24 May 2023

What are Expert Network Transcript Libraries?

Many firms have started offering digital libraries of transcribed expert calls in recent years. What are they, and how do they compare? Here’s our breakdown.

In the beginning, there was the Roundtable. GLG hosted meetings on popular topics, inviting a senior expert and a few clients for an “idea dinner”. Some meetings were held over phone, with clients dialing in to listen. Sometimes, a client couldn’t make the time of the meeting; so it got recorded and made available for purchase.

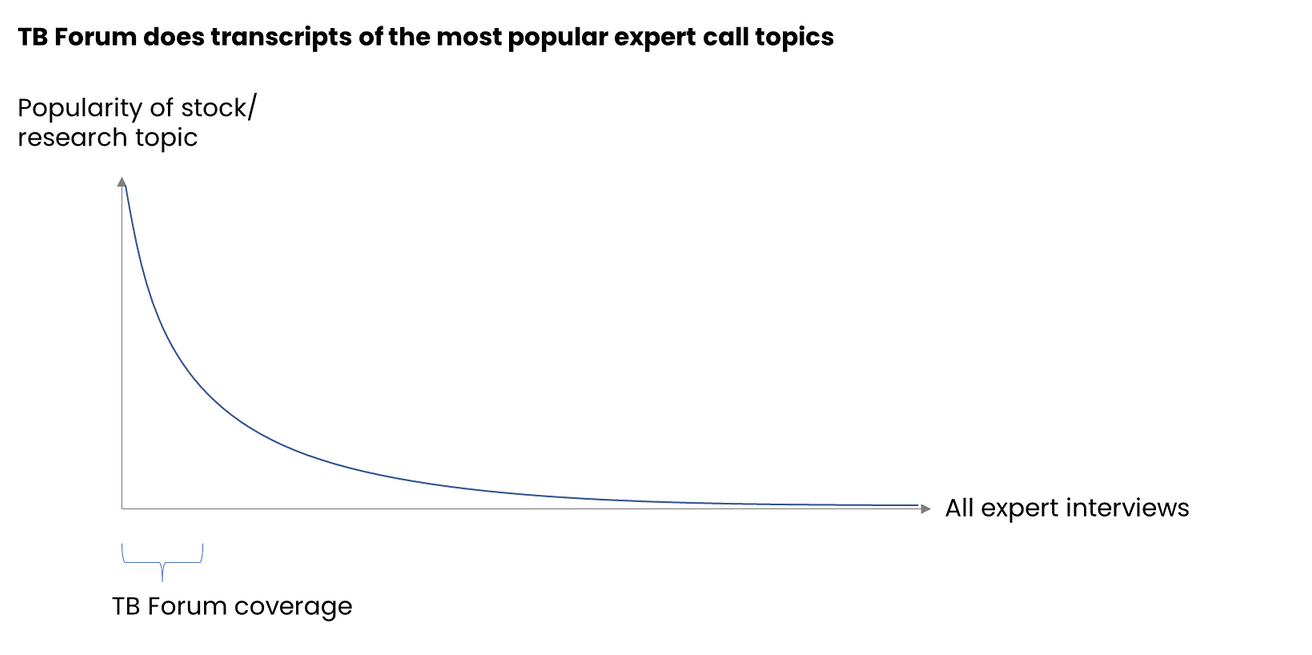

In 2013, Third Bridge took the model further, inventing the Forum product. At the time, TB was one of the largest expert networks globally. Whenever a big topic came around (e.g. earnings announcements in a popular stock), they found themselves selling 1h interviews with the same former C-suite execs to lots of investors who followed the stock.

With Forum, they forward-integrated, saying “hey all you analysts out there, we’ll do the call for you (and sell you the transcript)”. Some clients said “meh, I’m better at asking the right questions”, while others quite liked the convenience. They would read a couple Forum transcripts to “get smart” and do their own interviews on only the most interesting deals.

Going upstream

Over time, TB learned to anticipate which calls people wanted to do, and recorded transcripts well in advance. This wasn’t wizardry; they simply went for popular equities & debt securities that lots of funds trade in & out of around earnings announcements. This worked so well that Third Bridge even recast itself as a data company.

In 2018, Guidepoint got in the game, launching a tool called Guidepoint Insights. Similarly to Third Bridge Forum, it had full-time professionals employed to generate transcripts.

All the while, regular 1h calls remained the core business of both Third Bridge and Guidepoint. The new transcript services were seen with some skepticism from the core business, fearing they might “cannibalize” the 1h phone call.

In 2016, two brothers in Chicago had launched Tegus, a transcript-first expert network. The content library was the main biz; selling 1h calls the secondary. The business was inspired by Costco’s membership model:

Tegus charged clients a hefty subscription fee to access all content, instead of per transcript.

They incentivized (increasingly forced) clients who did calls with them, to also publish them to the content library. Clients pay just $4-500 per expert interview, but Tegus owns it, scrubs it for compliance sensitivities, and publishes it to their library after two weeks.

Together, this created a flywheel where users would read Tegus transcripts, do a couple follow-up calls and thereby generate new content for other subscribers to read. All the while, Tegus has an army of analysts generating call transcripts themselves, to make sure there is sufficient content available.

Whereas Third Bridge and Guidepoint sought a way to get more yield on certain popular expert interviews while still selling 1h calls, Tegus wants to become the content library of all transcripts, reducing the need for many interviews to happen altogether.

It's getting crowded in the library

In 2020, the expert network Mosaic launched a similar product, called Stream. It had many similarities to Tegus and the two are often mentioned alongside in Fintwit threads.

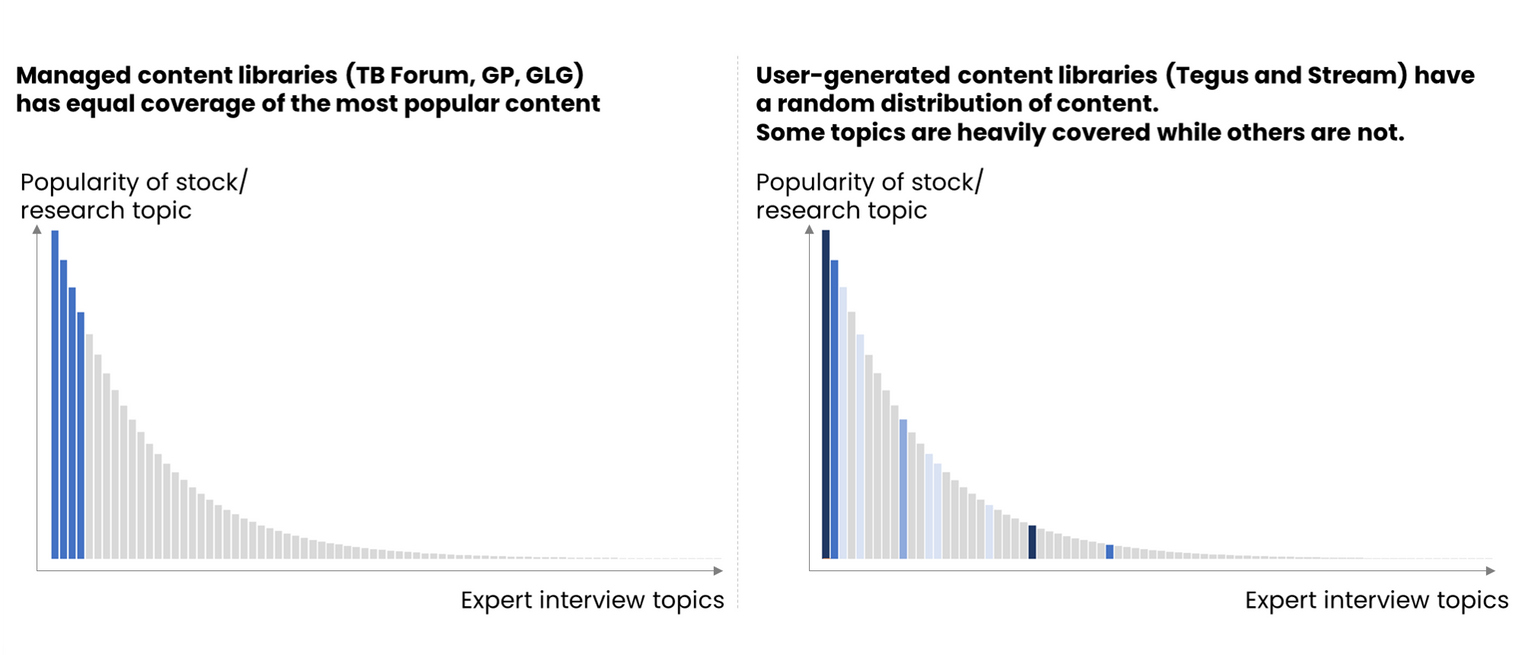

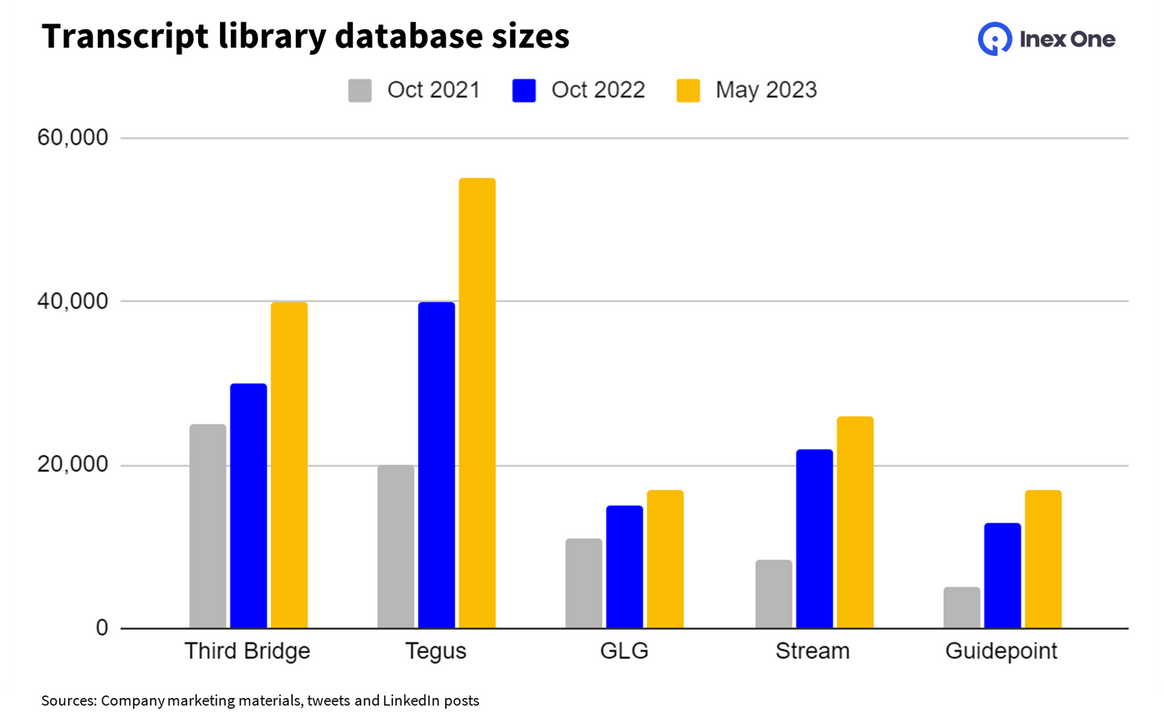

As of May 2023, Tegus has the largest transcript library in number of logged calls. There is however a notable difference in the type of content: Tegus and Stream content is mostly user-generated and often quite short. As calls are user-driven, there are multiple overlaps on the same asset (e.g. Tegus has ~500 calls on Block/Square).

Conversely, Third Bridge Forum, GLG and Guidepoint’s libraries are largely authored and planned. The interviews are longer and conducted by full-time employed, unbiased interviewers. This means there’s some merit to Third Bridge’s claim to have the biggest archive of expert interviews. But the services are increasingly similar, as also Third Bridge and Guidepoint started doing user-generated content.

Who is it for?

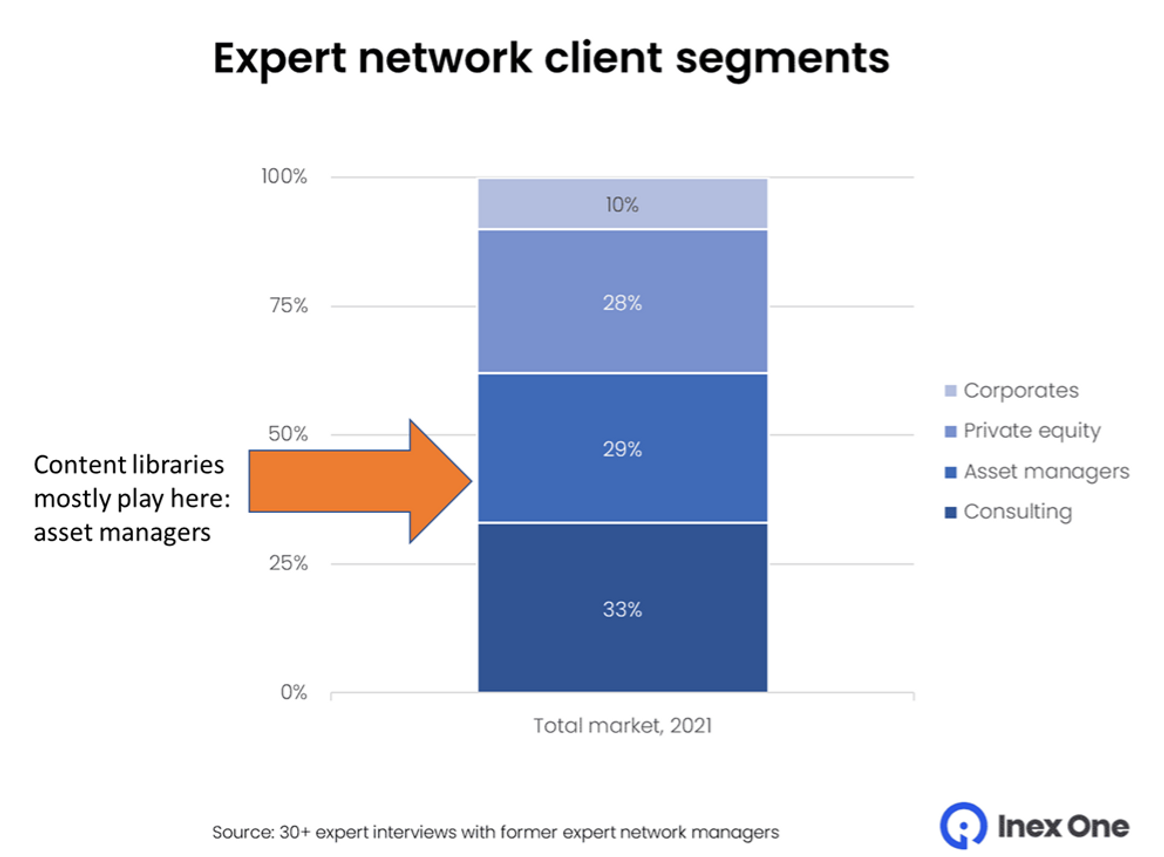

Content libraries are mostly used by public market investors. For example, hundreds of hedge funds and asset managers trade in and out of the Microsoft stock every week, so sharing transcripts of ex-Microsoft managers is relevant to lots of people.

On the other hand, PE shops (and the consultancies they hire) buy an asset and hold on to it for six years. After six years, any transcripts you did for the acquisition are pretty dated. So libraries of transcripts on past deals are less valuable for private equity investors.

The same applies in the corporate segment: Corporate strategy and M&A teams are typically very much experts themselves. When they do expert interviews, those are rather niche (in the far tail end of expertise). Again, transcript libraries have somewhat limited appeal, other than perhaps monitoring what your former employees tell the world about your firm.

That said, there’s a “bull case” for transcripts being relevant for just about everyone. It’s an efficient way to “get smart” on a general topic. This has an appeal for a lot of roles in different types of companies. One could argue that it has a bigger appeal than general expert calls, if it comes at a lower cost (in money and time to access).

Content meet Browser

In October 2021, two big announcements happened: Alphasense bought Stream, while Tegus bought BamSEC.

Alphasense is a Research Management System (“RMS”) helping mostly institutional investors (hedge funds, public asset investors) to index and smart-search through all their content (filings, earnings calls, expert calls – you name it). BamSEC is a rudimentary version of Alphasense.

The rationale is similar to both, here in the words of Alphasense: “This acquisition allows AlphaSense to add its market-leading AI search technology on top of an incredibly valuable content platform, and is consistent with the companies' shared mission to empower business and financial professionals to make smarter decisions through the best tech-enabled market intelligence and insights."

Here’s what I think happened:

Hedge funds liked and used TB Forum. They bought one-off transcripts and chugged them into their RMS:es alongside other relevant content of all sorts.

Guidepoint, Tegus and Stream grew the supply. The RMS companies noticed an opportunity to offer more call transcript content.

In June 2020, Sentieo (an RMS) struck a deal to redistribute all Third Bridge Forum content. (Sentieo was a close competitor to Alphasense, and later acquired by them in May 2022).

In Sep 2021, Alphasense raised $180m and went shopping for content. Stream was an apparent target.

Tegus feared becoming a generic content producer among others, as it would threaten their juicy subscription revenues (starting at $25k/seat). So they decided to become a full-blown RMS, and bought BamSEC.

The content arms race

In the past two years, the leading firms have been sprinting to build comprehensive research platforms.

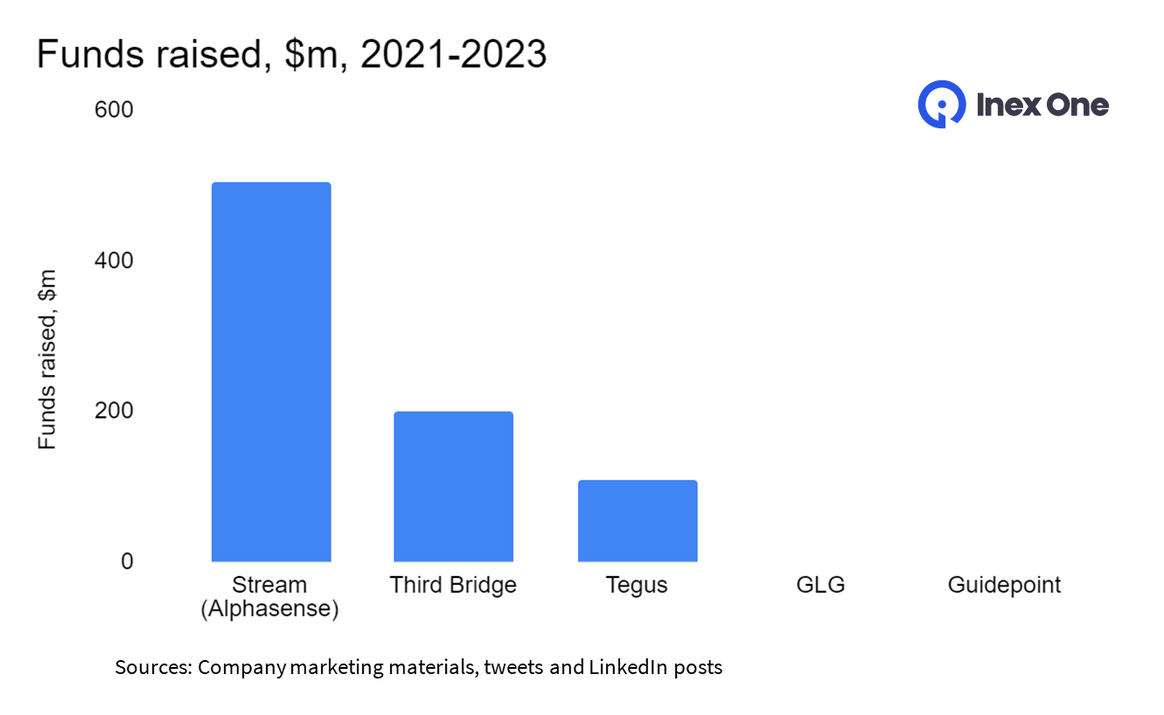

Alphasense-Stream has raised more than $500m to build “The market intelligence platform trusted by over 2,000 leading organizations”. In May 2022, it acquired Sentieo, its main competitor in AI text analysis and search.

Third Bridge raised more than $200m and hired 90+ professional analysts to interview experts and generate content.

Tegus raised $110m, acquired BamSEC, and in Aug 2022 also Canalyst (a platform that simplifies financial modeling).

While Alphasense and Tegus are evolving into broad RMS:es, Third Bridge distributes its both on their own Forum portal, and through multiple other RMS:es like CapIQ, Bloomberg, Factset and Refinitiv Eikon. Third Bridge seems more focused on the content they generate than what mode their clients consume it.

Why aren’t GLG, Guidepoint and Alphasights joining the 🥳?

GLG, Guidepoint and Alphasights are among the largest expert networks around. They should have the scale and funds to build at least a decent content library, perhaps even an RMS. Yet they’re plodding along compared to Third Bridge, Tegus and Stream. Why aren’t they joining the bandwagon?

Maybe they don’t like competition (wouldn’t surprise me much 🤭). Or maybe they see some other risks in the business model.

Addition on May 26th:

1. After sharing this blog post, some readers got back to me saying Alphasights is indeed working in stealth mode on "AlphaNow", a platform of user-generated content and company 1-pagers.

2. Also Guidepoint reached out to say that they're revamping their portal, expanding content globally and introducing new content types.

OKOK, so the battle is on!

Challenges to the transcript library model

Is content the holy grail for expert networks? It clearly has an appeal, but also a few risks: Compliance, Shelf-life and Quality.

Compliance. In most ways similar to compliance around regular 1-on-1 expert calls, but with one major difference: a leak of MNPI would be broadcast to a huge global audience. Oops. No wonder that Tegus talks about their huge compliance team. I wonder if this emphasis on reviewing "Every.Single.Transcript" means Tegus assumes some liability in case of a compliance breach?

Shelf life. How relevant is a transcript from last year to a stock you’re trading today? No idea. It could be a lot (“I use sentiment analysis over multiple years of transcripts to identify a trend”), or not at all (“there’s nothing as old as yesterday’s news”). Expert network databases are comparable – and shelf life is arguably short. Here’s why:

For more than 20 years, GLG has accumulated the largest expert database in the industry. Recently, it reached 1 million experts. But it didn’t give them any meaningful economies of scale. For more than a decade, GLG has been losing market share, despite that shiny database.Furthermore, an expert profile is arguably more valuable than a transcript. The expert can be engaged to speak on many topics, whereas a transcript is only a point-in-time snippet of one part of their knowledge.

Quality. Any content library will inevitably contain some great content, and some mediocre. The great content may or may not be relevant to whatever stock you are researching today. How do you distinguish signal from noise? If I read expert transcripts, will I get insights that my competitors don’t already have? Will I merely get cool ideas – that I might as well get in a distilled form, for free, on FinTwit or my favorite analyst’s newsletter? Also, does user-generated content risk introducing bias, or negative alpha, or even outright incorrect info?

There are also smaller primary research content businesses like In Practise, who have taken a niche focus and are segmenting the market further. The founders of In Practise were involved early on with Third Bridge Forum. In Practise publishes a relatively small volume of high quality interviews and research, aimed at long-term fundamental investors, and prices significantly lower than the larger players.

What about the experts?

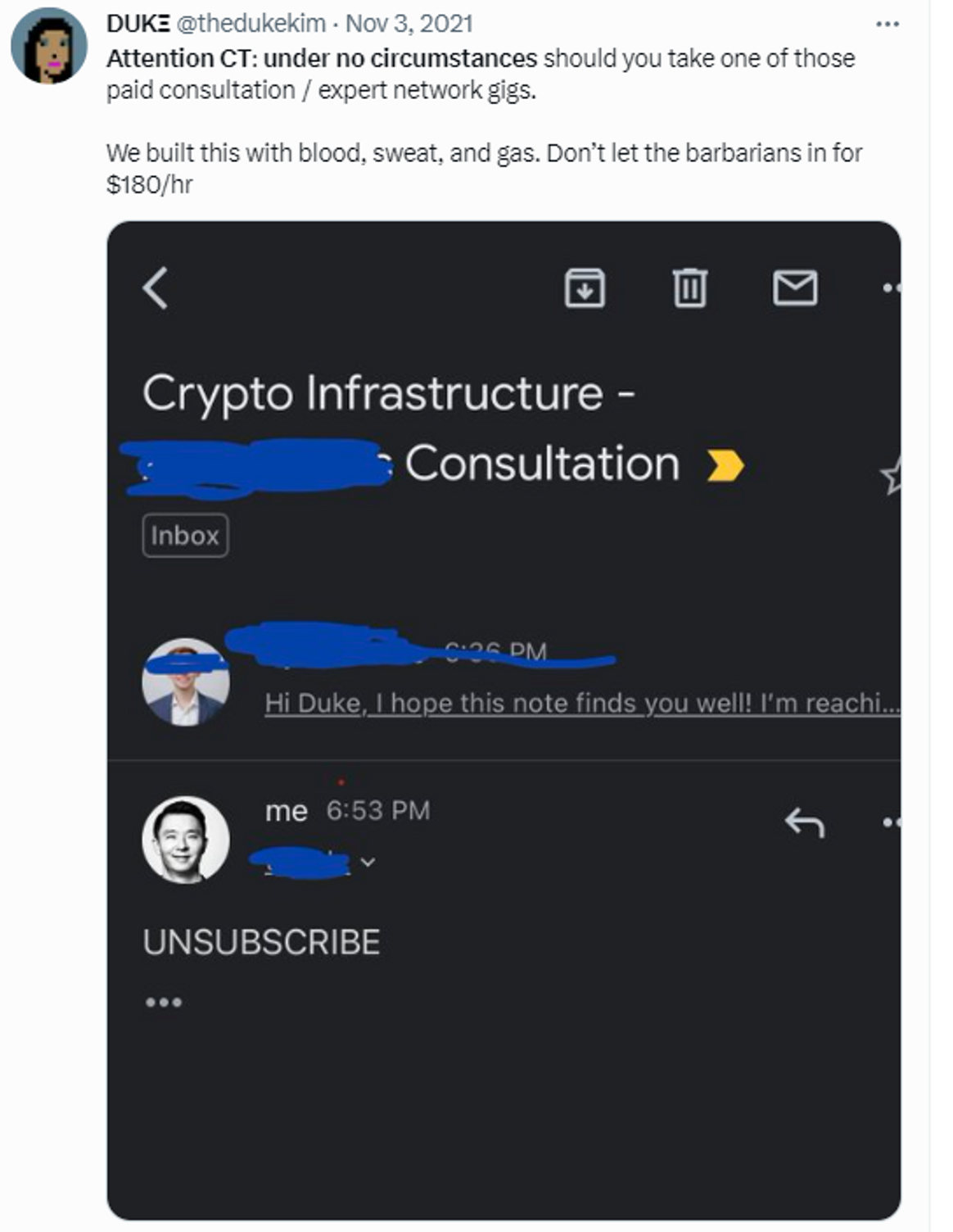

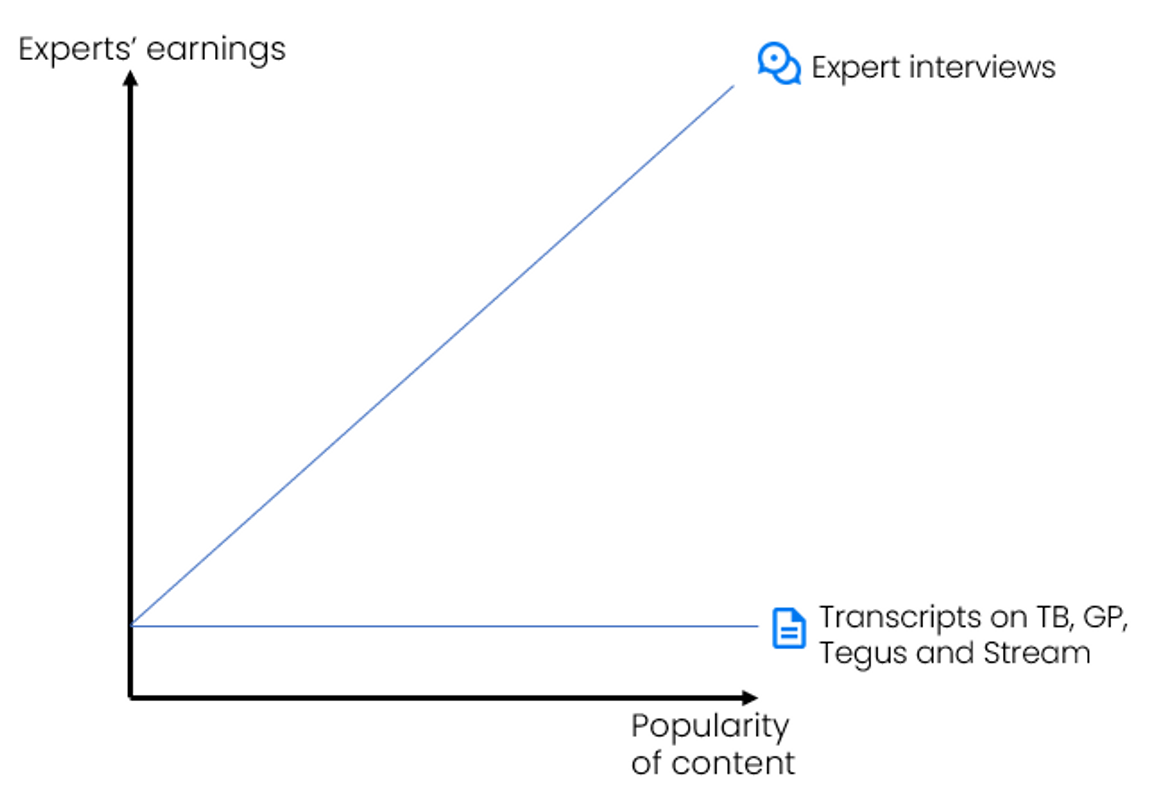

An expert on an expert network is able to resell their expertise many times over. As shown by recent IPO filings, some experts’ earnings go well into the tens of thousands.

Conversely, experts who record their knowledge onto content libraries get paid only once – when they record the content. Already today, some experts rumble about regular expert interviews, e.g.:

What if they discover the economics of sticking that experience onto a content library?

By agreeing to be recorded, the expert agrees to hand over all future earnings to the content library (for as long as the content is relevant). That’s a great trade for the content library, but not-so-great for the expert. This insight – and the general iffiness with being recorded and broadcast to anyone with a credit card – might make some experts decline working with the transcript libraries altogether.

This seems to be the case. We see many clients using a content library for run-of-the-mill content, while getting specialized insights from 1-on-1 calls with Inex One. When using Inex One, clients build their proprietary call transcript libraries. All calls are transcribed and made available within their firm only, enabling you to accumulate a proprietary insights asset.

The future of expert call content libraries

Content libraries are useful and therefore popular with investors. They’ll continue to grow, especially in high-deal-velocity areas (public markets and growth equity). Which type of content – user-generated or authored – that has the biggest appeal remains to be seen, as does the pricing power of the various players.

Other firms analyze more specialized industries (e.g. private equity investors, strategy consultants and corporate strategy teams), or have stricter confidentiality requirements. If you’re such a user, Inex One is the tool for you. Thousands of users do quality expert calls and surveys on Inex One. See why they love Inex One here, or book a demo.