09 Jun 2021

Part 3: How expert networks win in the 2020’s

Part 3: Resolution.

When the first expert networks started, 20+ years ago, they were knowledge partners to their clients and to their experts. As we saw in part one, LinkedIn eroded the entry barriers to the expert network industry, driving growth – and opportunity for new entrants. Part two describes how the industry grew transactional in the last decade, as expert networks focused on the top PE and consulting clients. Today, large teams of expert network associates do high-level searches across all industries and geographies. They are all a part of:

Our world of knowledge

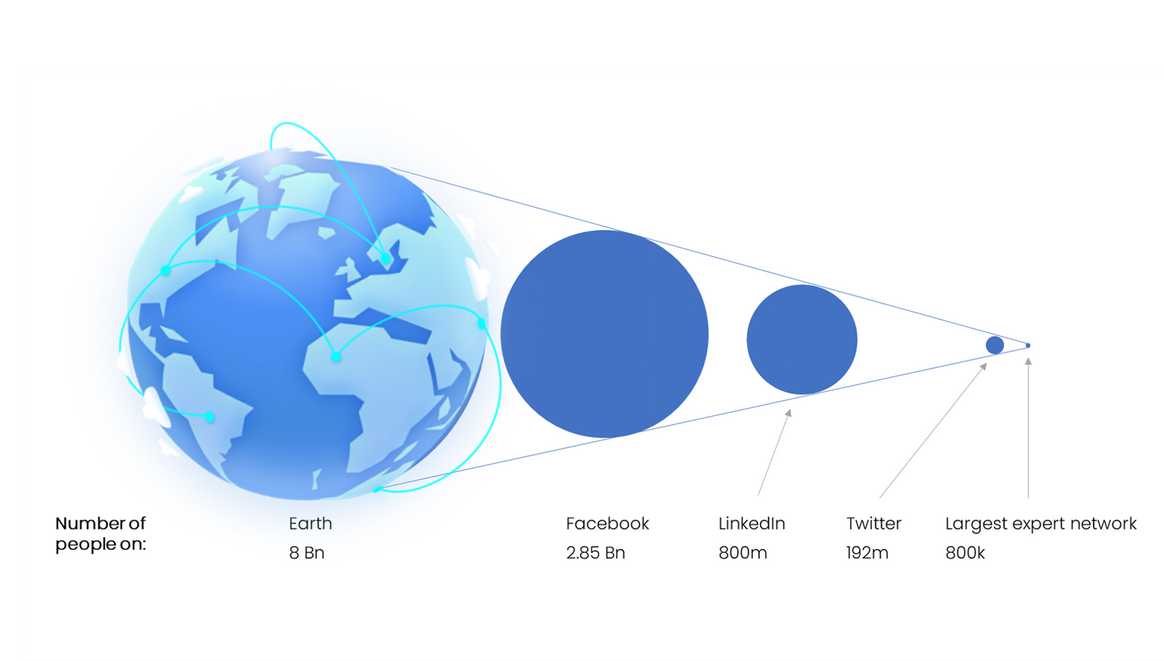

The global knowledge economy is massive. Expert networks are only beginning to map it out. Of some 8 billion people on Earth, LinkedIn alone has about 800m profiles (10%), while a big expert network like GLG has about 800k profiles (0.01%) in its database.

Expert network size matters - or does it?

Let's double-click the LinkedIn bubble

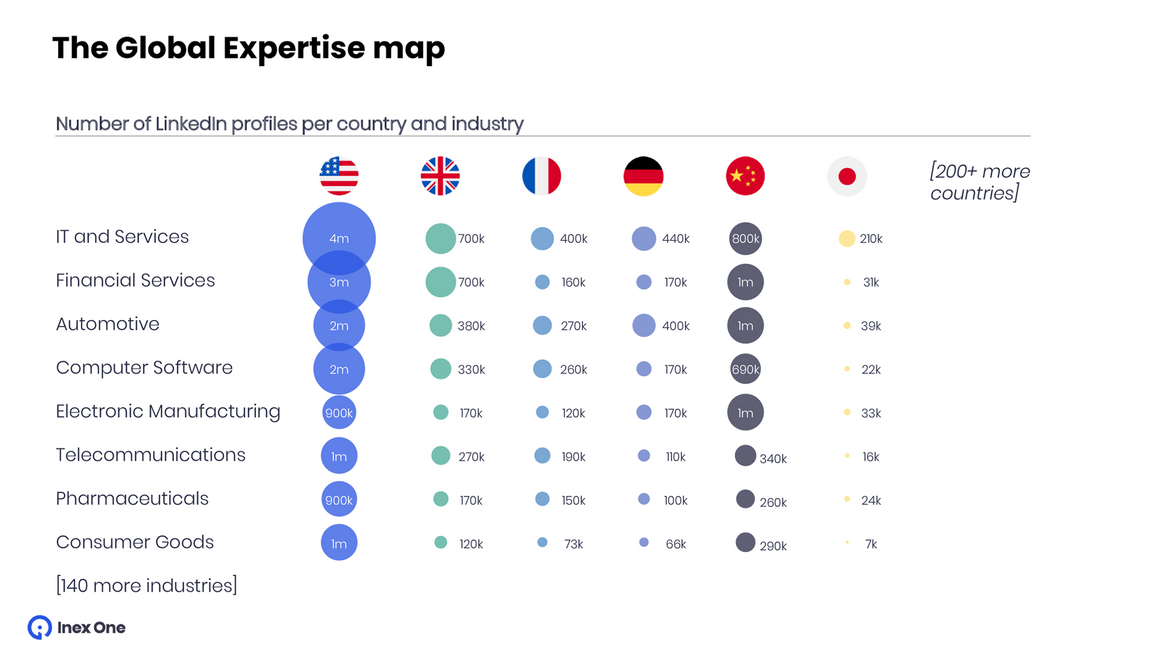

We can think of the 800m LinkedIn profiles as a sizeable sample of the world’s knowledge workers. To understand them further, let's segment these 800m profiles along two axes: their home country (e.g. Germany) and their job industry (e.g. Telecom). In each intersection of country and industry (e.g. Germany + Telecom), there are experts with unique skillsets. Using high-level LinkedIn data, here’s how global expertise is distributed:

The Global Expertise map - LinkedIn profiles by country and industry.

I make two observations here:

The knowledge economy is incredibly sophisticated and granular (each of these industry tags could easily fit hundreds of specialty areas), and

LinkedIn is heavily skewed towards US and UK profiles, with other large countries being wildly underrepresented. These are two good reasons to use specialized expert networks.

Traditionally, expert networks have been all over, picking a couple thousand people from each of the bubbles pictured. Mathematically, they are barely scratching the surface. In aggregate, this is a reason for the expert network industry's woes.

Jack of all trades - master of none?

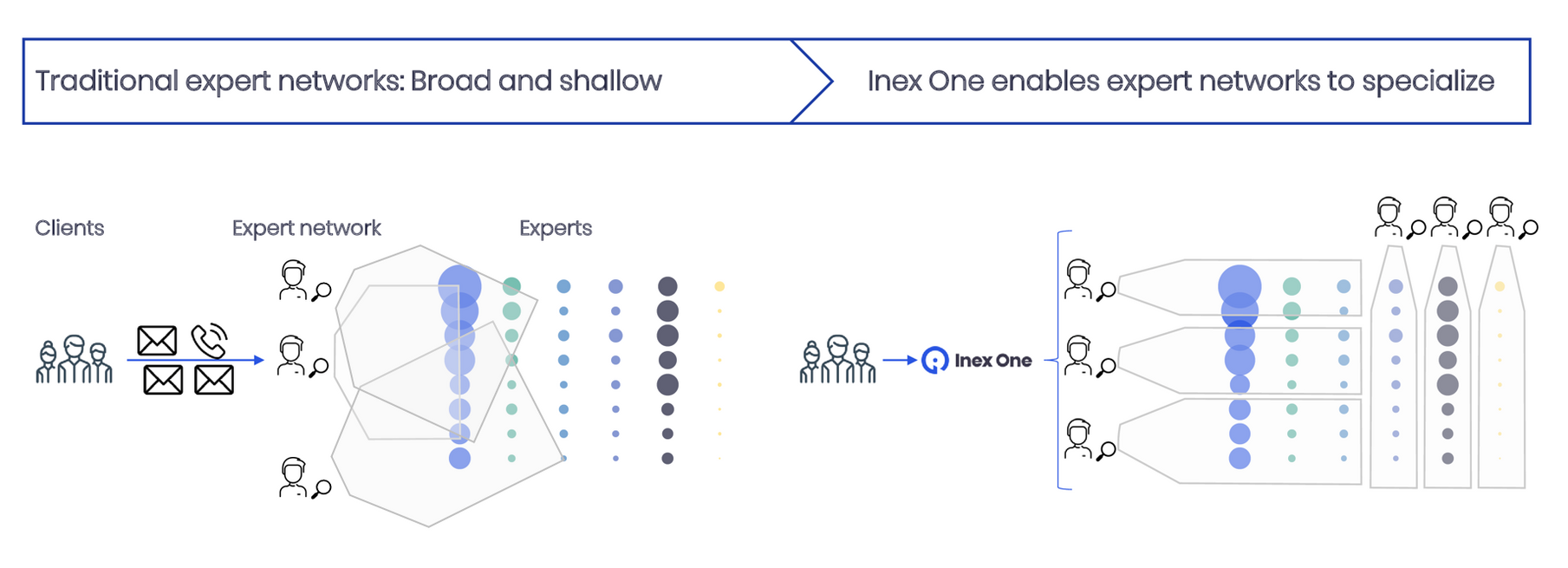

With more than 100 expert networks, the industry is getting crowded. However, most clients - myself included when at McK - see no difference between different networks. By sending a request to many expert networks, I would inadvertently optimize for the short-term (access to experts now), but suboptimize for the long-term (access to experts and quality of service in the future). This forces expert networks to become "jacks of all trades", and do a bit in every bubble on the Global Expertise map.

Having 100 expert networks do more or less the same thing drives client indifference, expert fatigue, employee churn and eroding profit margins.

But it doesn't have to be that way. Clients are clearly willing to pay for white-glove service from top-quality expert networks. Expert networks gladly focus on their strong segments of the Global Expertise map. Doing so, the expert network develops an expertise in its own right. It becomes ever better at serving those segments. This lets them evolve into true knowledge partners to their clients, allow employees to become experts in their own right, and build a sustainable economic moat versus other expert networks.

Inex One enables this specialization, by automatically matching client projects with only the expert network teams that are best for their research topic. When fewer but better expert networks are invited, the service quality goes up - increasing the user experience for all parties involved.

Expert networks win as high value-add knowledge partners

The industry goes full circle. Having started out as knowledge partners to their clients, expert networks grew increasingly commoditized in the eyes of the customers. Inex One enables expert networks to specialize, which helps the industry to optimize both short- and long-term. This solves the UX for all parties involved:

Clients: Get better service from true knowledge partners. A specialized expert network becomes your river guide to the industry, helping you advance your research.

When I (Max) was a clueless 20-something in consulting, I found myself emailing with equally clueless 20-somethings at my main expert networks. It was “the blind leading the blind”, as both of us had to learn every new industry at the same time. Access to specialized networks would have saved me many hours in the team room. 😅Experts: Experts are more likely to enjoy the interaction when engaged by a knowledgeable peer, than when feeling spammed with irrelevant requests. "Protecting the asset", improving UX for experts must be a top priority for the expert network industry.

Expert network employees: Being appreciated as a knowledge partner makes the work more meaningful and gives an opportunity to specialize. Developing into a well-connected industry expert improves your work enjoyment, job status and future career prospects.

Expert network firms: By specializing, expert networks build a sustainable competitive moat, compounding value over time. When your employees become knowledge partners to clients and experts on a part of the Expertise map, you raise entry barriers towards competitors from entering it. Becoming really good at a topic, your operating costs (and employee churn costs) go down, enabling sustainable profits.

The future of professional learning

Inex One collaborates with some of the best expert networks in the world, building tech for an efficient industry. We're only getting started on the journey to improve the expert network industry and professional learning at large.

Do you want to be part of shaping the bright future of the expert network industry? Check out our open positions.

Do you want access to the best expert networks? Sign up as a client here.