15 Jun 2022

Crunch time for Private Equity Consulting

For years, private equity has kept strategy consulting firms bustling with activity. Ever-larger generations of consultants have passed through the private equity “ringfences” at firms like Bain, BCG, McKinsey, Oliver Wyman, LEK, Kearney, and EY-Parthenon. In addition, firms like CIL Consultants and Stax have emerged as CDD specialists. I did a lot of PE work as a consultant, and I even quite enjoyed it!

However, lately we’ve been hearing that PE investors are pausing projects and taking longer to make investment decisions. Generally, people pin the deal-market slowdown on inflation and rising interest rates. In the short run, it means private equity consultants will get home in time for dinner.. but should we be concerned about the industry at large?

Rising interest rates, what does that even mean?

Idk, I was a PE consultant, not a trader, so here’s my simplistic explainer. Any productive asset (a company or a stock etc.) is worth the sum of its future cash flows. As interest rates rise, far-out cash flows become worth less, so asset prices fall.

Nobody knows how far valuations will fall, or if they might rebound soon. This uncertainty makes both sellers and buyers hesitant to transact, each waiting for a better - or at least a stable - price.

Does this mean that PE deals are over?

I won’t pretend to know these things, so let’s have a look at what we know about private equity. Unlike publicly traded stocks where the value is apparent to anyone, the value of private equity funds is sort of decided by… the private equity fund. This makes sense in a way: nobody really knows the value of a company when it is not being bought or sold.

Looking at historical data, private equity has performed better than pretty much everything. Bain & Company’s new PE report (p.25) says: ”Buyout fund returns continue to outpace public equities across all time periods and around the world”.

Now some finance people say:

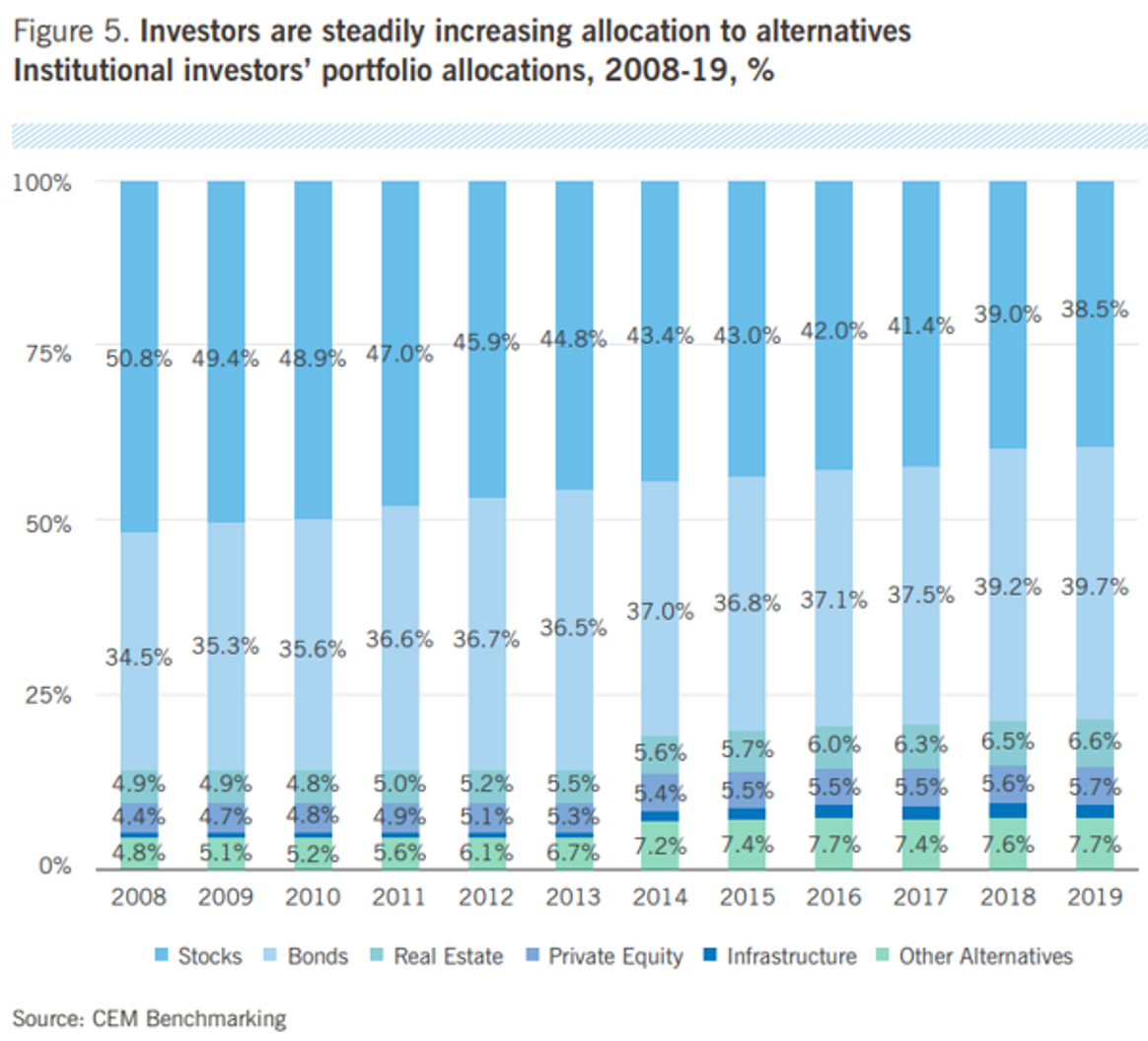

I don’t say much here. This all is being debated by scholars of course. Meanwhile, money keeps flowing into private equity and other so-called alternative assets.

This image is a bit old, but a recent survey (of mostly family offices and consultants) seems to confirm the trend in 2021.

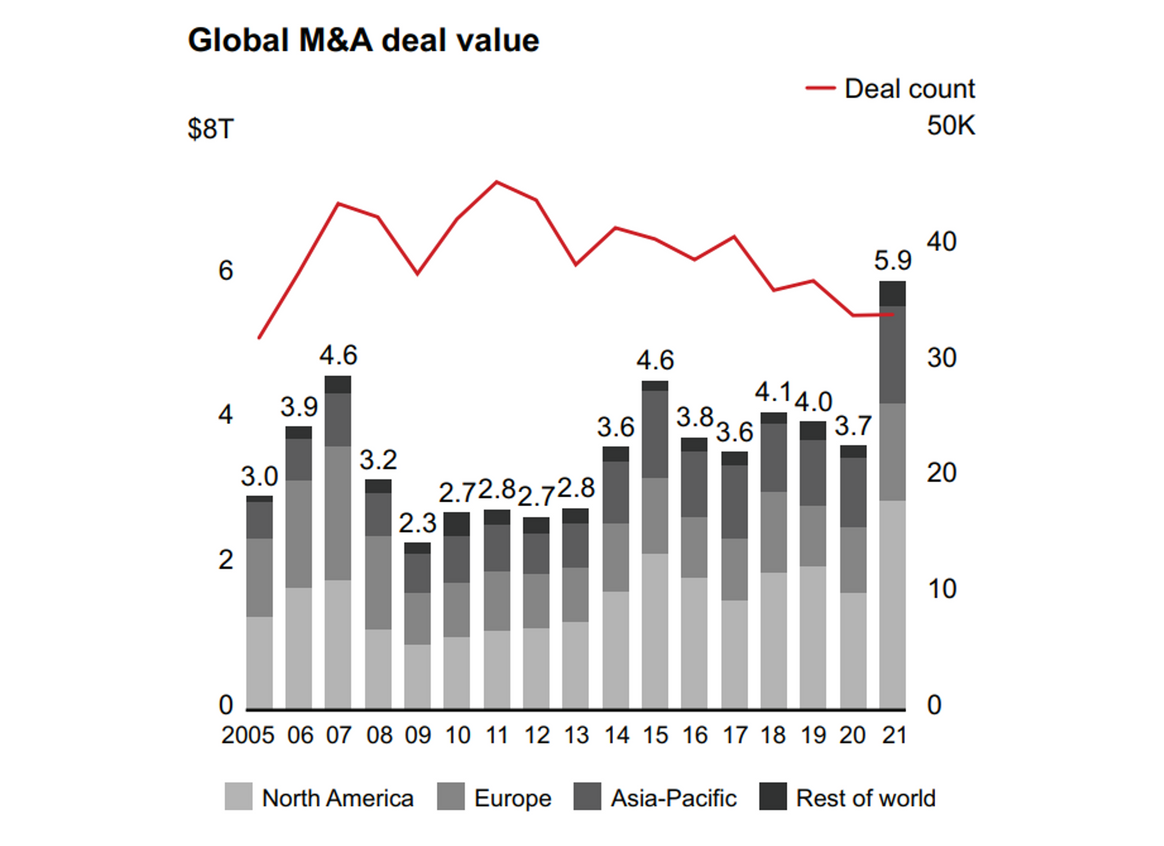

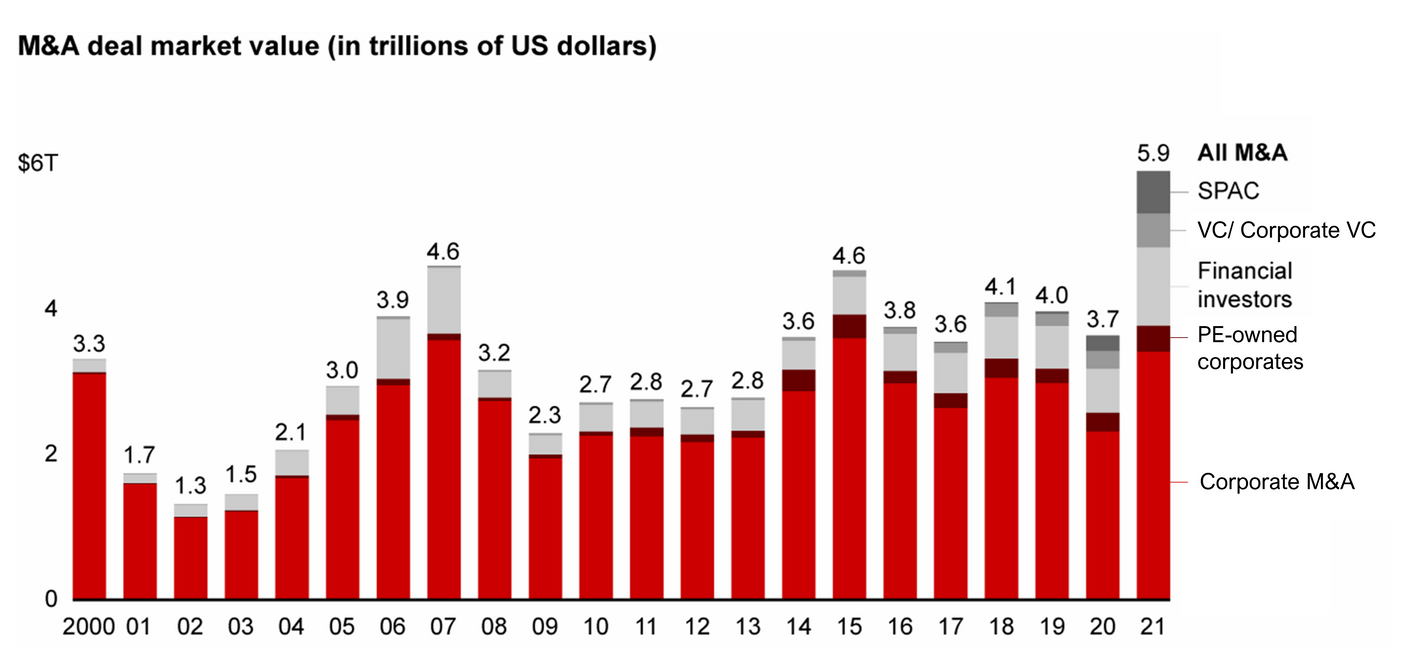

As more money is allocated to private equity, more deals can be made. And oh boy have there been deals. Bain & Company (p.13) says the global M&A market hit a record high last year.

What could stop the deals?

According to Bain (again, p.2), that would be (1) inflation and (2) global disruptions partly triggered by the Russian invasion of Ukraine.

It's already here

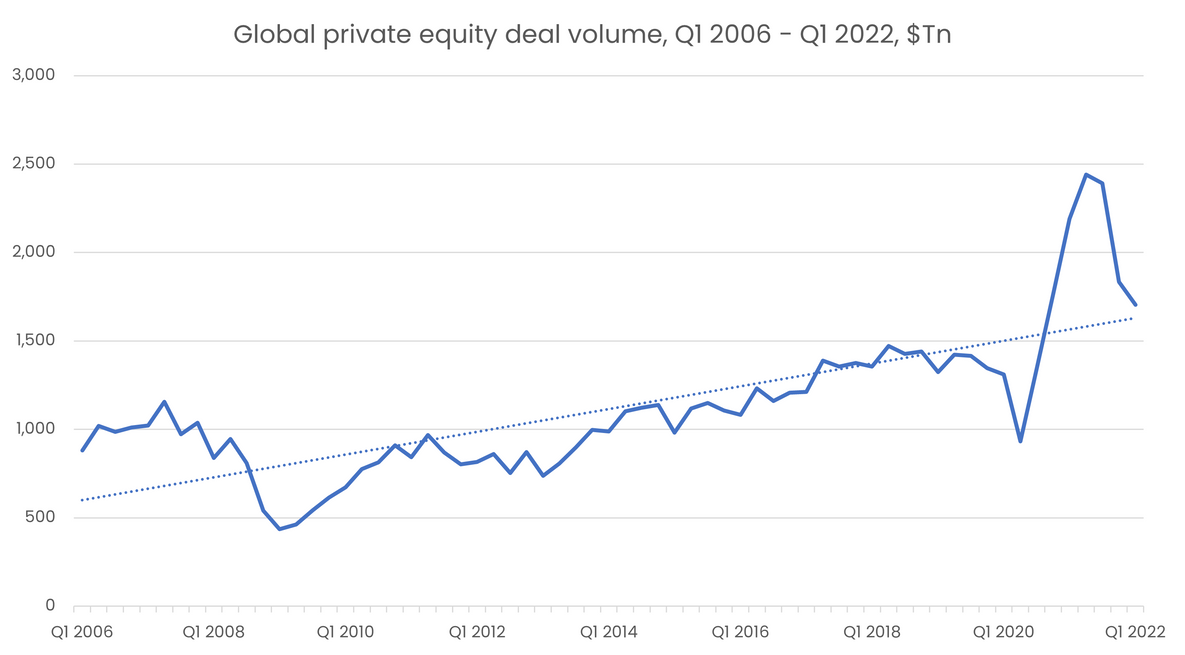

Turns out PE deal activity has already begun falling. Here are some slides that I made for my Board meeting this week. Check out the correlation of the two charts on p1 btw - is PE activity a leading indicator for expert network recruitment?

OK but how big of a deal is PE?

Private Equity is roughly 15-25% of global M&A value, according to Bain/Dealogic, and McKinsey. The rest is mostly corporates - with some companies doing lots of deals. Corporate M&A teams engage consultants of many sorts (banks, lawyers and financial advisors), but they typically have less of a need for commercial due diligence - the services typically done by strategy consulting firms.

Corporates typically understand the industry they operate in well, lest they go out of business. Conversely, private equity teams frequently engage CDD consultants to get smart on companies in many different industries. PE deal activity, therefore, is the main driver of the CDD consulting industry, and - in extension - of the expert network industry.

Note: I simplified the original Bain chart a bit. Private Equity is largely what Bain calls “Financial investors” in this graph, plus part of VC/Corporate VC.

Choppy seas ahead

We cannot say for certain “how bad it will be”, if at all. In BCG’s recent survey of 150 investors (p.10), two thirds said they expect a recession in the US during this year or next. 60% of them expect inflation to remain above 3.5% in 2023 and 2024. What that might mean for deal volumes, I’ll leave to the experts.

On the positive side for the industry, capital continues to be allocated to private markets. As for deal volumes, 2021 was an exceptional year. What we see now might be a reversal to a long-term trend of growth in deals.

In the short term, I think it’s prudent to plan for some volatility. Towards the end of this year, investors will hopefully be more confident in valuations and have adjusted to higher interest rates. They’ll need to deploy all that dry powder eventually, and when that time comes - they need their trusted advisors.

Until then, private equity consultants - and their expert network partners - will likely get to enjoy those dinners-at-home for just a little while longer.