23 Aug 2022

Expert networks: Power by the Hour

I like British stuff. And few brands are as iconically British as Rolls Royce.

Started back in 1906 by Charles Rolls and Henry Royce, the firm has moved people worldwide with cars, airplanes, and naval engines. You could fill libraries with business insights from their history, but my favorite is the “Power-by-the-hour” concept.

Three blokes and a 1937 Rolls Royce Phantom III.

This is the perfect example of how everybody wins when incentives align. Here’s the story:

Aviation: the good old days

In the early days of aviation, airlines managed everything from ground operations to airplane ownership and flight operations. Airplane engines are a surprisingly large part of the total cost, and airlines shouldered the burden of maintaining, monitoring and replacing their engines.

As engines approached the end of their expected lifetime, an airline would buy new ones from a vendor like Rolls Royce. In addition to replacement costs, airlines had to contend with a joker in the pack: unforeseen engine failure. Events like this could - and did - cost airlines millions in lost revenue and reputational damage.

Airlines thus faced a tradeoff between buying expensive new engines more often, or risking sudden engine failure. Neither option is very attractive.

A meal being served on a 1955 SAS flight. No engines in sight.

Rolls to the rescue: power-by-the-hour

Rolls Royce solved this problem with a subscription approach to jet engines. Airlines would pay just one predictable fee. And the important part: they’d pay only per hour of flight time. This completely changed the aviation service business by aligning incentives between Rolls Royce and the airlines they supplied.

This “Power-by-the-hour” concept gave airlines their dream exit from the jet engine owning business. Instead, they could focus on perfecting their core business: taking passengers comfortably from A to B.

Conversely, Rolls Royce specialized in building and owning jet engines. They leveraged their vast new subscriber base to invest in ever-better engines. This modernized global aviation and paved the way to the near-seamless international travel we enjoy today.

Great.

What’s this got to do with expert networks?

Why expert networks want you to prepay for credits

Traditionally, clients pay expert networks in advance to get “call credits”. These credits are then deducted throughout the year as expert interviews are made. Expert networks may bill multiple credits per call, adding extra for “premium experts”, transcripts, a few minutes over the hour etc. But you’ve agreed on a price, right?

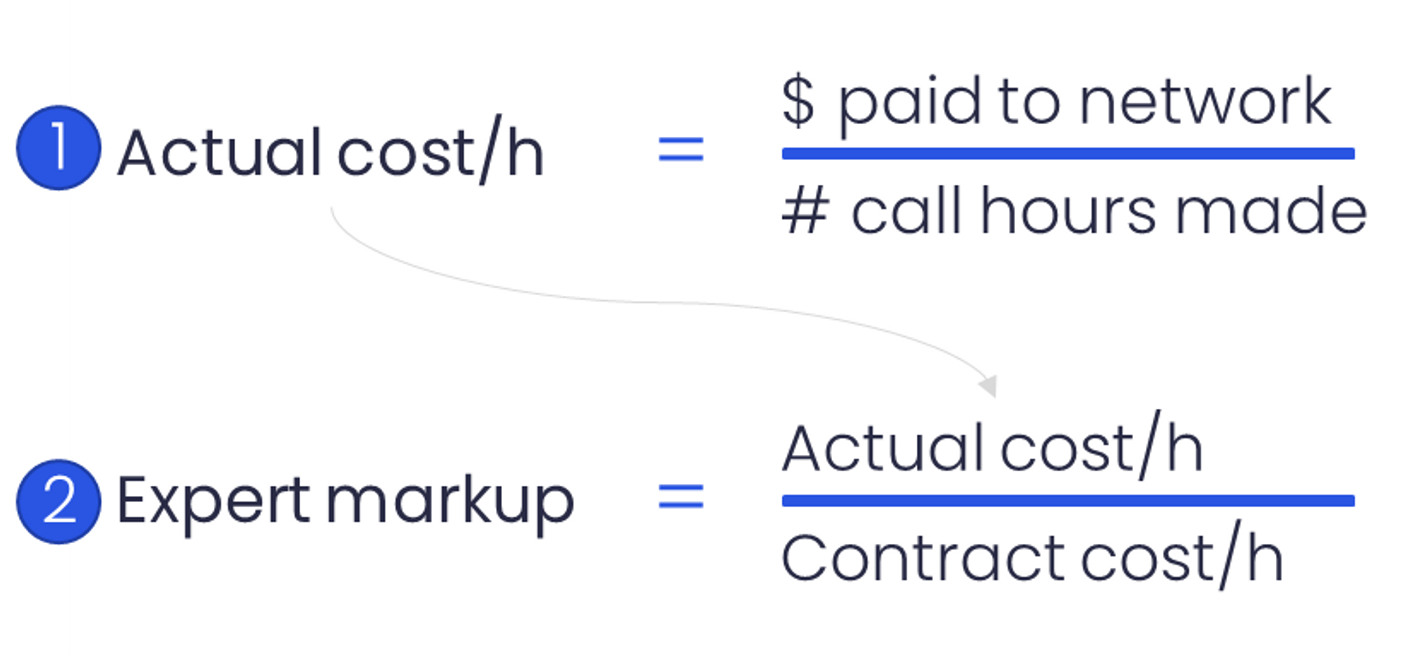

Turns out that expert networks routinely charge more than one credit per call. The client ends up paying a higher actual cost/call than expected. Early findings from our new survey indicate this expert markup is often 1.2-1.4. This means clients pay 20-40% more for calls than they had expected to do.

This markup is notoriously difficult to notice, as it happens in the exchange between associates, beyond the structured annual contract negotiations. So here’s how to calculate it:

Inex One: Power-by-the-hour

With Inex One, you get pay-as-you-go access to 25 excellent expert networks. For consultants and private equity firms, this is a dream exit out of the call credit owning business. Instead, you can focus on your core: making smart business decisions.

Conversely, Inex One specializes in collaborating with the best expert networks. We leverage our tech and vast user base to help expert networks get ever-better operations. This has paved the way to the efficient knowledge-exchange that our clients enjoy today.

The incentives align:

Expert networks on the Inex One marketplace are incentivized to offer affordable interview prices. They only make money if you like their experts, as does Inex One.

Clients get access to the best expert networks, and insights-by-the-hour. Get yours today.