Tegus Expert Network

Tegus is an expert network based in Chicago, where it relocated from San Francisco in 2018. It was started in 2016 by two brothers with backgrounds in finance and at AlphaSights, another expert network. Tegus runs an expert transcript library, with 100k transcripts in May 2024. In June 2024, AlphaSense announced they acquired Tegus in a deal valuing the company to $930m.

Looking to use an expert network like Tegus? Try these resources:

The history of Tegus

In addition to a standard expert network service, Tegus offers an expert transcripts library similar to Third Bridge‘s Forum product, AlphaSense, and services offered by GLG, Guidepoint, and In Practise. These calls are to large part generated by Tegus customers, who get discounted rates in exchange for allowing their calls to be recorded, transcribed, and resold to Tegus subscribers.

Conversely, firms that use Inex One accumulate their internal content libraries. All calls done on Inex One are recorded and transcribed (for free), and stored on your proprietary transcript library. While this is not shared with anyone outside of your firm, you may choose to make it available to your colleagues. This way you avoid doing the same call twice, and can quickly share learnings across the firm.

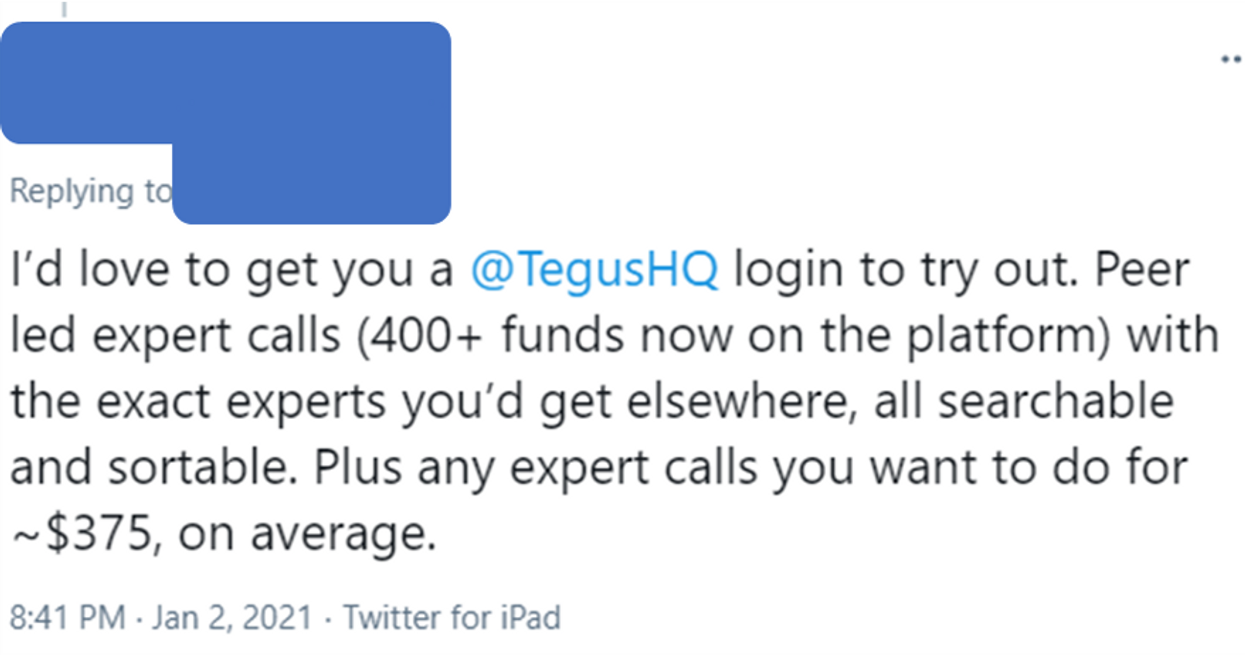

Tegus has a strong followership on "fintwit", where independent investors laud the company's accessibility and service level. Really nice vibes, and a testament to Tegus truly making expert insights accessible, notably in the hedge fund and growth equity segments where lots of funds look at the same assets.

Tegus pricing

The Tegus CFO described the business model in a couple tweets early January 2021, shown below. Tegus prices subscriptions based on fund AuM, starting at $20-25,000 per user and year. If both the client and the expert agree to have your calls published to all Tegus customers, you pay $550/call (on top of the $25,000 "starter fee").

After being acquired by Alphasense in 2024, Tegus materially raised prices. Many customers have switched to Inex One, claiming the pay-per-use pricing and access to multiple expert networks in one platform was a better fit.

Tegus traction

Tegus shares traction data on Twitter and in press releases. Put together, the announcements tell a nice growth story. The database has grown to include 100,000+ transcripts as of April 2024, with 3,500 new transcripts added every month. We tracked it below:

Transcripts on the Tegus database and growth rate, data from Tegus ads, interviews and Twitter

Something happened in Q1 2024. Either Tegus had a blowout quarter despite (according to Glassdoor reviews) slowing growth and competitors catching up, or it changed the way it counts its transcripts.

In just 5 months, the database grew from 65,000 to 100,000 transcripts, an implied growth of 7,000 new transcripts/month. Meanwhile, in the April press release, Tegus said it produced nearly 3,500 calls per month. 🤔 Anyhow, here's the growth graph, using the Tegus template.

Tegus revenue estimates

In October 2024, the CFO left and stated on LinkedIn that the firm "ultimately reached >$120m ARR", and sold for $930m. This implies a 7.75x revenue multiple.

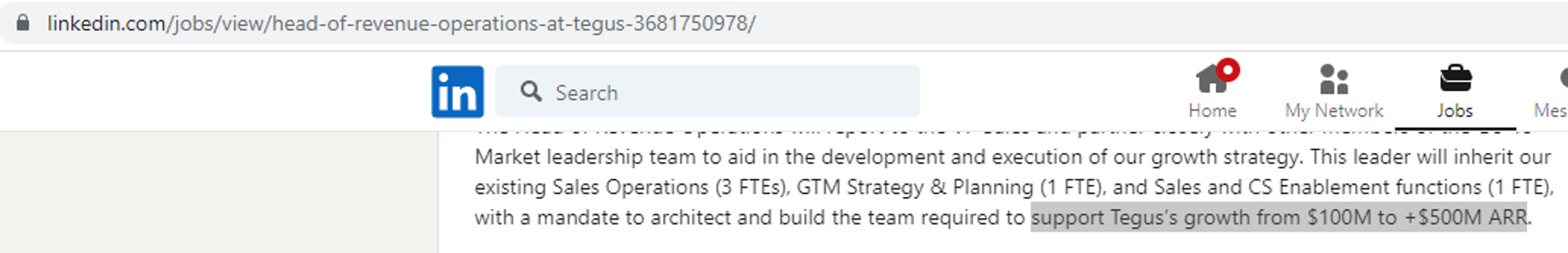

In August 2023, Tegus stated that it generates $100m ARR, when hiring for a Head of Revenue Operations (pictured).

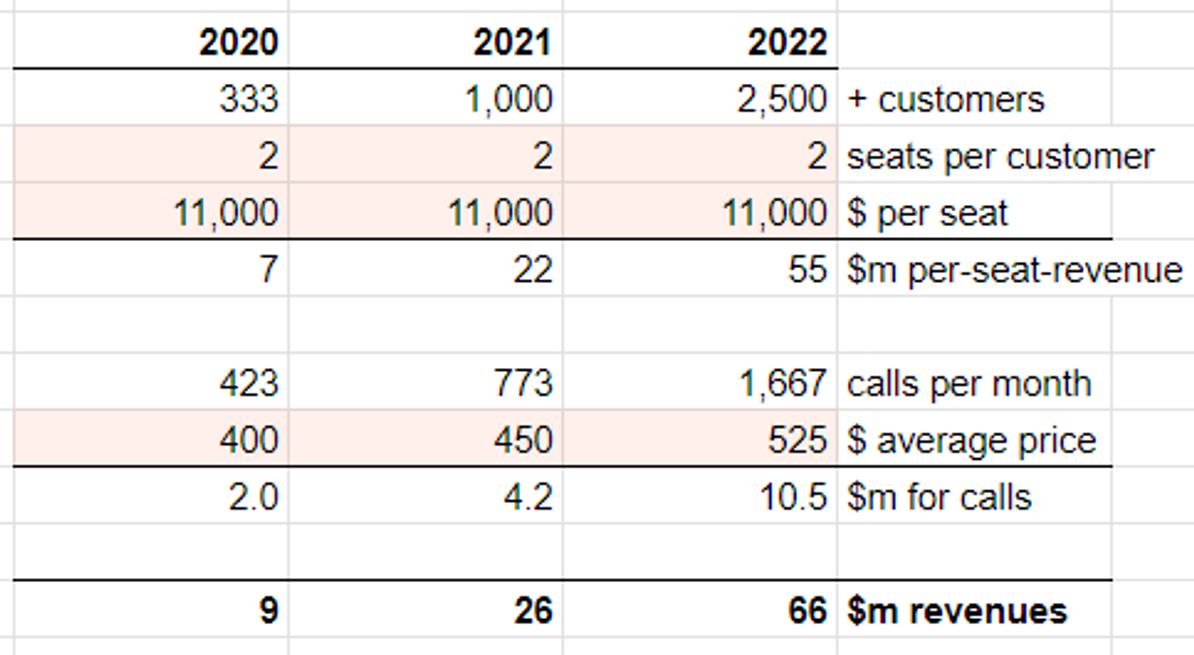

In 2022, we estimated that Tegus does $66m of revenues for the full year. Were we sure about this? Not really - the big unknown is how many users are paying for platform access, and how much they pay.

When estimating Tegus' revenues, the unknown "X-factor" is #seats/customer followed by $/seat. Pink cells are estimates.

Sensitivity check (what would change the numbers?)

Number of seats per fund: Most Tegus customers are family offices, (smaller) hedge funds and growth equity funds, which is why we estimate 2 seats/customer. This might be too high, or too conservative, and has big impact on total rev estimates.

Fee per seat: $11,000/seat, as we've modelled, is comparable with the fees for Factset, with other terminals being more expensive. We know from user interviews that Tegus offers attractive deals to grow the user base, which is why we assume their effective per-seat fee is about half of the list price.

Highlights and notes

Tegus was founded in 2016, based in San Francisco.

The company raised $1.5m in 2017 from Investment Group Santa Barbara, at a $4.5m post-money valuation.

In 2018, Tegus moved its HQ to Chicago.

March 2019 it made an announcement it was planning to hire 100 additional employees by 2020.

In October 2021, Tegus acquired BamSEC, a research tool for indexing and browsing SEC filings. The deal has many similarities to the Alphasense-Stream acquisition, combining expert transcript content with a tool to index and browse them.

In November 2021, Tegus raised $90m in series B from Oberndorf Enterprises and Willoughby Capital. At a supposed valuation of $3 Bn+, this means the investors got a ~3% stake. The funds were said to be used for further growth and to broaden the data offering and product suite.

Late 2021, Tegus announced in job postings that revenues had tripled and that they were on track for a near-term IPO.

In August 2022, Tegus acquired Canalyst, a platform for ready-made financial models and company data.

In September 2022, Tegus raised a $20m topup round from Positive Sum, the VC firm of investor Patrick O'Shaughnessy. The investment might have been made earlier, as Patrick has played ads for Tegus on his podcast (recommended!) for a couple years.

In the same month, Tegus' CTO and Chief Product Officer left the firm.

In Q4 2023, Tegus laid off 10-15% of the workforce having not seen all the growth it had expected, according to Glassdoor reviews.

In April 2024, Tegus announced their database reached 100,000 transcripts.

In June 2024, Tegus and AlphaSense both announced their intention to merge, in a deal valuing Tegus to $930m, and AlphaSense to $2,420m. Among the investors were Blue Owl, a "BDC" lender that had also lent >$150m to GLG with two vehicles.

Curiously, still in September, the two (now merged) firms were bidding against each other in Google search results. This might be a mistake by the marketing teams, or reflect some earn-out clause for Tegus.

We identified Tegus as a regional challenger in our review of the 2019-2024 expert network market size. Regional challengers are separated from other smaller expert networks by merit of their growth and/or business model.