02 Aug 2021

LinkedIn - a threat to Expert networks?

Is LinkedIn a threat to expert networks? This question comes up regularly: At times from clients, and surprisingly often when speaking with former GLG executives.

Curiously, our friends at Integrity Research looked into this question already back in 2008. At the time, LinkedIn had some 30 million CVs and struck a deal with DeMatteo for some privileged access. While not much came out of that deal - could this time be different?

During the spring, LinkedIn launched Marketplaces to facilitate gig services (payments) on top of its Profinder service (search and find freelancers). Over the last few years, LinkedIn has hired 30 former expert network professionals from GLG, AlphaSights and Guidepoint. Will the big behemoth try to replace expert networks altogether?

LinkedIn Marketplaces and the 80/20 market

So far, the services offered on LinkedIn Marketplaces are similar to those on other large freelancing sites: pieces of design, copywriting, research or coding that may be provided by a sizeable subset of the population of freelancers. Over time, LinkedIn plans to expand further. The Marketplaces Product Leader says:

Building the vertical marketplace model honed by the UpCounsel team into LinkedIn’s platform and social graph, and then replicating it across 100 different industries […] Of course, one of the verticals we will be developing and broadening is Legal.

When doing so, they will inevitably step further into the territory of large freelancing platforms such as Upwork, Freelancer.com and Fiverr (collectively at ~$1 Bn in 2020 revenues; with a TAM of perhaps >$500 Bn). Will LinkedIn go beyond them?

LinkedIn - the platform company

LinkedIn has about 750 million profiles, a digital treasure trove of career data. As a repository of profiles, LinkedIn has become a platform that other firms build their businesses on. For example, recruitment firms, marketers and salespeople have built businesses that mostly or entirely rely on LinkedIn data.

LinkedIn's growth fundamentally changed how recruiting firms work, just as it did to expert networks. In parallel, it created new business opportunities for itself and for others.

With the addition of Marketplaces, LinkedIn now forward-integrates: it will start doing some of the stuff done by these other businesses. I think they approach it like this:

4 categories of on-demand services

The global on-demand service market is vast and complex. There are innumerable types of services, and billions of potential candidates to perform them. Let's illustrate it with a graph: there are many candidates available to perform more generic services; fewer candidates available for more unique services.

There are fewer candidates available, the more unique service is needed

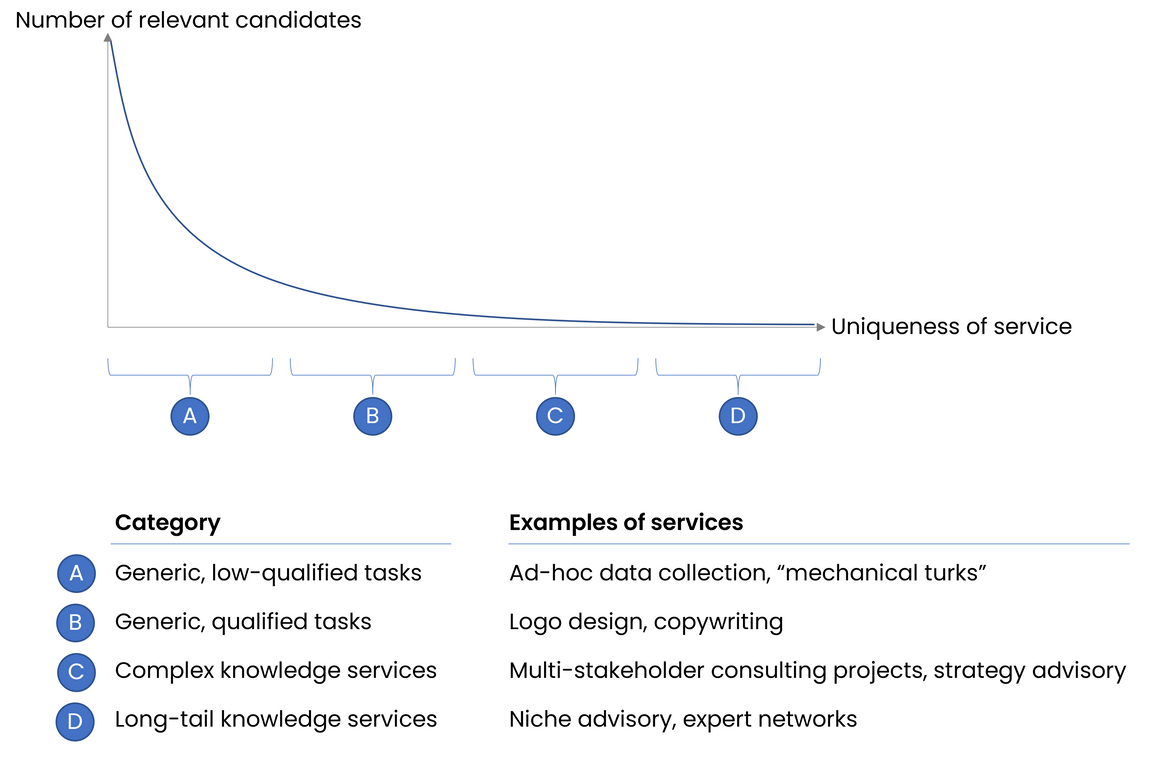

Furthermore, let's split "on-demand services" into four broad categories:

A. Generic, low-qualified tasks

B. Generic, qualified tasks

C. Complex knowledge services

D. Long-tail knowledge services

The five jobs of a matchmaker

In theory, LinkedIn could try to automate access to all candidates across all service categories. This means it acts as a matchmaker, between employers who need services, and candidates willing to perform them. Sprinkle some jazzy AI on LinkedIn's dataset and you're good to go? Sounds like a cakewalk.

As always, however, the truth lies in the details. Having run an expert network myself, I think there are five broad "jobs" that such a matchmaker should do. Your success as a matchmaker depends on your excellence at each of these jobs. Neither is easy - they require skill and expertise, which sets the good firms apart from the rest. The five jobs are:

Identifying candidates that are most relevant to perform a service.

Vetting candidates to make sure they are indeed willing and able to perform the service.

Ensuring compliance throughout the process.

Ensuring confidentiality throughout the process.

Administering logistics around the service performed and payments for it.

Matching these jobs against the four service categories from above, we get a matrix 🤩. The traffic lights show how difficult it would be to automate the matchmaker-job, for a given service category.

Generic, low-qualified services (e.g. manual web scraping, or Uber Eats), have plenty of candidates, standardized services and straight-forward compliance rules. These services are easy to automate for an automated matchmaker.

Generic, qualified services (e.g. logo design, copywriting), has relatively many candidates and straight-forward services. This is where LinkedIn Marketplaces goes head-on with services like Upwork, Freelancer.com, and Fiverr.

Complex knowledge services (e.g. accounting services, multi-stakeholder strategy projects) and long-tail knowledge services are two steps further on the uniqueness axis. Here, automated matchmakers run into three types of challenges:

Three challenges for automated matchmakers

Long-tail challenges: Finding relevant candidates gets more difficult in the long-tail (finding a needle in a haystack). Automating super-granular matching either requires datasets that don't exist, or risks creating lots of noise from false positives.

Agency challenges: Both compliance and confidentiality are challenging to maintain in an automated platform, once you start dealing in complex services or when there are only a few relevant candidates.

Automation challenge: Service and payment exchange is difficult to automate and get right for complex, multi-stakeholder projects.

Will LinkedIn Marketplaces compete with expert networks?

As in all of my posts, there's an expert network angle. These fascinating companies operate at the cutting edge of the global on-demand knowledge market. LinkedIn may eventually venture into the longer-tail of knowledge services, but I believe it would take ages, if at all.

LinkedIn Marketplaces will be limited for the same reason that other freelance platforms, expert network DIY Marketplaces, or "AI" expert networks do not pose a competitive threat to regular expert networks. The value-added services provided by expert networks are too distinct and specialized to be replaced by DIY services or automation - at least for the foreseeable future.

The automation opportunity in expert networks

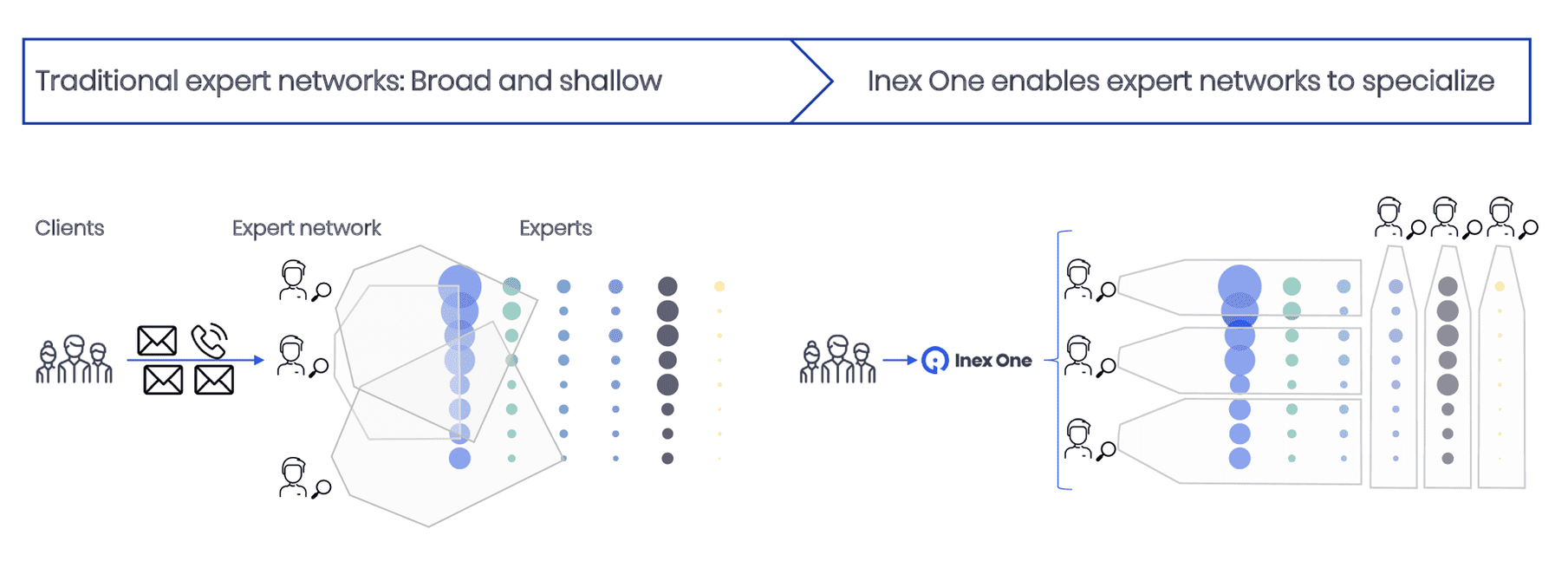

While the matchmaking jobs will remain with skilled expert network professionals, that doesn't mean the industry won't change. The way that clients interact with expert networks is inefficient, driving up OpEx for all parties. Inex One's platform solves those challenges, while leaving the matchmaking jobs in the hands of the specialized expert network.

Consequently, expert networks operating on Inex One enjoy a sustainable competitive advantage versus other networks. This translates into efficiency gains for expert networks and cost savings for clients, with some clients saving >40% of expert network cost.

To see Inex One in action, sign up here or contact sales.

-----------------------

For further reading and discussion, I recommend:

The LinkedIn bear case: the great unbundling

The initial Forum post on this topic

How expert networks win in the 2020's