06 Jul 2023

Why Run a Survey?

Many clients ask “Why should I even bother with a survey?”. A lot of insights can be gained from online research and expert interviews. Why would any client spend additional money when an expert can get you all of the information you need?

It’s a fair question.

Let’s break this down further and use an example.

Jane Doe is an associate at Mega Gains Capital, a private equity firm focused on tech investments in Europe. She has been researching a software company, AccountPay International, which offers Payroll and Accounting software to companies across Europe. Jane and her colleagues are working through the standard DD process… legal, HR, financial, etc. Recently, however, she’s been working her way through the commercial due diligence and has also hired consulting firm McKansas & Company to help.

Now, they are diving deeper into the commercial diligence questions… How big is this market? Who are the main competitors? What is the growth outlook? But Jane and her hired consultants are stuck on the customer side… specifically why there isn’t a lot of diversity among AccountPay International’s customers.

Now, there are a few options here for Jane and her consultants:

Run expert interviews with customers & potential customers of AccountPay to understand what they like and don’t like. Given the type of customer and presence across Europe, they’ll likely need to speak with quite a few experts to gather enough information to make an informed decision on the investment.

Or she could run a survey.

What would a survey look like? To start, Jane and her consultants need to define a few things:

What is the goal of the survey?

What questions should they ask?

Who is their Target Audience?

1. Setting the goal:

This seems pretty obvious but is oftentimes overlooked - before you jump straight into writing your questionnaire and getting bids, think about what you want to achieve with your research and what you want to do with the results. Is your goal to validate an hypothesis? Get customer feedback? Find new revenue streams? Without a clear goal you run a high risk of using the wrong methodology, asking the wrong questions, or even targeting the wrong audience (i.e. wasting a lot of money and time).

Going back to Jane’s survey, an unhelpful goal would be “we want to understand what potential customers want with accounting & payroll software”. Instead she and her team should be more explicit “We would like to understand why AccountPay International customer base is made up primarily of businesses with 100 or less employees and how they can add larger customers with 500-1000 employees”

2. Defining your questions:

One of the most undervalued but most important parts of a survey is making sure you ask the right questions. In market research lingo this is called Questionnaire Design or Survey Design and is imperative to get valuable data. There’s a lot of things to consider when writing your questionnaire. To name a few:

Length of your survey - Make sure your survey isn’t too long otherwise you risk survey fatigue (try taking a 30 minute survey online and see how focused you are by minute 25).

Industry best practice is to try and keep the length of an online survey to around 10 minutes.

Avoid leading and biased questions - for example, don’t use “how great were our amazing sales representatives” and instead write “how helpful or unhelpful were our sales representatives”.

Use multiple-choice/closed survey questions where possible.

Use qualifying/screener questions to make sure the right people take your survey.

There’s a lot of great resources to help you write a smart questionnaire. By using Inex One, you can be matched with the right provider who can support you across all parts of the survey lifecycle.

3. Defining the target audience:

When you have a clear goal in mind for your survey, it’s straightforward to define your target audience. In Jane’s case, there could be a few options:

Current customers of AccountPay International across their largest markets

Previous customers of AccountPay International who decided to switch to their competitors

Customers who evaluated AccountPay International but ultimately decided to use another software solution

Potential Customers of AccountPay International

But let’s go back to Jane’s goal “We would like to understand why AccountPay International's customer base is made up primarily of businesses with 100 or less employees and how we can add larger customers with 500-1000 employees”.

Knowing the above, it’s probably helpful for her to survey the following audiences:

Current customers of AccountPay International who have 100 or less employees (what do they like, what are they missing)

Current customers of AccountPay International who have 500 or more employees (what do they like, what are they missing & compare these results with audience type 1)

Current customers of competitors of AccountPay International with 500 or more employees

But couldn’t Jane and her team get this information from a few expert interviews? Well, they could but would the opinion of a handful of companies be representative or significant enough to invest millions of dollars?

Probably not.

Expert interviews are a great way to gather qualitative insights but by running a survey Jane and her team:

Can get insights from hundreds of customers & potential customers within a few days (imagine how long it would take her to complete 50+ of expert interviews).

Utilize a cost-effective method of gathering information quickly and at scale.

Gather quantitative data points to support & inform the qualitative insights they get when interviewing experts.

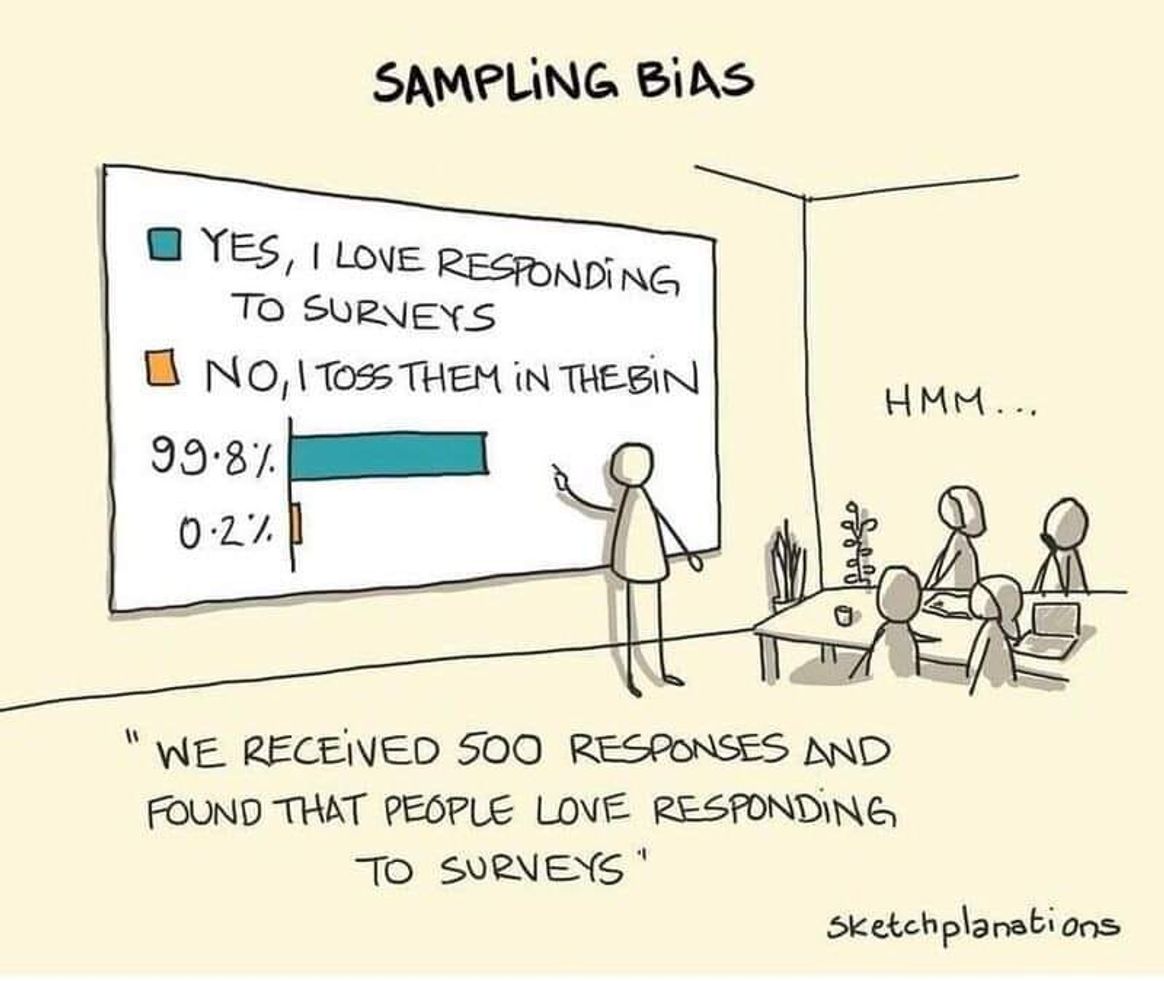

Finally, when talking about audience targeting we always have to mention making sure you use trusted & high quality providers to ensure the right people are taking your survey. Fraud is one of the biggest issues in the survey world and bad data can mean investors spend a lot of time and money and end up with nothing to show for it.

Inex One requires all of our partners to go through an extensive and rigorous onboarding so you know you can rest assured that you’re only getting high quality, trusted results.

So what’s next?

Now that Jane and her team have their research goal, questionnaire objectives, and defined target audience, they are ready to find the right partner to run the survey. Jane could use Google or ask her colleagues, or she can just go to Inex One and launch her project in a few minutes.

In less than a day, she’ll have bids from multiple survey providers and can work with one or as many as she needs to complete her survey. Even better, Inex One handles all of the administrative work of contracting and payments, and the easy-to-use tech platform means that her workflow is painless.

Looking to launch a survey or want to learn more?

Inex One offers a comprehensive solution for your primary research needs, catering to strategy consulting, private equity, market research, corporate sectors and more. With a seamless workstream, access to selected expert networks and survey providers, and a secure insights library, Inex One serves as the ultimate one-stop-shop.

Launch your survey here, or click here to discuss your research needs with our team.