03 Nov 2022

How the survey industry works

The survey industry is a $57 Bn behemoth, encompassing a wide range of research services, use cases and methodologies. As Inex One launches a survey platform, we set out to define and demystify the industry.

We’ve done this once before: explaining and demystifying the expert network industry. Investors and strategy consultants now work with the best specialized expert networks on Inex One. Some clients save >40% on cost, and many users say that using Inex One is superior to legacy expert networks.

The survey industry: using available data

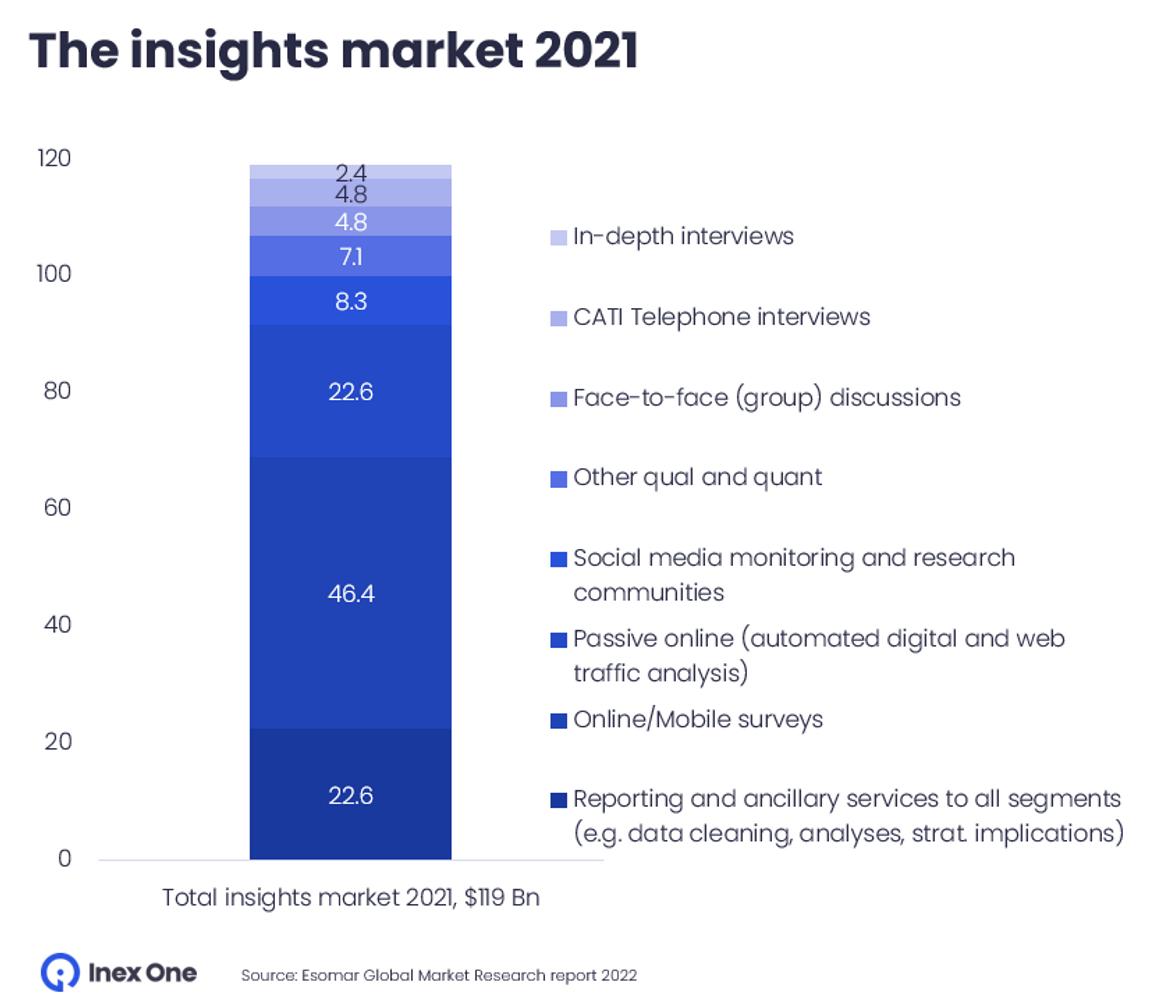

The survey industry is a subset of the wider insights industry, with a turnover of roughly $119 Bn globally, according to industry association ESOMAR. The main services provided here are online/mobile surveys (qualitative and quantitative), passive online research, and social media research. Reporting is another big piece and a special case. While the other service categories are actual research methods, reporting means all services around them (e.g. selecting research method, designing a survey, cleaning and reporting the data). Market research firms and strategy consultants do this type of work.

The global insights industry 2021

Breaking it down

Here’s one way of slicing the ESOMAR data into smaller buckets. I estimate that surveys and related reporting were worth $57 Bn in 2021. This includes both quantitative and qualitative surveys, and related reporting. Check out our survey glossary to clarify any tricky terms.

I made this graph with Think-cell. I love this service. The company - a lean tech team in Berlin being market leaders in a global niche - has been an inspiration to us when building Inex One.

What are B2B and B2C surveys?

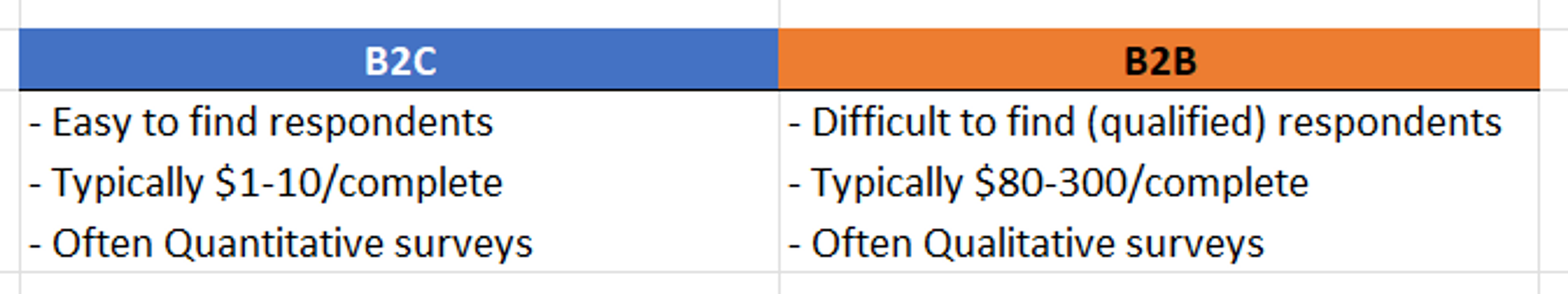

B2C surveys target respondents for their personal insights as consumers. These surveys typically ask questions about their consumer behavior, preferences, and buying intent. These surveys can go to broad audiences (e.g. coffee drinkers, parents in the countryside). B2C survey questions often focus on an experience, e.g. “How do you perceive this brand”, “Would you recommend this product?”, or “What would you be willing to pay for X?”.

Correspondingly, B2B surveys target respondents for their professional insights. B2B surveys ask questions about things like industry trends & outlook, and key purchasing criteria when evaluating a business purchase. Consequently, a B2B survey targets a smaller part of the general population than a B2C survey does. This lower “incidence rate” means that surveying B2B respondents is typically 10-30x more expensive than B2C.

Got it, now what are Quantitative and Qualitative surveys?

Generally speaking, B2C surveys are quantitative, while B2B surveys are qualitative. There are of course lots of exceptions to the rule, but the general availability of B2C respondents makes those surveys quantitative almost by default. Similarly, “the general unavailability” of B2B respondents makes those surveys qualitative in most cases. You might not find enough respondents for a proper quant survey even if you may have wanted it. :)

Quantitative B2C audiences are typically defined only high-level with a few data points (e.g. location, gender, age group, FB likes). These surveys are often published on offer walls where members of communities or loyalty/reward programs can opt-in to take them. Also, some panels recruit respondents with online ads or mailing lists/ or blasts.

Qualitative surveys are more in-depth, often asking detailed questions from a smaller group of available respondents. To ensure data quality and the relevance of each respondent, respondents need to go through more thorough checks (e.g. manually recruited by an expert network). Therefore, qualitative surveys (often targeting B2B respondents) tend to be 10-20x more expensive per respondent than those targeting B2C (which are often quantitative).

Here are two very qualitative elephants, just because I needed to break up this big block of text.

Who does surveys?

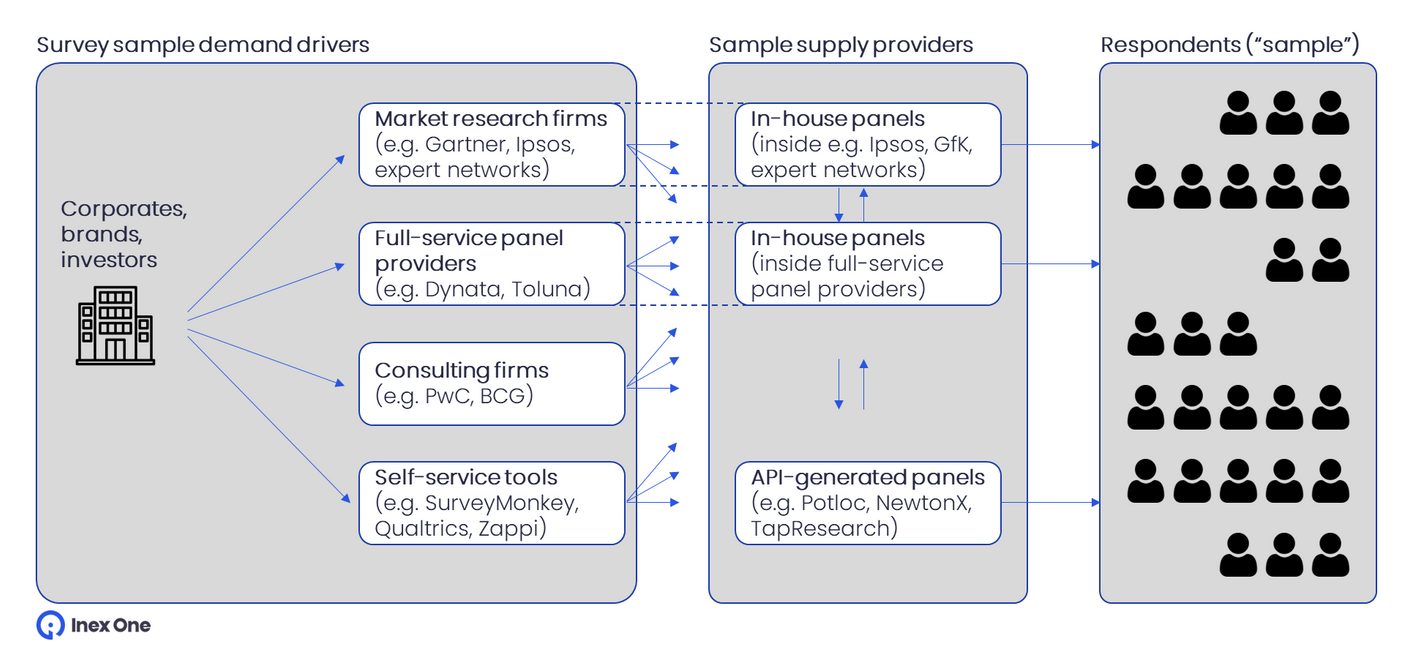

Corporates, brands and investors are the main survey buyers. They typically engage market research or consulting firms to run research projects with surveys. Those firms, in turn, provide a range of ancillary services beyond just a survey. This includes designing the survey and deciding on respondent groups, analyzing the raw data, making strategic recommendations, and overall project management. They often run expert interviews in parallel, using Inex One. In very specific or simpler cases, they could also run the survey in-house, using a self-service tool to design the survey.

How do I run a survey, and who is involved?

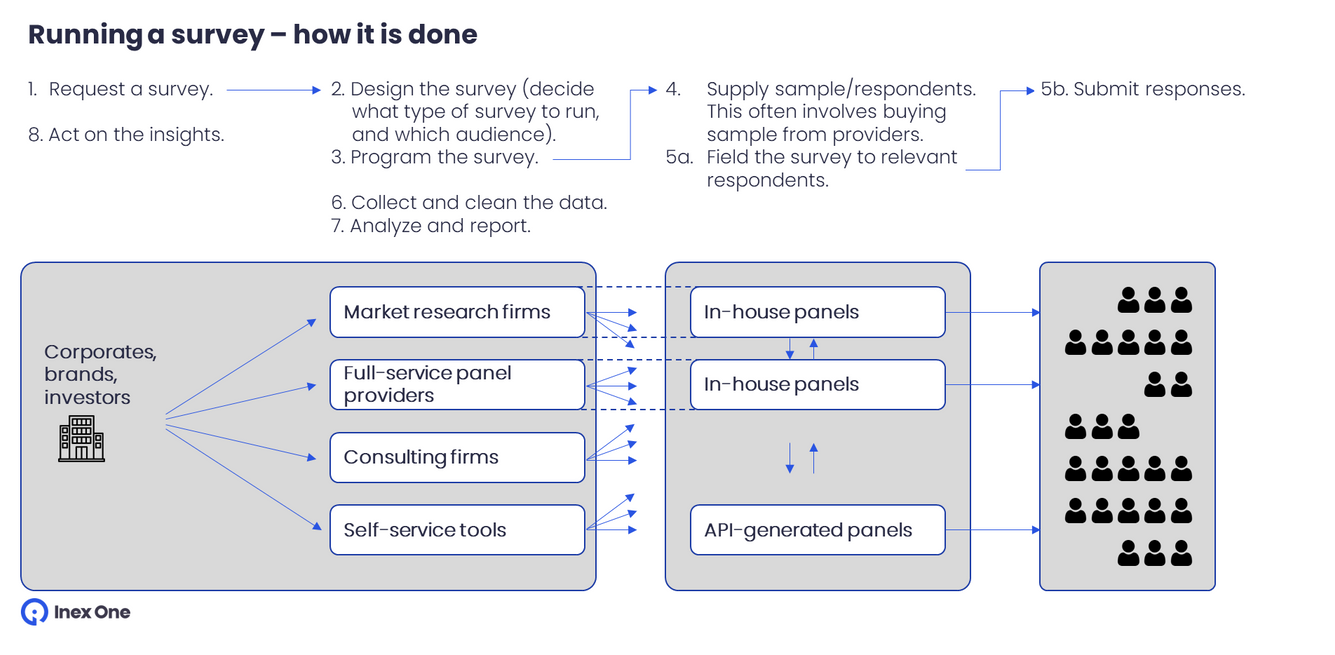

Here’s the general workflow for an online/ mobile survey:

A corporate, brand or investor requests a survey.

A survey vendor (or the buyer themselves) designs the survey. This includes deciding what type of survey is needed (e.g. number and type of respondents, which questions and their prioritization).

A survey vendor (or the buyer themselves) programs the survey. This means putting it into a survey tool that generates links for respondents, and adds any logic needed (asking different follow-up questions based on replies to previous questions).

Once programmed, the survey needs sample, relevant respondents. The survey vendor may have that themselves, or they engage other vendors. Here’s where it gets really funky: all survey suppliers buy sample from each other, and from exchanges like Cint. There’s a constant asking and quoting of prices, to get sufficient sample at the most time- and cost-effective terms.

When the respondent panels have been selected, the survey is fielded (sent out for answering). As replies come in, these are aggregated and cleaned for bad data (e.g. unqualified or duplicate respondents).

Once you’ve collected the data, it’s time to analyze it. Survey vendors have different capabilities to do this: some do it well, some do it poorly, and some leave it entirely to the end-customer themselves (which can be desirable!).

The typical action flow and parties involved in a survey.

How do I launch a survey?

The easiest way to launch a survey is on Inex One. You get access to the best survey providers in one portal, and help with scoping and designing your survey. This helps you to get an optimal survey quality, price, and speed of delivery.

Launch your survey here, or click here to discuss your research needs with our team.