02 Jun 2024

Tools for international market research

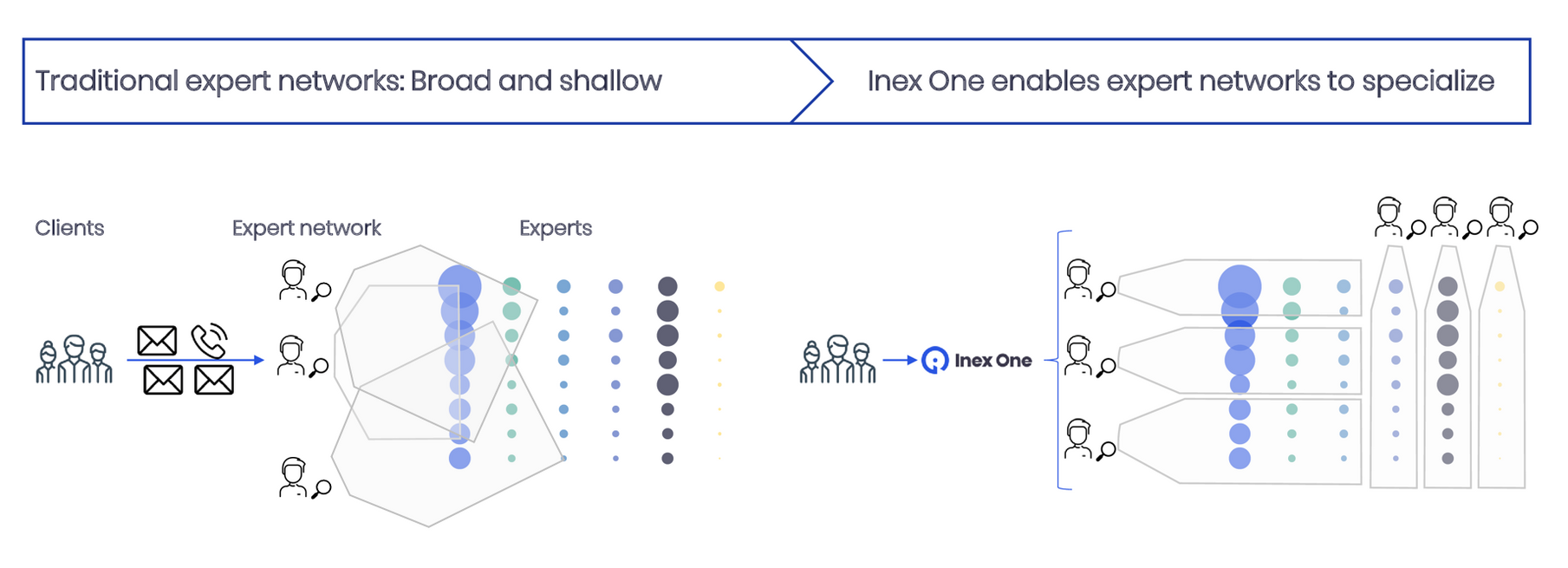

International market research is difficult. Once you go cross-border, you run into a new set of challenges. Which vendor should I engage? How does the contract and pricing look? Can I trust the quality?

We've built Inex One to solve these challenges. I was myself a big market research buyer back in consulting. I used multiple expert networks and survey firms in parallel - it was messy and draining!

With Inex One, you can access all the best international market research providers in one place, for expert interviews and surveys. You have one single contract that applies to them all, and prices are stated clearly upfront.

Inex One also monitors supplier quality across. More than 6,000 users of Inex One worldwide give feedback on the vendors' quality and price-performance. This feedback informs what features we build, and how likely a vendor is to be recommended for future projects in that geography or industry. The best vendors get loads more business, while some lower-performing are eventually taken off-platform. This ensures that customers always get the best service in the market.

Tools for cross-border market research

Let's say you are a Corporate strategy team in the US, doing research for your international expansion. You could engage a strategy consulting firm, or you could do the research yourself.

The first thing you would do is to search online. You will find these things:

Market entry reports from consulting firms (each one of varying quality, recency, and relevance.

Market reports from public agencies (e.g. this one, this one, or this one).

You're welcome. Now, let's say you want to go one level deeper, with some proprietary research. You'll want to speak to local experts - people who have worked in your industry and can relate to your business. This is where many strategy professionals turn to expert networks. (If you're entirely new to them, check out this primer: What are expert networks?).

Which expert network should I use?

It depends. Expert networks are specialized, high-velocity headhunting firms. They each have their strengths and weaknesses, as we discuss in the expert network market sizing. If you research a specific geography or industry, you want expert networks that share your focus.

We've listed a few common themes here:

Expert networks in Japan. The Japanese economy is the world's third largest after the US and China. But the expert network industry took longer to develop in Japan than in many other large economies, with VisasQ starting in 2012. Today, it's bustling, with both domestic and international players having offices in Tokyo. With Inex One, you can access multiple top Japanese expert networks under one contract.

Expert networks in Korea. The first Korean expert network, Nathan Research Group, started in 2013. Today, there are multiple expert networks in Korea, many of which are available on Inex One.

Expert networks in Europe. There are more than 15 expert networks in Europe, ranging from multinational companies to regional specialists. With Inex One, you can access expert networks specialized in all major languages and regions, e.g. the UK, Nordics, German, French, Spanish and Italian-speaking regions.

Expert networks in the Middle East. There are four expert networks with offices in Dubai, from which they service the Middle East: GLG, Infoquest, Guidepoint, Alphasights, and Swissmen. In addition, Atheneum and IDR have offices in Pakistan, serving the Middle East.

Expert networks can also be approached from a functional perspective, where different client segments have different needs. So far, there are two industry categories with multiple dedicated expert networks are:

Expert networks for Energy, Industrials and Materials. Four expert networks are focused on the global energy industry: ENCO Insights, Pangea SI, Candour Energy, and KEEN.

Expert networks for Healthcare and Life Sciences. The expert networks who say they have a particular focus in healthcare are Guidepoint, Atheneum, IDR, and Techspert. Other networks with meaningful healthcare practices include Alphasights, Third Bridge and GLG.

Compare expert networks with our guide, or work with multiple top networks in one unified platform - on Inex One.