23 Oct 2024

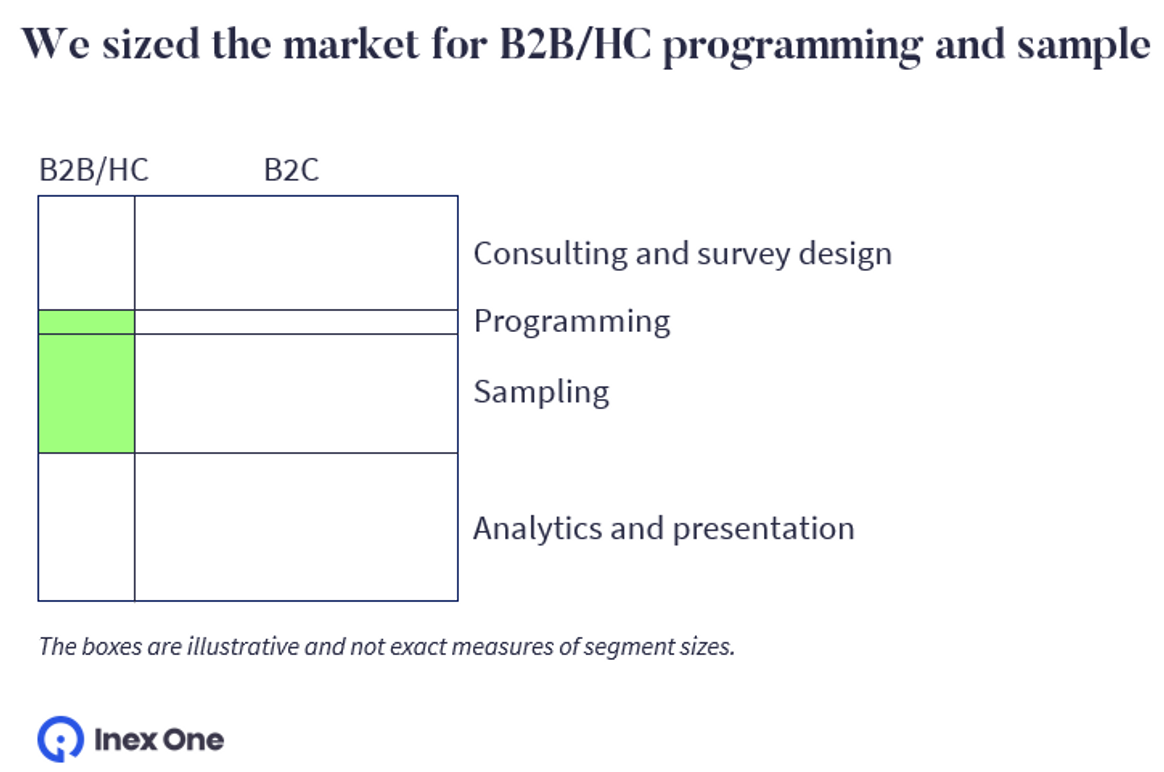

The B2B and Healthcare survey sampling industry market sizing

In 2023, the B2B and Healthcare survey industry reached $1.1 billion, growing by 5% from the previous year. We conducted a comprehensive bottom-up analysis, estimating the B2B survey revenue of 50 leading survey firms, panel providers, and expert networks. This research draws upon more than 100 conversations with leaders in the B2B survey industry, and the work we do with the leading B2B survey companies on Inex One. We’ve compiled a unique set of data combining public, hard-to-reach, and proprietary sources, to benchmark and sense-check the numbers.

Having done a few years of expert network market reports, this is the first extensive sizing of the B2B and Healthcare survey industry. We welcome feedback, additions, and improvement suggestions.

In contrast to B2C surveys, B2B and Healthcare surveys target respondents based on their - typically very specific - professional qualifications. Healthcare is a large and distinctive (special qualifications and regulations) part of total B2B, and is therefore often defined separately. But in this article, we use “B2B“ to describe all professional segments, including healthcare.

B2B surveys represent a subset of the $142 billion global insights industry, as defined by ESOMAR. In a related article, we discuss the methodology behind bridging the gap between the global $142 billion and our $1.1 billion estimate. To get the actual dataset, you can purchase it here.

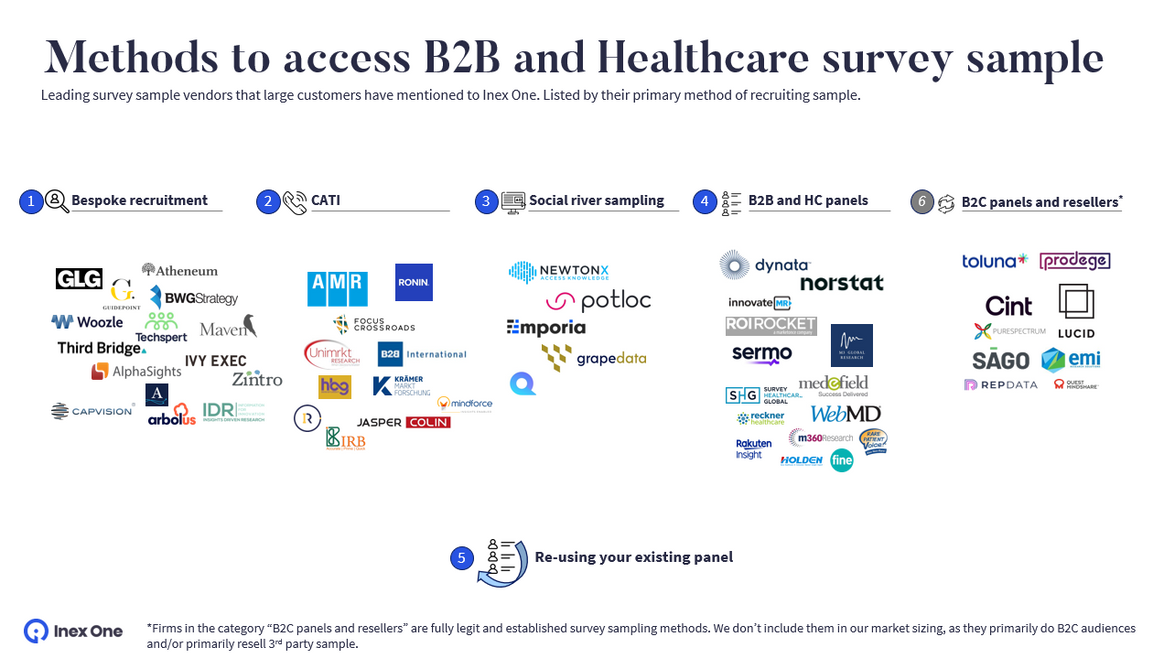

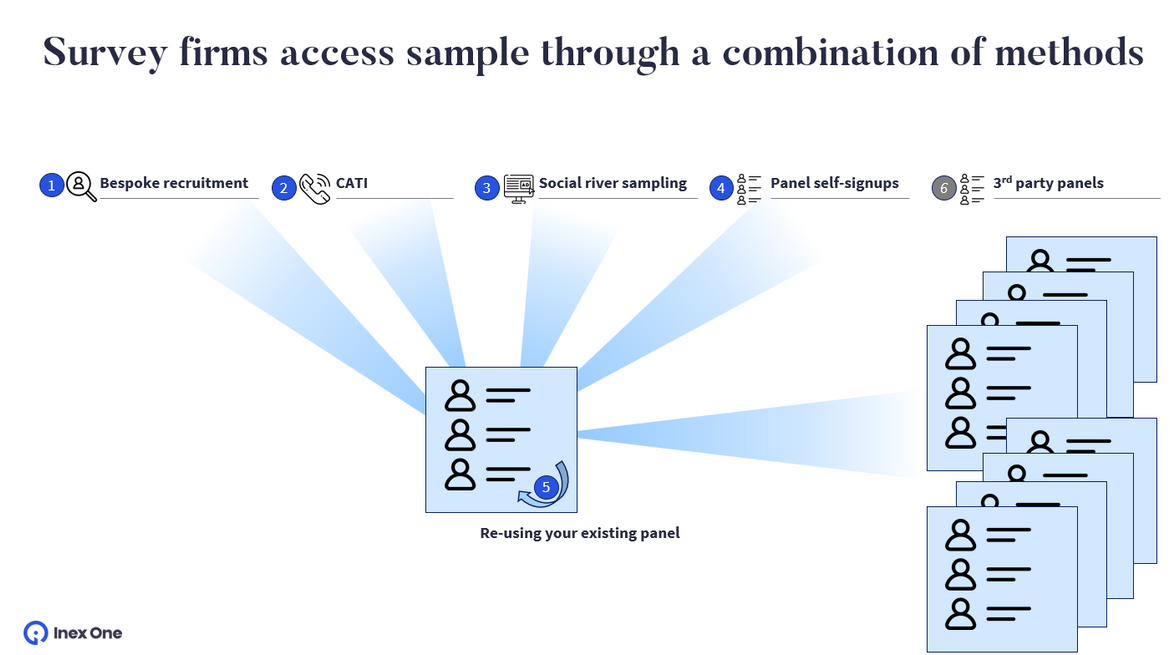

The B2B survey industry has five main methods to access respondents, with a sixth being access through external panels. Below, we explain these approaches. If any survey terminology looks unfamiliar, use the survey lingo explainer for reference.

The 5 ways to access B2B survey sample

When investment firms, strategy consultants, or market research firms want to survey professionals, they have five ways to get hold of them. Here are the vendors that these firms mentioned frequently to us:

The firms are listed by their primary method of recruiting survey respondents. This is a bit simplified, of course. In practice, survey sample providers use multiple methods in parallel. A firm like NewtonX for example, uses social “river sampling” as the primary method of finding new respondents, but complements with bespoke recruitment. They also tap into their own database of previously engaged respondents. Many firms also top up their own pool of respondents (whether freshly recruited or from their database) with 3rd party sample.

Some firms have built an entire business on brokering 3rd party sample. They focus on client service and consulting, sometimes survey programming, and then access respondents from other firms. Many of these firms (e.g. EMI, RepData, Cint) have bought or developed their own trust scores and high-end fraud detection tools.

To an economist, this division of labor sounds fair, and it often is. But especially in B2C surveys, excessive 3rd-party sampling has contributed to massive quality and fraud problems that the industry is grappling with.

Finally, 3rd-party sampling creates a Russian doll-problem when estimating revenue. So when sizing the industry, we excluded firms that mostly use 3rd-party sample.

So. Exclusions, exclusions. Now let’s get to the good part. How do these firms recruit respondents for B2B surveys?

1. Bespoke recruitment

Bespoke recruitment is done mainly by expert networks. These firms collect detailed profiles and CV history of individuals and qualify them over the phone. This method guarantees high-quality respondents, but is also the most expensive way to build a survey panel. Bespoke recruitment of respondents is not an economical way of recruiting an entire survey panel; the cost of recruiting like this is higher than the CPIs most customers are comfortable with. But expert networks have a growth hack for their survey panels: they build them as a side effect of selling $1,000+/h expert interviews. Bespoke recruitment is economical when you do expert interviews, which lets you accumulate an expert database that can also be used for B2B surveys.

2. CATI

Telephone survey interviewing has been around for ages. Its popularity got a boost in the 1970’s, when interviewers started doing Computer-Assisted Telephone Interviews (CATI): recording responses in real-time and getting guidance on the next questions from a computer. CATI brought big efficiency improvements and has ever since been a core market research method. Most CATI firms focus on political polling and B2C research, but some firms also have a material B2B business.

Today, most large CATI firms operate globally from India, Pakistan and the Philippines, but there are large CATI centers also in many OECD countries, e.g. Krämer and AMR Research in Germany, Ronin and B2B International in the UK, and Focus Crossroads in the US.

At first glance, a CATI center looks similar to a bespoke recruitment firm: rows of desks with people in headsets talking to experts/respondents. The main differences are that CATI interviewers are typically temps (“0-hour contracts”), and projects are sold as complete research pieces (“you will get 400 completes on this in 3 weeks”) rather than multiple vendors competing to fill them. The majority of CATI business is B2C and political research, but the approach is effective also for B2B surveys.

CATI firms typically don't accumulate databases of respondents but are still effective for projects requiring quick, high-volume data collection from specific respondent groups.

3. Social (online) river sampling

Ever seen hyper-targeted ads on LinkedIn/Facebook asking you to do a survey? That’s social river sampling - an effective way to recruit specific B2B respondents.

Social river sampling companies use tech tools similar to what edgy sales teams use, as they (a bit simplified):

Generate automated gross lists of people who have the exact CV profile that you want by trawling mostly LinkedIn but also Github, Twitter, etc.

Attract them to your survey:

Serve ads.

Send messages (e.g. DMs/ InMails, email cadences, automated texting).

Typically ask you to verify your identity with your LinkedIn account, in conjunction with completing the survey.

Social river sampling is similar to bespoke recruitment, but automation keeps your costs down to a level where you can often source the respondents from scratch. You don’t get as detailed profiles and you’re a little more exposed to bots/fraudulent respondents, but savvy buyers understand that and consider it alongside the - oftentimes lower - price tag.

4. B2B and Healthcare panels

Recruiting people for surveys is costly - what if you could get participants to sign up themselves? Turns out, it's possible!

B2C firms recruit consumers en masse through games (e.g. Prodege), or online reward pages. Consumers visit these platforms for entertainment or rewards and encounter small polls along the way.

So where on the internet do senior B2B leaders hang out? I want to slide my survey in their DMs.

Well, B2B panel firms have a few hacks for this, for example:

Social networks or industry guides (e.g. Sermo, WebMD and M3 all offer healthcare professionals social networking sites, online guides that they can browse for advice, or online directories to promote their services).

Partnerships with other firms’ B2B communities. For example, Dynata has a long-standing partnership with airlines and hotel chains. These firms let Dynata send surveys directly to business travelers and reward them with air miles. It looks like this, and has given Dynata access to hard-to-reach B2B demographics - even though not everyone on Reddit was impressed.

5. Reusing your panel

On top of recruiting new respondents using methods 1-4 above, any B2B/HC survey firm worth its salt has a database. This is where they store respondents they’ve engaged previously. These respondents’ profiles get enriched over time, as each respondent takes more surveys. This is called a knowledge graph, creating returns to scale for survey firms as they grow (provided they don’t churn the respondents!).

How to get quality respondents for your survey

All these methods are established and proven ways to access B2B and Healthcare survey respondents. Different vendors have specialized in different recruitment methods, and each built a database and industry knowledge reflecting the type of survey projects they’ve done historically. Therefore, the survey firm that is best suited can vary between projects.

Inex One partners with the best B2B and Healthcare survey firms globally. On the Inex One survey platform, you can find and engage multiple top vendors and compare their bids. Find the right survey firm, to get high-quality insights for your most important business decisions.

Ready to access the best B2B and Healthcare survey firms? Get started here, or book a demo.