expert networks with a strong foothold in their respective regions or industry verticals, while also offering global services. Capvision and SixDegrees have a strong position in China. VisasQ is particularly strong in Japan and with the acquisition of Coleman have gained a significant foothold in the US as well. ProSapient and Atheneum have significant market share in Europe (especially within consulting firms).

What about the 100+ smaller expert networks? Smartly, they don’t try to beat the giants at their own game. Instead, most of them win by picking a specific lane:

A specific region: Focus is solely on a specific region (e.g., DACH, GCC etc.)

An industry vertical: Focus on specialized verticals such as healthcare, energy, deep-tech etc.

A different business model: For example building libraries of expert call transcripts shared with many clients, going into prepackaged data services, B2B surveys, or expert witness services.

We find a handful of these firms being particularly strong in their business – these are our ‘regional challengers’ separated from the larger ‘regional prospects’ category.

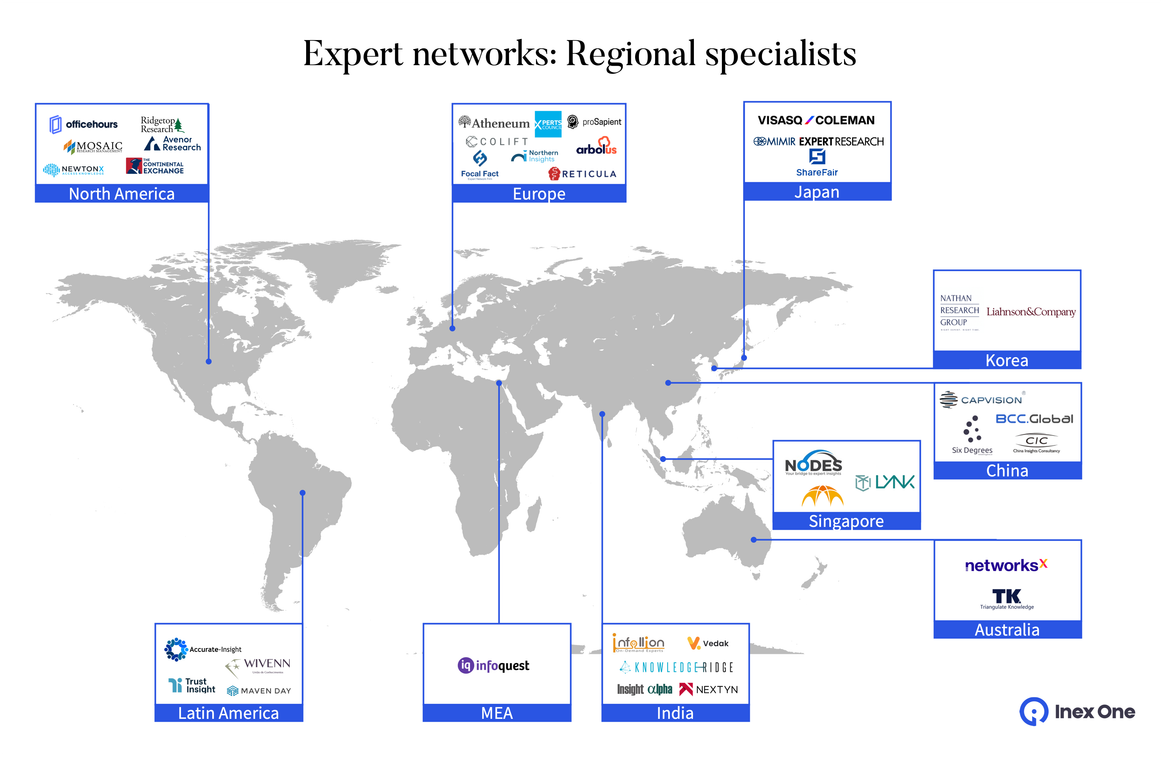

Expert networks specialized by region

When we closely look at who has ‘boots on the ground’, the territorial division becomes stark. It is a smart play by these players who are doubling down on regional focus before they can go after the global giants. We have plotted notable regional firms below.

VisasQ, Mimir and ShareFair are strong in Japan, whereas Capvision, BCC, Six Degrees, and CIC play in China. Nodes, Liahnson, and Arches each cover different parts of Southeast Asia.

Infoquest has a focus on the Middle East, as do Accurate Insights and Trust Insight in Brazil. Europe has a number of firms with a particular strength in their home market, such as Atheneum, Colift and EPH in Germany, Xperts Council in France, and ProSapient, Arbolus and Focal Fact in the UK and Ireland.

Who are the customers of expert networks?

If you looked at the expert network industry in the early 2000s, it looked like an exclusive service for the hedge fund community. The services, however, were soon in demand in the wider financial industry, reaching private equity firms, asset managers, banks and consultants. And from there onto the regular economy, as corporations of all types adopted expert networks for strategy and market research. We estimate that about 11,200 firms use expert networks in 2026 - a scale that was hard to imagine even just a decade ago!

This ‘democratization’ of usage is primarily driven by a few fundamental trends:

Increased supply

More experts can be searched and contacted online than a decade ago.

Professionals across industries are increasingly open to the concept of micro-consulting.

Increased demand

A phenomenal growth in private equity assets under management fuels spend on deal analysis by both PE firms and the consultants that they engage.

Corporate strategy, product, and strategy teams are increasingly accessing expert networks to inform their strategic decisions.

Market researchers, upset by mediocre B2C sample quality, are increasingly shifting attention and spending to the qualified B2B respondents of expert networks.

Growth engines

There are four key client segments that drive the industry:

Consulting (incl. market research)

Asset management (including hedge funds, long only funds, SWFs, IMs and family offices)

Private equity

Corporates

Though the user base has grown, spending is skewed towards a smaller number of large customers. In 2026, the consulting sector remains the largest segment, accounting for almost half of the total industry spend. Widespread adoption within corporates has catapulted them into being the largest segment in terms of numbers, yet they only account for a tenth of the industry spend. Capital market players show a remarkable balance - 44% by client numbers and 42% by industry spend.

We see that the firms that predominantly serve consulting and PE firms (e.g., AlphaSights, Dialectica, Inex One and partners) are among the fastest-growing in the industry, compared to firms with a larger asset management business. The asset management customer group has also shifted part of their spend to transcript libraries from doing traditional ‘one-on-one calls’. This has driven strong growth for players offering libraries, and intense competition. Incidentally, transcript libraries have also eroded 1-on-1 call margins in that segment.

If you are interested in more detailed coverage on the expert network industry, you can get the full 2025 market sizing dataset here.

2026 and beyond: The next era of Expert Networks?

Is the expert network industry finally ‘maturing’? It’s a question that comes up every time the market slows down. Fears that the industry reaches maturity come and go as the industry swings from frantic growth to temporary slowdowns.

The industry has kept growing through multiple economic cycles and crises. However, the ‘next era’ of the industry will look very different from the last.

The pressure on 'legacy' players

The heat is turning up on the legacy players. They are facing two major challenges:

Expert fatigue: the ease of finding experts attracts new entrants to the market and risks creating a fatigue both among experts (receiving too many identical requests) and among clients (receiving too many similar sales pitches). The increased competition has eroded the margin.

Marketplace efficiency: platforms like Inex One enables a more efficient market, driving business to high-performing expert networks, away from legacy operators.

Interestingly, the predicted ‘consolidation’ of the industry hasn’t really materialized. Instead, the industry is more fragmented than ever with new firms focusing on specific regions and industries where they can offer better quality popping up every year.

This is where we think the industry is headed in the next decade: a more efficient, tech-first market. At Inex One, we’re building the infrastructure for the next phase. By creating a platform that allows clients to access the best specialist networks in one place, we’re helping to turn a fragmented market into an efficient one. The "Old Guard" model of relying on a single, massive vendor is fading; the future belongs to those who can find the best experts, wherever they happen to be. Do you want to be part of this change? Read the reviews of Inex One, or contact us today!

Note: We have approached this market sizing as CDD consultants do: by analyzing public financial reports, IPO filings, benchmarking and, of course, hundreds of expert interviews over the years. Thank you to everyone who contributed with insights! However, if you have a different take on where the numbers landed or want to dive deeper into the 2026 forecast, I’d love to hear it. Let’s talk on LinkedIn or book a meeting!