AlphaSense Expert Insights

AlphaSense Expert Insights is an expert transcript library, operated as part of AlphaSense. AlphaSense is a research management system, not to be confused with the expert network AlphaSights.

Alphasense Expert Insights milestones:

Alpha-Sense was founded in 2011 as a platform to analyze financial datasets and documents. This page focuses on the expert network side of the house, which came through an acquisition a decade later:

2020 - Founded as Stream Research Group by the expert network Mosaic Research.

October 2021 - Acquired by AlphaSense for $50 million. They first communicated that Stream would operate as an independent entity, only integrating AlphaSense's text processing tech and cross-selling the content library to AlphaSense's existing clients.

December 2021 - The company rebranded to 'Stream by AlphaSense'.

May 2022 - AlphaSense acquired its competitor Sentieo, the first firm to successfully aggregate GLG, redistributing its expert transcript content. See all historic M&A in the expert network industry here.

2023 - Rebranded to AlphaSense Expert Insights.

June 2024 - AlphaSense said they'll acquire Tegus, its main rival in the expert transcript library business.

July 2024 - AlphaSense acquired the aggregators of market reports Marketresearch.com and Profound.com. There was no formal press release, other than from the seller Freedonia Group saying "it was sold". But as usual, LinkedIn is your friend 🕵♀️

November 2024 - AlphaSense did a round of layoffs that created some noise on LinkedIn. Although not entirely unexpected to rightsize a bit after going on an acquisition spree, this was a new kind of signal from the growth juggernaut as it prepares an IPO.

January 2025: Alphasense got a lawsuit against itself from the expert network Alphasights. The case was for trademark infringement and unfair competition. AlphaSights alleges that the similar names and AlphaSense's use of "AS Expert Insights" are causing widespread confusion among clients and experts. AlphaSights contends that this confusion is damaging its brand reputation, especially when customers are dissatisfied with AlphaSense's directly competing services. In August the same year, the court denied AlphaSense's motion to dismiss key claims, allowing the case for trademark infringement and dilution to proceed.

AlphaSense acquiring Tegus - June 2024

On June 11, 2024, Fortune magazine was first to report the rumors that AlphaSense would acquire Tegus. AlphaSense later confirmed in a press release., saying they valued Tegus at $930 million. If the deal goes through, it consolidates the two biggest players in the expert transcript library industry.

Both firms have been on an acquisition spree:

Tegus, founded in 2016, had raised ~$112m and acquired both BamSEC (2021) and Canalyst (2022). These acquisitions supported its vision of becoming a full-blown research platform for institutional investors - competing with the likes of Bloomberg, FactSet - and AlphaSense.

AlphaSense, founded in 2011, had raised acquired Stream (2021) and Sentieo (2022).

Tegus and AlphaSense had fought a bitter legal battle in the months leading up the acquisition. AlphaSense sued Tegus for copyright infringement in Sep 2023, accusing them for copying its interface and features - specifically related to the interface from BamSEC, which Tegus had acquired 2.5 years earlier. AlphaSense claimed to have suffered from losing 47 customers and price erosion. The litigation was resolved on May 8, 2024, without stating any reason publicly. A month later, the deal rumors were published.

It followed a familiar pattern from when AlphaSense acquired Sentieo in 2022, having first sued it for copyright infringement in 2020.

AlphaSense IPO

AlphaSense has discussed IPO:ing multiple times, including June 2022.

In June 2024, an IPO was rumored to happen "in roughly two years". The company had to first turn profitable, and diversify its client base (beyond institutional investors).

AlphaSense fundraising and client base

AlphaSense has raised about $1,400 million equity financing over multiple rounds:

October 2025: Alphasense stated $500m ARR and 6,500 customers and 200k+ transcripts in the library.

March 2025: Alphasense announced they've reached $400m ARR and 6,000 client firms, including 88% of the S&P 100. It had over 150,000 transcripts in the library.

June 2024: AlphaSense announced the Tegus acquisition and a $650m fundraise co-led by Viking Global and BDT & MSD Partners, alongside many others - notably including Blue Owl, who had already lent >$150m to GLG with two vehicles. The deal valued Tegus at $930m giving the firms a combined valuation of $4 Bn. This means AlphaSense's standalone, pre-cash valuation would be $4 Bn - $930m - $650m = $2,420m. AlphaSense said they had >4,000 customers, while Tegus' website said they had 2,500.

April 2024: The company said it did $200m ARR, and served more than 4,000 customers including >80% of the S&P 100.

Sep 2023: $150m at $2.5 Bn valuation, led by Bond Capital.

April 2023: $100m at $1.8 Bn valuation, led by CapitalG. At the time they had 4,000 customers.

June 2022: $225m at $1.7 Bn valuation, led by Goldman Sachs AM and Viking Global. At the time they had 3,500 customers, including 78% of the S&P 100, and 70% of top AM firms and banks.

Sep 2021: $180m, unknown valuation, led by Viking Global and Goldman Sachs AM.

July 2019: $50m, unknown valuation, led by Innovation Endeavors. At the time it has >1,000 customers including >50% of the S&P 100 and 33 of the 50 largest investment firms.

March 2016: $33m at an unknown valuation, from investors including Tribeca Venture Partners. At the time, it served ">400 investment firms, banks and corporations globally".

AlphaSense pricing

AlphaSense said seats cost between $10,000 and 20,000 each, in an April 2024 Forbes article. In 2023, someone on the internet said $5 - $7k/user and year, which echoes what we heard from clients at the time.

AlphaSense as an Expert call transcript library

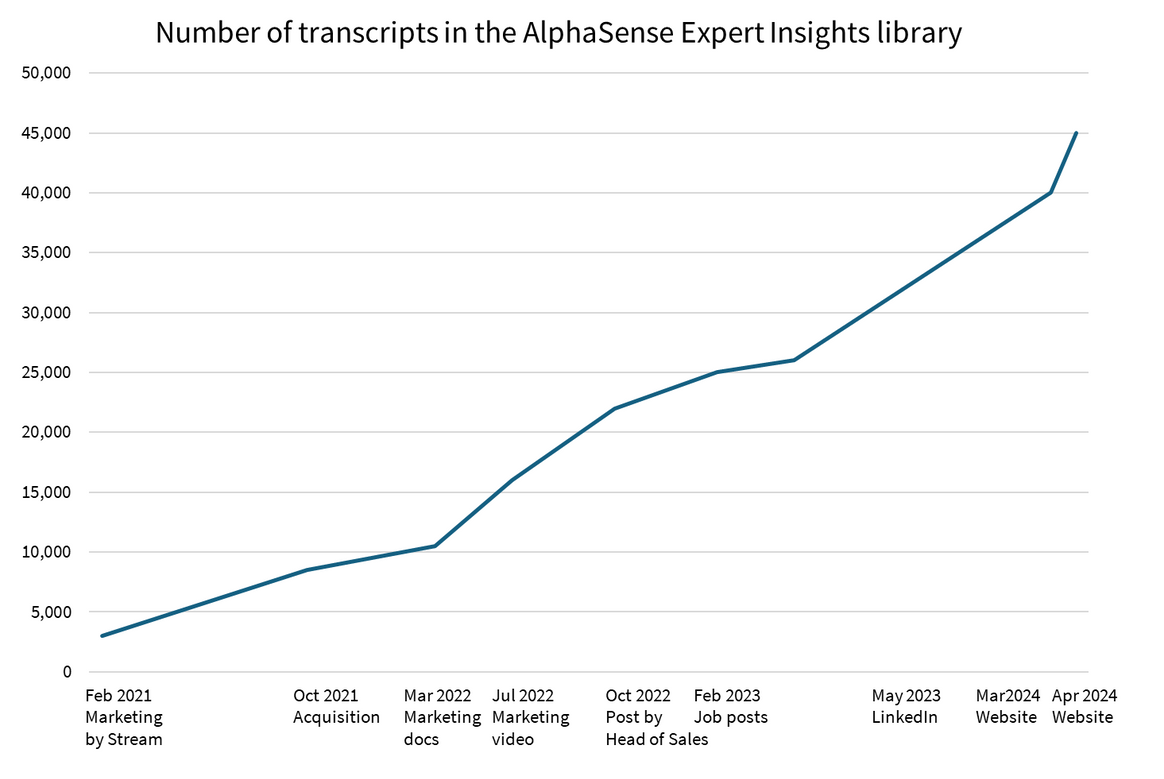

An expert call transcript library is one of the six expert network business models. We've tracked the library's evolution below, by tracking AlphaSense's marketing, website, and LinkedIn posts, e.g.:

In March 2021, Mosaic Stream said the library had around 3,000 transcripts of expert calls, adding almost 300 transcripts/month.

In October 2021, when AlphaSense acquired it, the library had grown to 8,500 transcripts, implying a growth rate of close to 800 new transcripts per month. In March 2022, the service was said to host 10,000+ transcripts.

The AlphaSense Expert Insights model is similar to that of Tegus (which it acquired in Jun 2024): investment professionals and company employees conduct expert calls (at low or no cost) which are transcribed and added to a library. Other investors subscribe to the library, and may conduct expert calls as well.

Early on, some experts claimed they were not getting compensated for their participation.

Mosaic Research independent contributor on Twitter

Other content libraries from Third Bridge (Forum), Guidepoint, GLG, and In Practise. Content on these platforms was originally entirely generated by analysts employed at the expert networks, but at least Third Bridge has started blending in user-generated content.

Conversely, firms that use Inex One accumulate their internal content libraries. All calls done on Inex One are recorded and transcribed (for free), and stored on your proprietary transcript library. While this is not shared with anyone outside of your firm, you may choose to make it available to your colleagues. This way you avoid doing the same call twice, and can quickly share learnings within the firm.