11 May 2021

Have expert networks recovered from the Covid pandemic?

Let me spoil the intrigue immediately: we believe that the expert network industry is back on track - and booming. It is hard to be 100% certain without seeing the newest financials, but expert networks’ hiring trends suggest that the industry has largely recovered after a short-term blow dealt by the Covid pandemic.

Our new hobby: monitoring expert network job ads

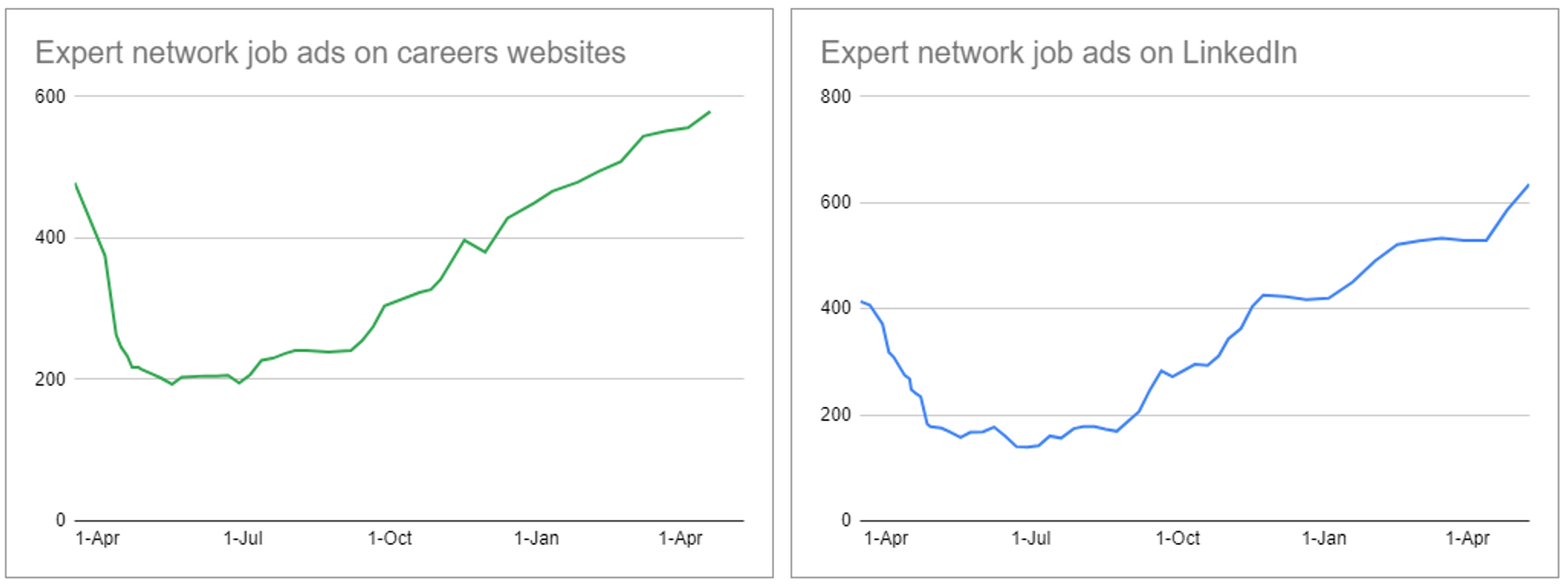

What makes us think so? When the pandemic broke out last year, we began tracking the number of job advertisements from 16 large expert network firms, on LinkedIn and careers websites. Check out our findings here:

Expert network job ads: way above the pre-pandemic levels

March 2020 saw an immediate drop in the number of jobs advertised, which continued through July. However, at the end of the summer the hiring seems to have picked up. Today it is back to the pre-pandemic levels (and even seems to have exceeded them!).

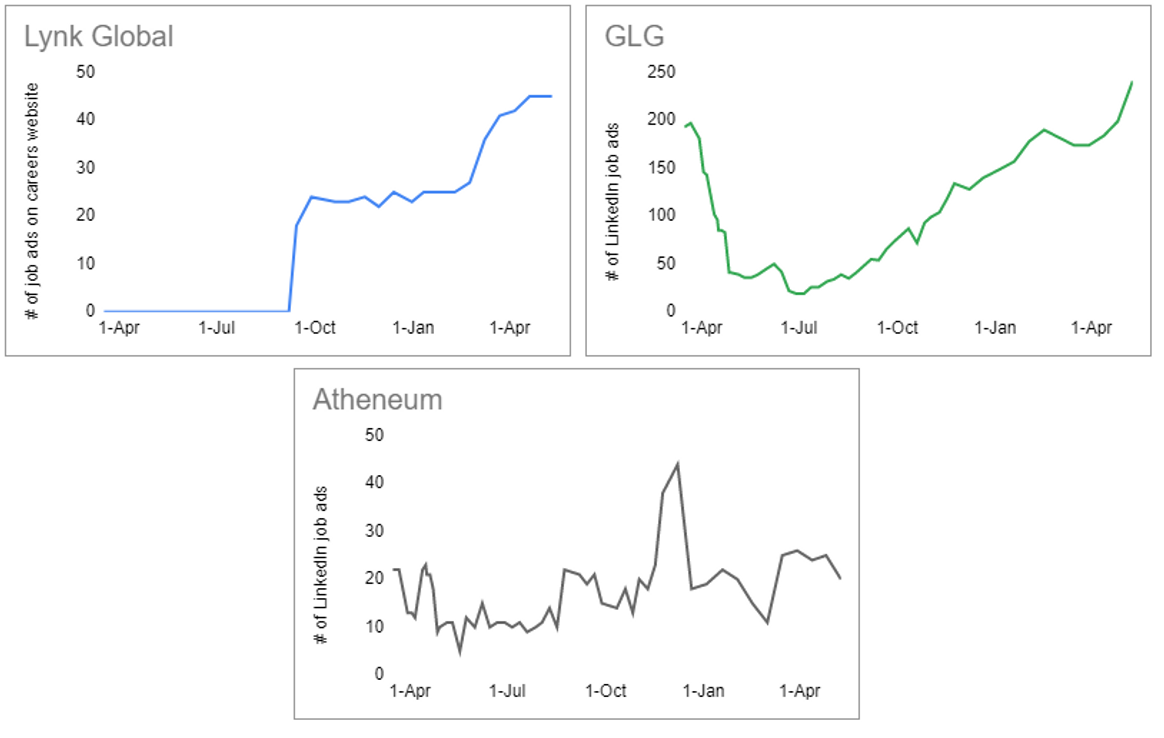

How did different expert networks behave?

The changes in hiring patterns during the first wave of the pandemic differed quite a bit across the large expert network firms. GLG's hiring curve has a convex shape. It hit the bottom in the summer months of 2020 and rebounded gradually towards the end of August.

Atheneum's hiring dipped between May and September 2020, but not as dramatically as GLG's. At the beginning of November, Atheneum increased its hiring above the pre-pandemic levels, but reduced it shortly afterwards.

Lynk Global, an up-and-coming Hong Kong-based expert network, appears to have been in a complete hiring freeze until the end of the summer. However, their hiring picked up in relation to their January-21 funding round.

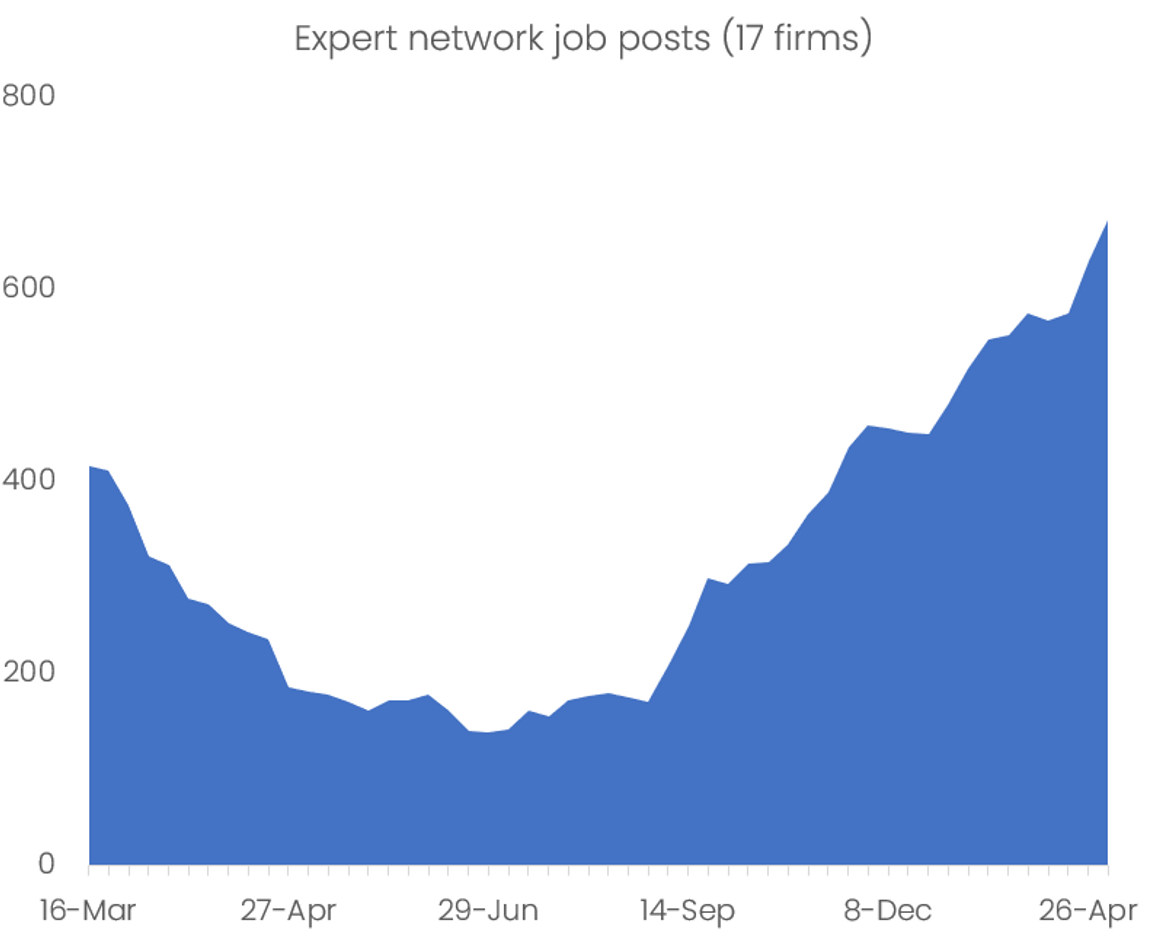

The numbers in aggregate

Clients use Inex One to aggregate insights from multiple smart expert networks. Correspondingly, the aggregate hiring data of multiple expert networks is the best indicator of the industry health. Here are the aggregate job posts from 17 expert networks since the early phase of the pandemic.

Expert network job posts aggregated

An illustration of why the combined picture is better than the isolated: some expert networks were growing healthily without publishing many job posts. A few examples are Dialectica and Techspert (both doubling in size last year), and Capvision (adding 100+ employees).

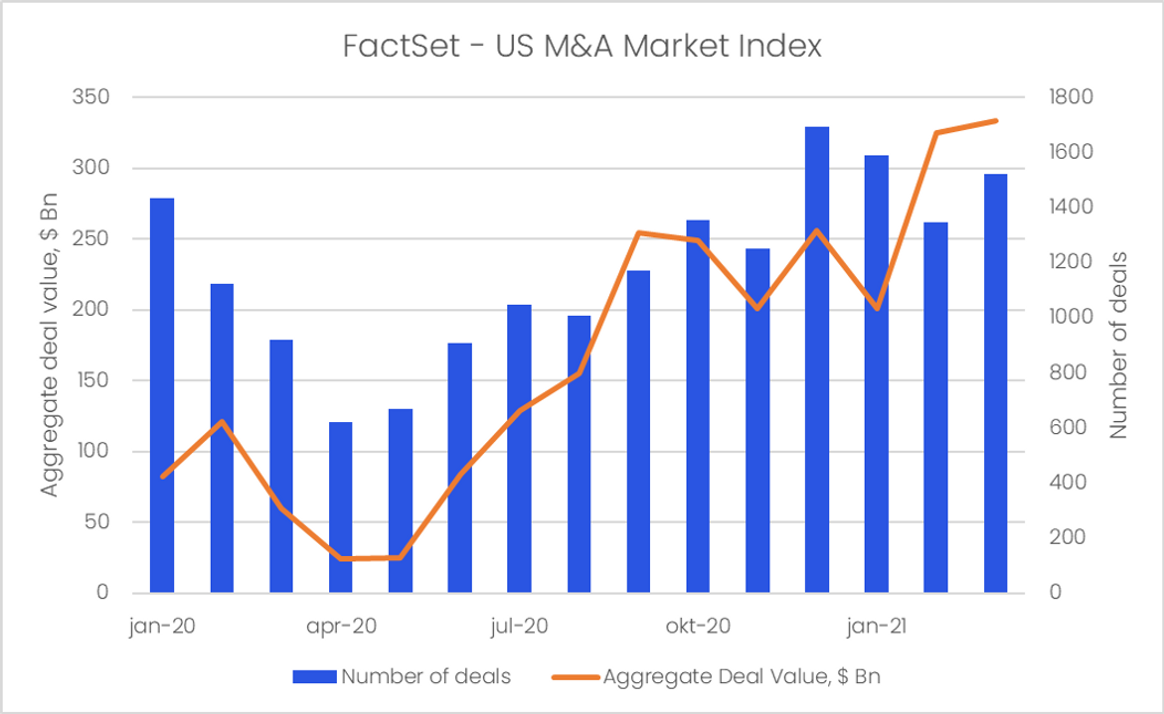

What does the shape of the expert network hiring curve resemble?

Expert networks earn the major share of their daily bread by supporting PE houses and consulting firms in deals and due diligences. Therefore, it is not unexpected that hiring has been closely following the deal trends (with a lag of approximately 2 months).

Global M&A Market Index in 2020

Data from Factset Flashwire Advisor Quarterly data

The Global M&A Market Index dipped in April-May, before recovering in June. Seeing this rebound in M&A activity and in demand for their services, expert networks went back to the job market seeking new talent.

Today the expert networks are again recruiting healthily. This is a clear sign that expectations about the future of the industry are quite positive. If you've been looking to work for an expert network, now is a good time to make it happen! 😉

Pon the replay

As the expert network industry rebounds, let's make it stable for the long run. A negative (albeit temporary) demand shock called for productivity increases in expert networks, and investors seek efficient remote due diligences. Inex One tech helps great expert networks work efficiently with smart clients.