16 Feb 2022

Who uses expert networks?

Expert networks let you tap into the most niche knowledge around. They're like 'Google for everything that's not on Google'. Interviewing experts is an efficient way to get an information edge. Sounds great, but who uses expert networks, really?

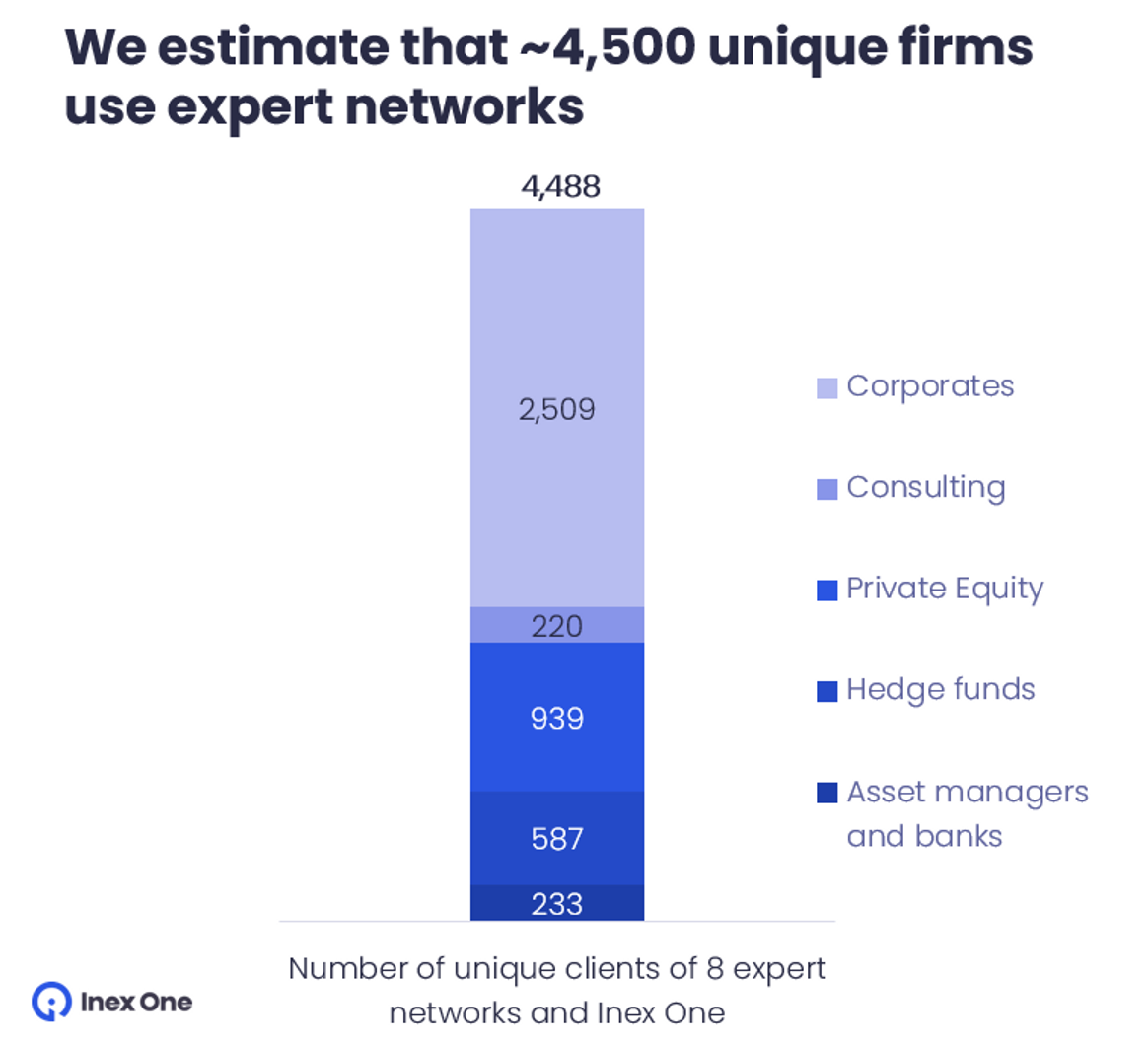

We estimate that some 4,500 firms within investments, strategy consulting and corporate strategy do. How did we get to this number?

How do we know 4,500 firms use expert networks?

Sometimes, your answer is hidden in plain sight. For the last four years, Inex One has been analyzing and improving the expert network industry. We sized the market to know which clients we should focus on helping first. First, we approached it as a classic consulting interview case, “top-down”.

From a top-down approach, the total addressable market is about 10,000 hedge funds, 10,000 PE funds, plenty of strategy consulting firms, and more than 100k large companies in the EU and US alone. That sounds like a lot, which was handy when we raised money last summer. But this is just one way to estimate it. What about bottom up?

Sizing the expert network industry, bottom-up

It turns out the answer was already given to us - by the expert networks themselves. GLG, the biggest expert network, literally says how many clients they have, and their breakdown by type. Not only in its informative S-1 filing, but also in a number of factsheets over the years. A marketing flex, I guess, but also great data for our sizing!

GLG says it serves 2,700 clients which includes 800 private equity funds, more than 500 public equity firms, 40% of the Fortune 100, and “most of the top management and strategy consultancies” (S-1 p8). Also,

Alphasights works with 250+ PE funds, 450+ hedge funds, 100+ asset managers, 20% of the Fortune 500 companies, and the top global consulting firms.

Third Bridge serves “over 1000 investment firms”.

Guidepoint serves "over 1000 institutional and corporate clients".

Capvision serves 707 financial institutions, 200 consulting firms and 329 “other corporations”.

VisasQ serves 921 clients with a breakdown that looks like 560 business corporations, 261 consulting and finance and 100 “overseas” clients.

Coleman has 300+ clients “comprised of the world’s largest HFs, mutual funds, PEs, consultancies and corporations”.

Inex One serves 221 clients, last time I counted. These are 65 private equity funds, 55 consulting firms, 19 hedge funds/ asset managers and banks, and 82 corporates.

Prosapient serves “over 100 clients across Europe and the USA”.

(There are actually more than 120 active expert networks, but these are some of the larger ones, so let’s start with these eight above, plus Inex One.)

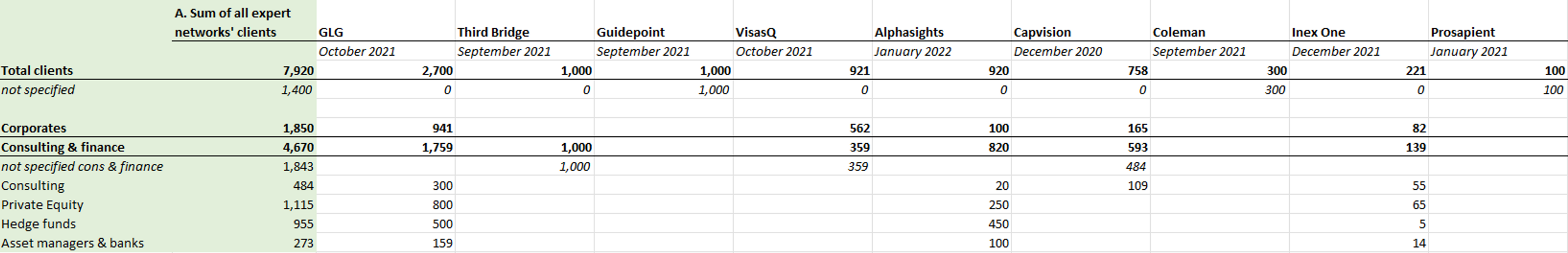

Here are the numbers all put together:

This sums up to 7,920 clients, across these eight expert networks plus Inex One.

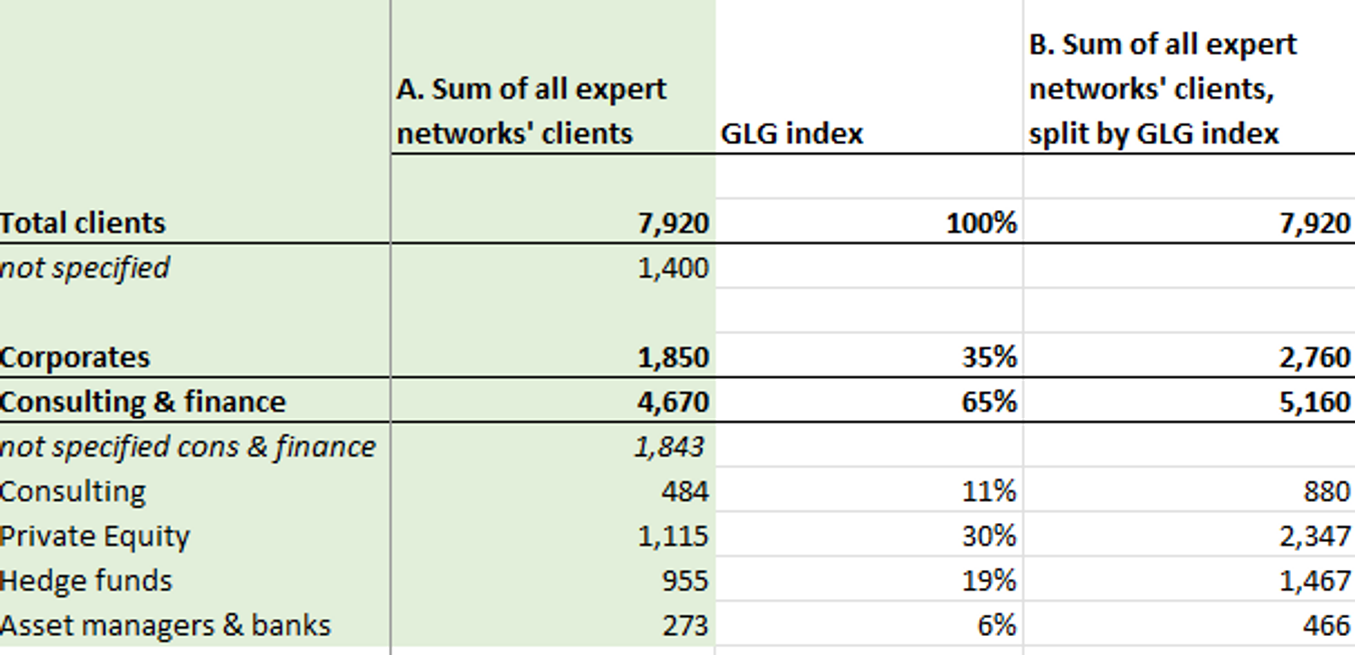

For some expert networks, we only have the high-level number, not the breakdown in client segments themselves. But let’s assume that GLG, at ~33% of the total industry, is a good proxy for the overall distribution of clients across segments. Applying GLG’s client mix across all firms above, we get these numbers:

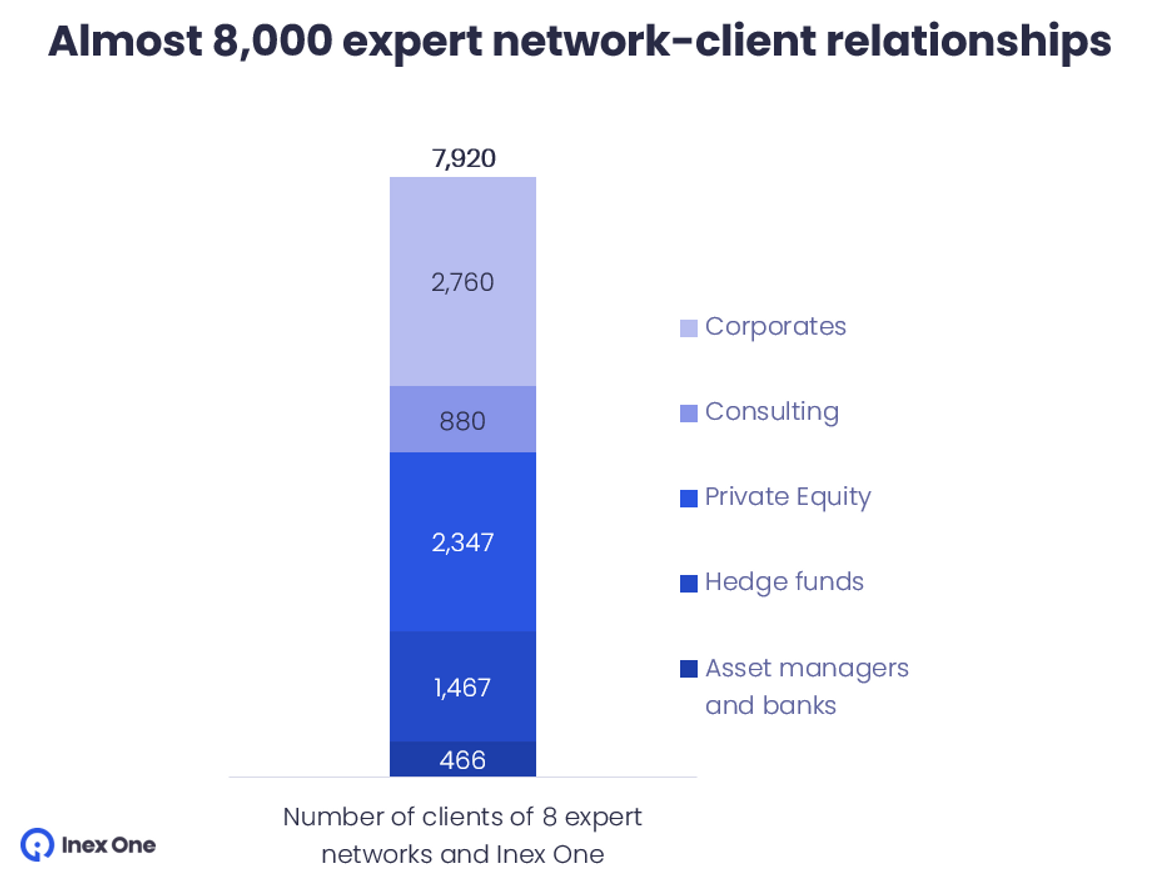

Or in a more visually appealing bar chart:

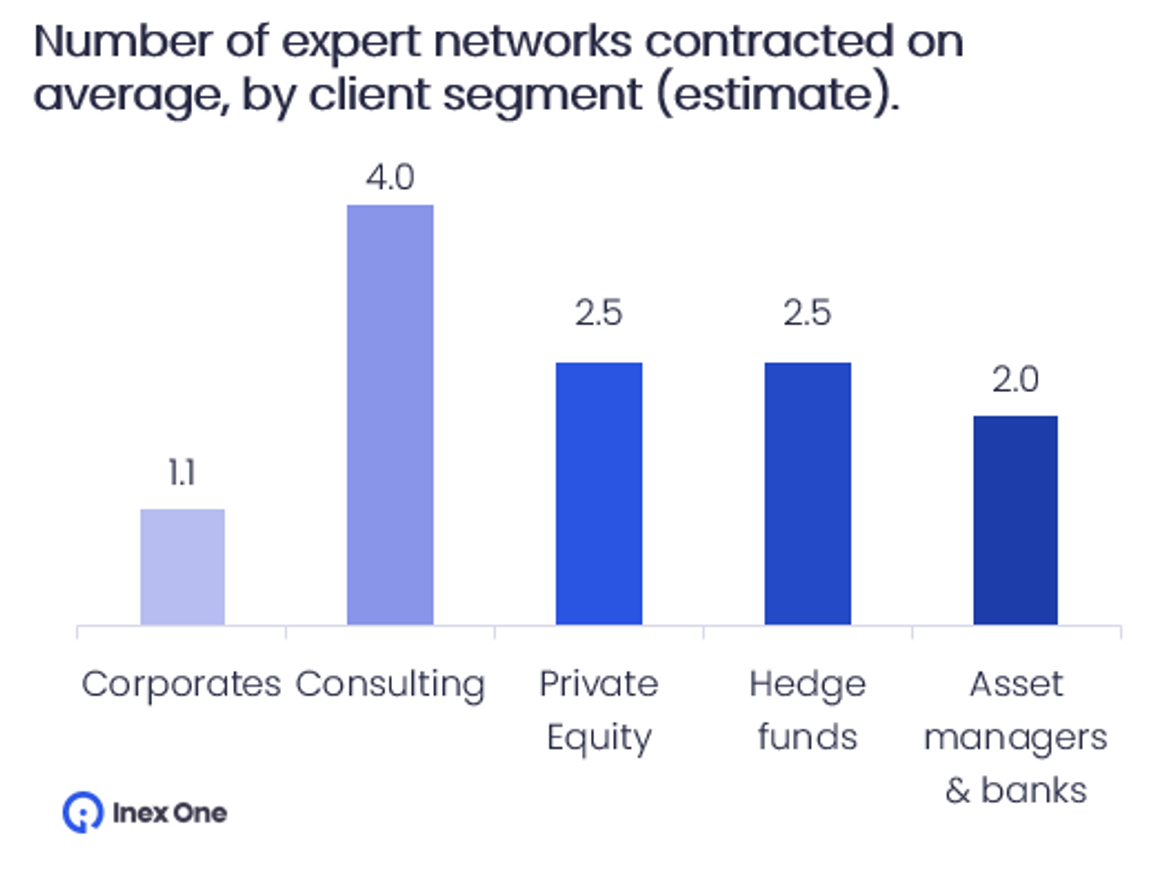

That’s a lot of clients! Now, most firms actually use more than one expert network. Such “multi-sourcing” is especially common with consulting firms and large Investment firms; less common with corporate strategy teams. So to adjust for multiple expert network contacts, we discount the size of each client segment by some guesstimated factors.

Adjustment for multiple expert network contracts

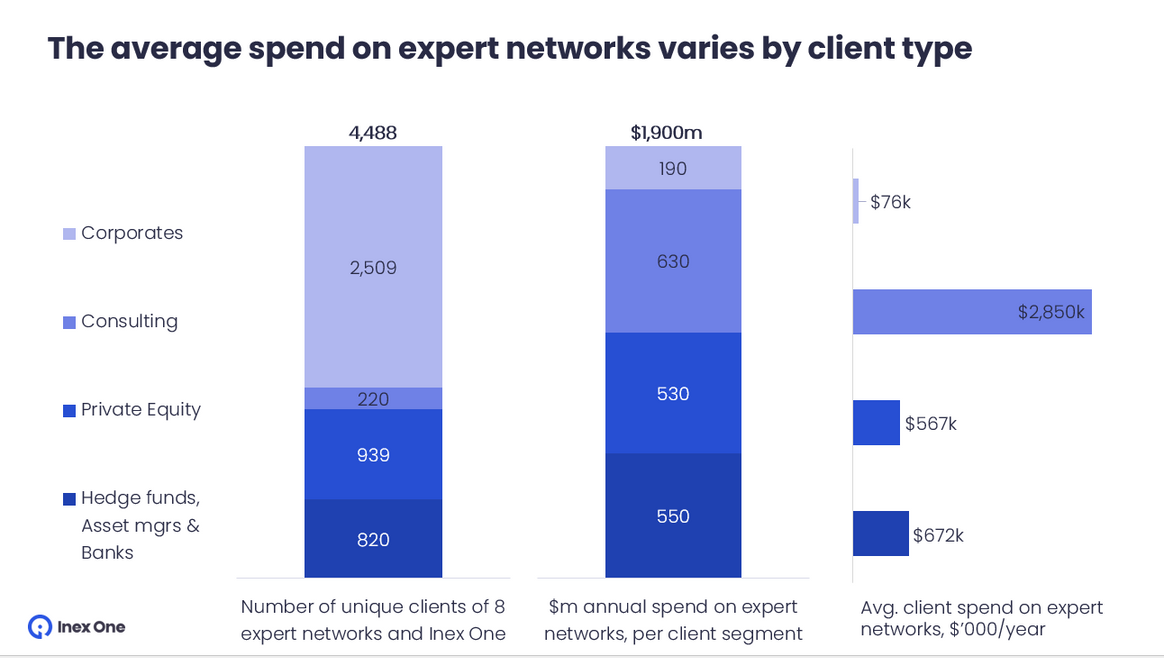

After that adjustment, the “real number of client firms” gets closer to 4,500. Some 35% are corporates and the remaining 65% are in consulting and finance.

We then take it one step further, splitting the total expert network industry revenues of $1.9 Bn across each of the segments. We find that the average spend per client firm differs greatly. The average corporate spends just $~76k / year. On the other hand, the average consulting firm spends $2,850k, while PEs, hedge funds and asset managers average spend is around $600k per year.

(here we sum hedge funds, asset managers & banks in one, as the estimate for their spend was not divided)

Most certainly there are large usage differences among client firms. However, the recent market growth shows the value of using experts for all segments. Expert network services are not just for finance and strategy consultants, but increasingly popular also among corporate strategy teams, pharmaceutical companies and market research firms.

Some clients still use just one or two legacy expert networks, relying on their databases. That is like using Encyclopædia Britannica - it also didn't age well. New expert networks are capturing market share, by recruiting experts specifically for the client request at hand. Such experts are typically more relevant, less “generic”, which gives the client better insights.

Another old database.

Now back to Google. Inex One is the platform to access more than 25 specialized experts networks. You get access to unique experts, fast and efficiently.

To see it for yourself, check it out here or get a demo.

You might just become client number 4,501!

----------------------

Sources, notes and limitations:

Alphasights website, Third Bridge LinkedIn, Guidepoint website, Capvision prospectus, VisasQ filing p28, Coleman filing 2021-08-18 p19, Prosapient announcement.

We only included a subset of the more than 120 expert networks that exist. If we had included more, the total number of clients estimated would have been higher. However, most smaller expert networks don't publish the number of client firms they serve.

We applied GLG’s client split, because it is the largest expert network and the client split was readily available. However, Alphasights has fewer corporates and consulting clients than GLG, making hedge funds and asset managers a much larger % of their total clients) Using their split would have made our estimate of the two latter segments larger, and the $-spend-per-firm smaller.

The adjustment for “multi-sourcing” is a big assumption, based on what we’ve learned from conversations with hundreds of clients. It might be off, but we think it’s roughly correct. After all, our expertise is expert interviews. ;)