29 Feb 2024

Expert network market size

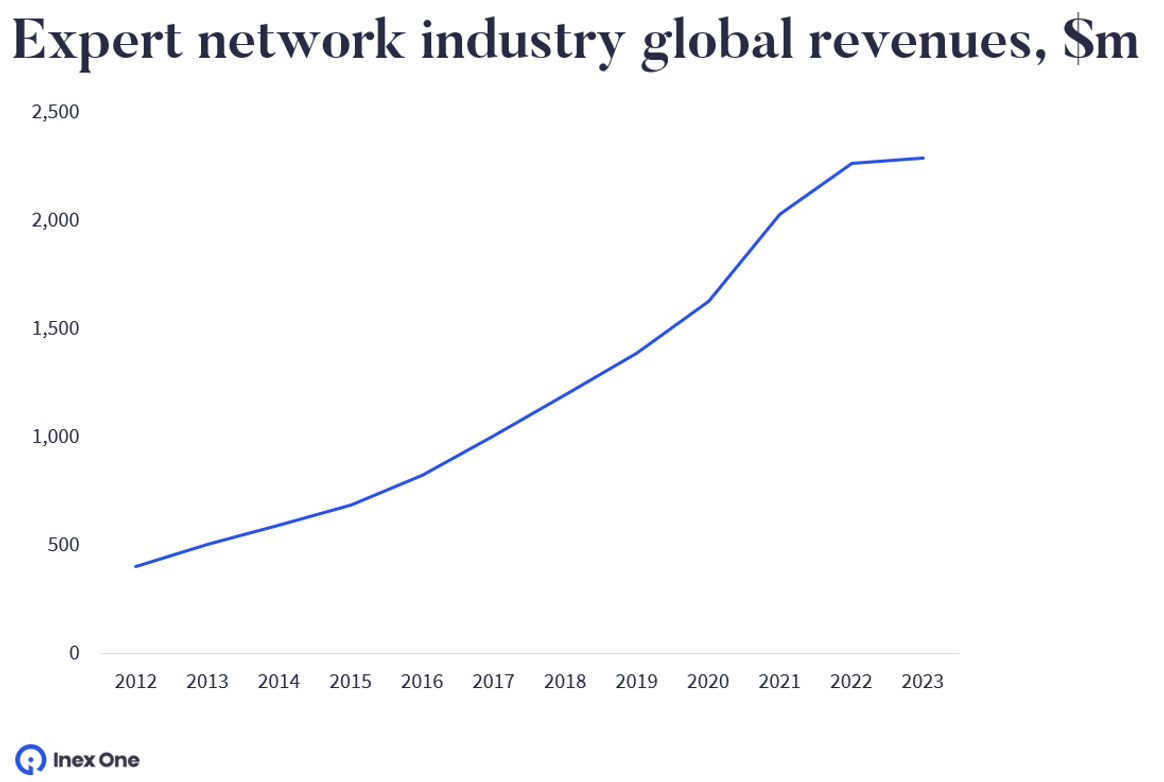

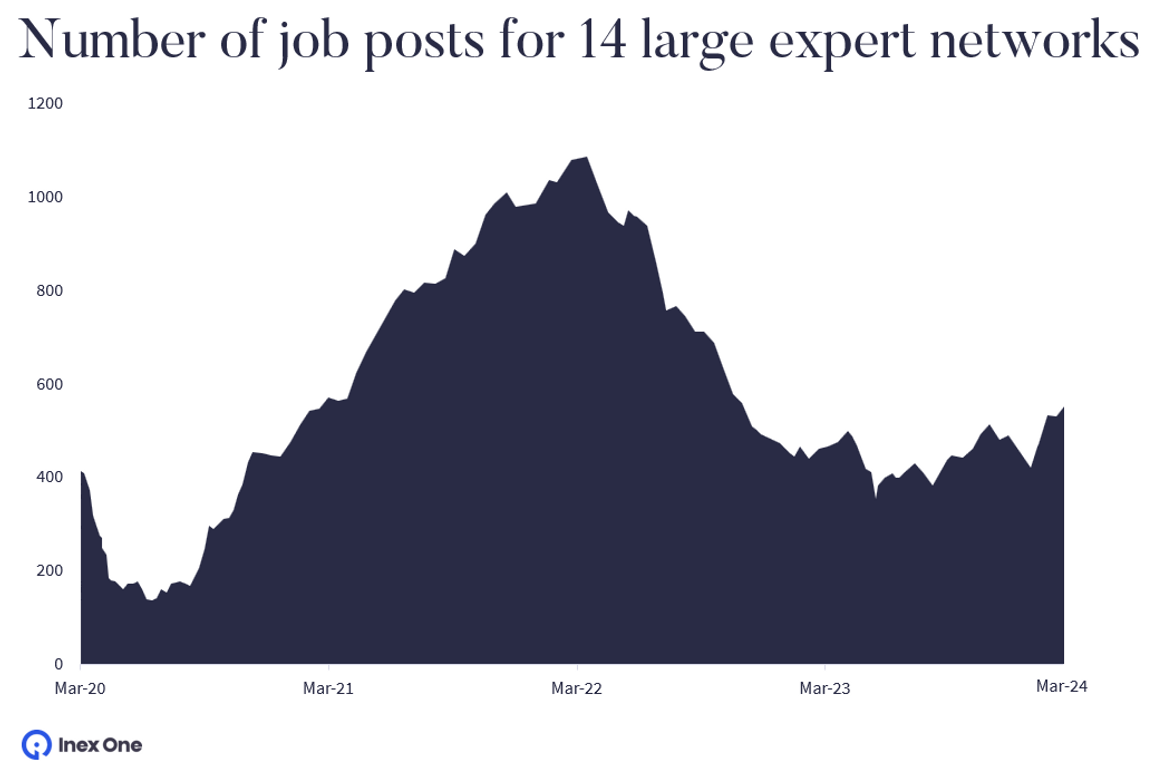

The expert network industry grew by 1% in 2023. Years of rapid expansion came to an end as private equity deal volumes dropped, consulting CDDs dried up, and corporate budgets got reined in. Still, the industry held up as revenues surpassed $2.28 Bn in 2023, generated by about 120 expert networks worldwide.

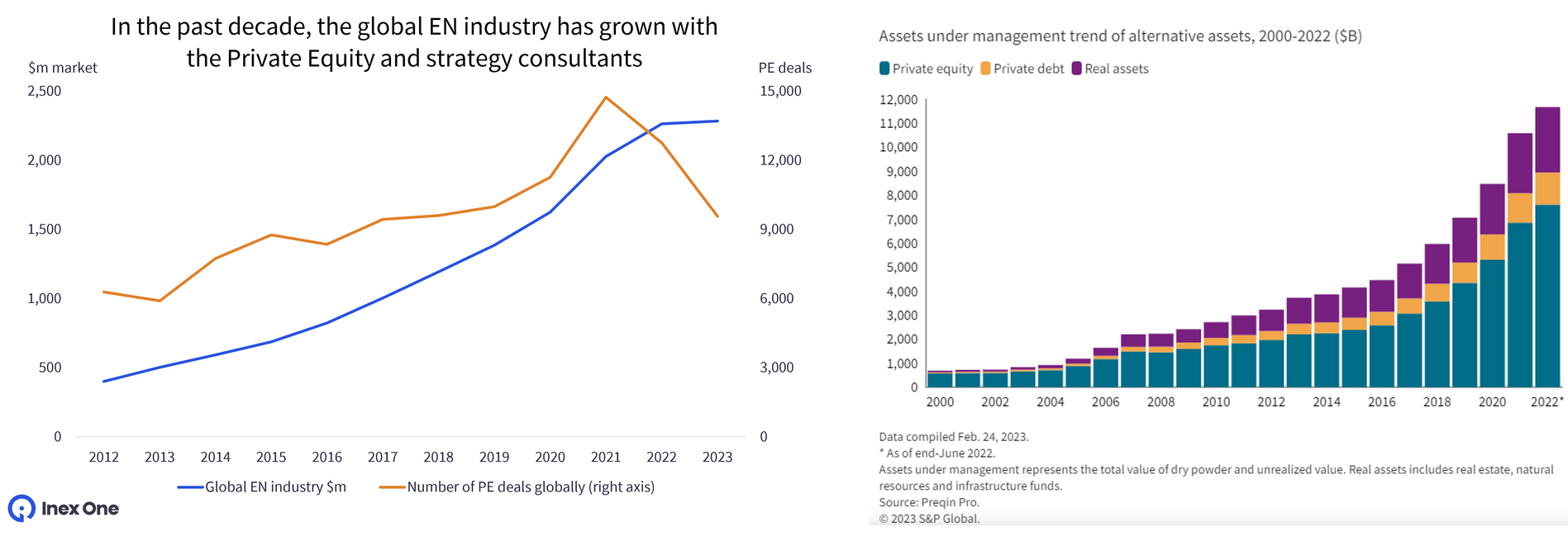

The industry has seen 16% average growth since 2015, mainly driven by widespread adoption of expert networks in the growing private equity industry and the strategy consultants they engage. Other client groups contributing to overall industry growth were corporate strategy and market research teams (many firms entirely new to the service), and hedge funds and asset managers (increasing their usage).

A pandemic-induced dip in H1 2020 was recovered by even stronger growth in 2020-21, only to slow down in 2022 and 2023 as global deal activity fell.

We approached this market sizing as a CDD consultant would do: by analyzing public financial reports, IPO filings, benchmarks of available data and - of course – hundreds of expert interviews over the years. Thank you to everyone who contributed with insights!

Looking to start using an expert network? Try these resources:

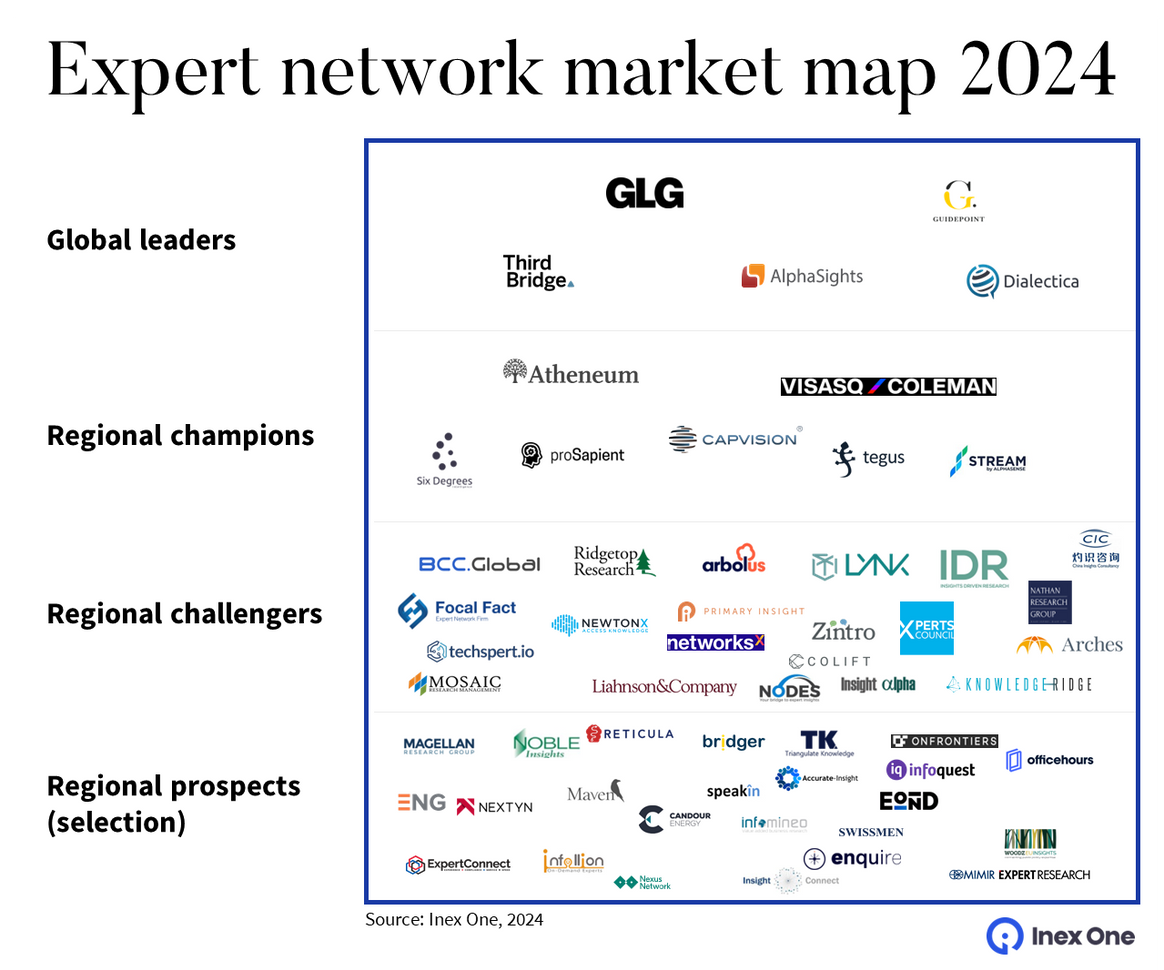

Global expert network market 2024

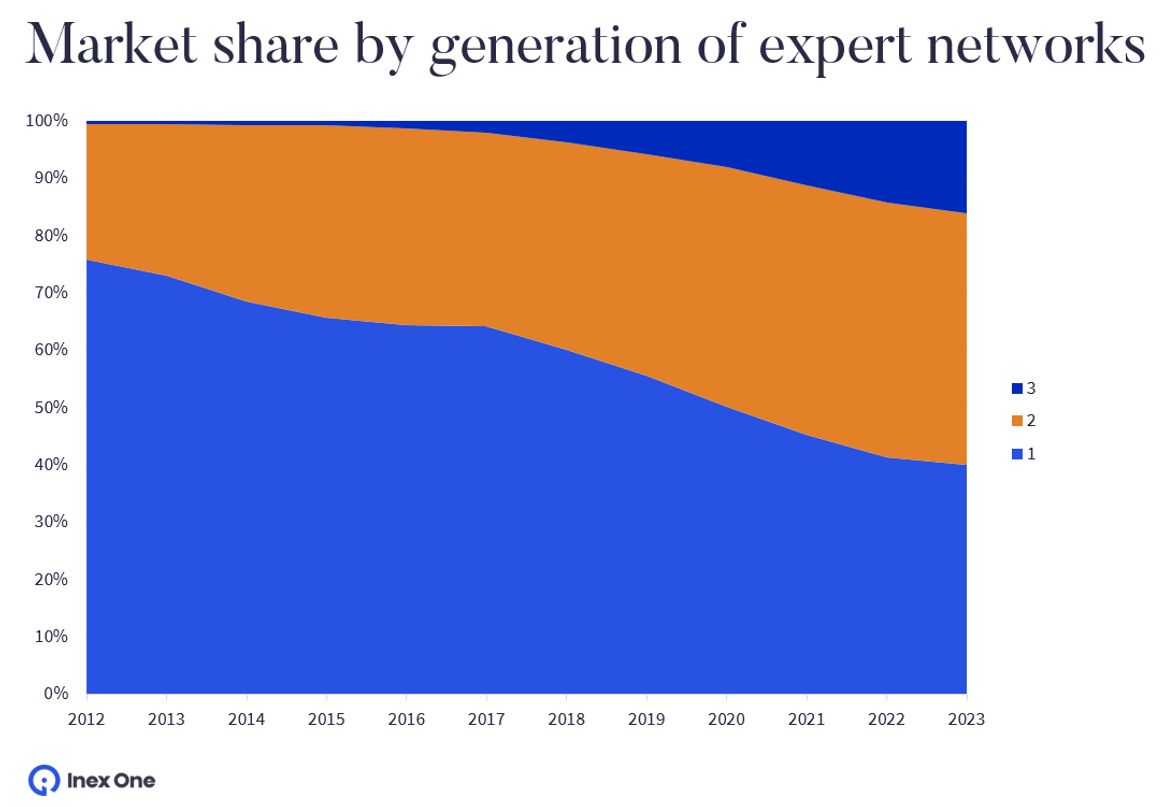

GLG remains the largest player in an increasingly crowded market, but has struggled with growth lately. Consequently, competitors are chipping away at GLG’s previously dominant market share.

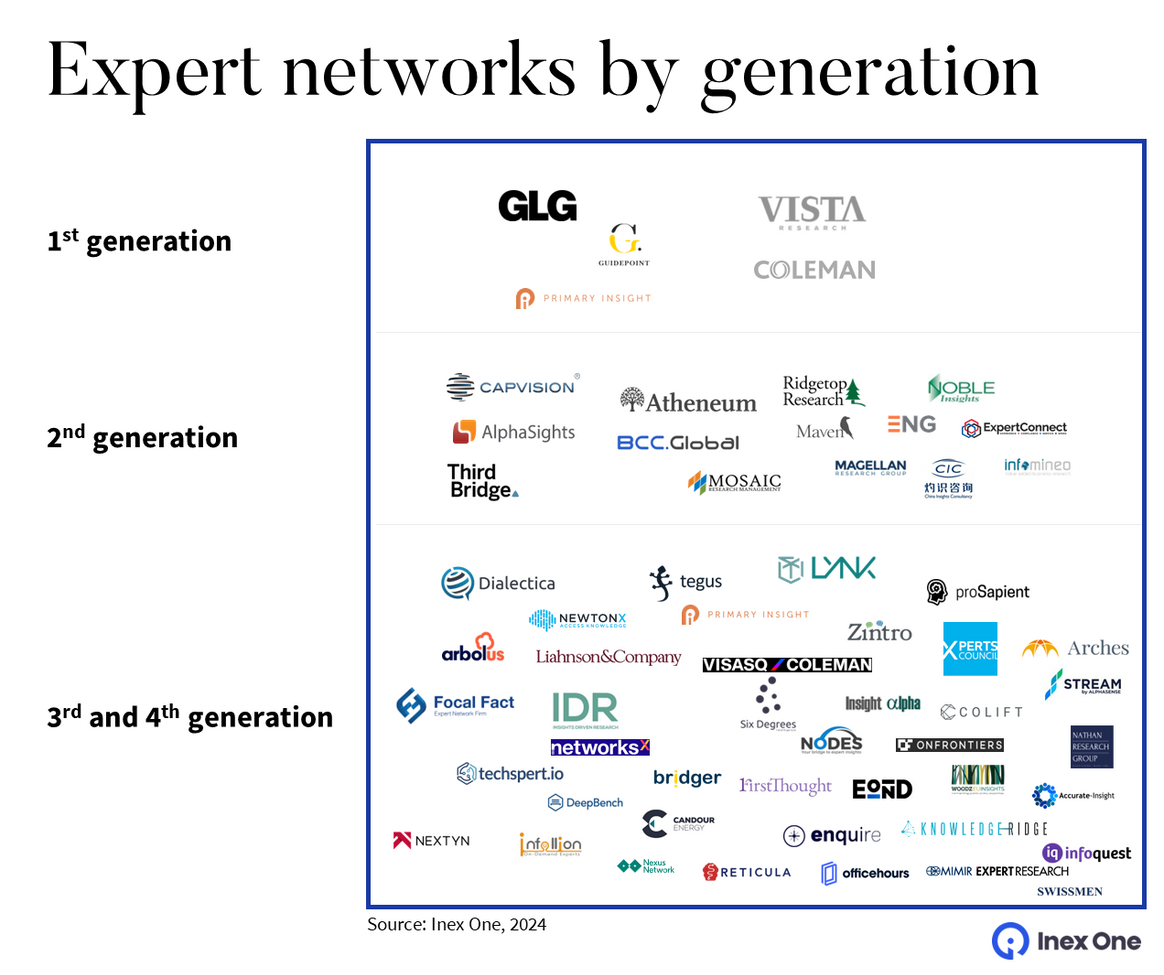

Over the industry’s 25 years, four broad generations of expert networks have emerged. Each generation has built on previous generations’ successes, while altering the operating model and/or focused on underserved client segments.

1st generation expert networks

The first expert networks were all founded around the turn of the century. These included GLG (1998), Vista Research (2001), Coleman (2003), Guidepoint (2003), Primary Insight (2005), and a few more. These trail blazers of the industry were all New York-based, building a proprietary offline rolodex of experts that they would resell to primarily public market investors (hedge funds, asset managers), family offices, and banks/brokers. The founders mostly had a background in hedge funds, banks/brokers, and financial data companies.

2nd generation expert networks

Seeing the success of early expert networks, a new generation sprung up from 2006 onwards. The founders had often been clients of the 1st-gen networks, e.g. strategy consultants as the founders of Capvision (2006; Bain), Third Bridge (2007; Bain), Alphasights (2008; Bain, McKinsey), Atheneum (2010; Kaiser Associates, McKinsey), BCC Global (2008; McKinsey), or employees, e.g. Mosaic Research (2010; Vista), Ridgetop (2008; Vista), Maven Research (2008; GLG), Magellan (2014; Alphasights).

The 2nd gen expert networks initially struggled to break into the investment clients, as 1st gen networks were already entrenched. So instead, these newer expert networks focused on Private Equity clients, who were just starting a long bull-run, and the strategy consultants they employed.

Every client segment behaves differently. While institutional investors had predictable research needs around earnings releases, PEs and Consultants had faster-moving projects that could start “whenever”. They also researched more niche and ever-changing industries, so expert networks had to do more custom-recruiting. 2nd generation expert networks focused on this and excelled.

3rd generation expert networks

A new generation of expert networks sprung up in the mid-2010’s, often founded by former employees at incumbent networks. These firms used modern technology (either internally built or building on top of Inex One), with Tegus and AlphaSense Expert Insights (fka. Stream) going for entirely new operating models. They focused primarily on strategy consultants, and the emerging corporate strategy segment. Many of them successfully targeted a niche – whether a region, an industry segment, or more price-sensitive client segments.

3rd generation expert networks include Dialectica (2015; ex-Alphasights), Techspert (2015), Lynk (2015; ex-GLG investor), Liahnson (2015, ex-GLG), NewtonX (2016, ex-McKinsey), Prosapient (2018; ex-Coleman), Tegus (2016; ex-Alphasights), SixDegrees (2017; ex-Third Bridge), Focal Fact (2018; ex-GLG), Arbolus (2018; ex-Alphasights), Bridger (2019; ex-Guidepoint), FirstThought (2019, ex-Guidepoint), Nodes (2019; ex-GLG), Arches (2019; ex-Accenture), NetworksX (2020; ex-Third Bridge), Triangulate Knowledge (2020, ex-GLG) IDR (2020, ex-Atheneum), Colift (2021).

Also Inex One (2018) is in the 3rd generation. While it's not an expert network itself, it solves the same "job to be done" for clients: getting great experts fast, and run B2B surveys. Inex One partners with some of the best expert networks across generations, who sell their expert services on the platform.

4th generation expert networks

More recently, we’ve seen additional entrants, again founded by people with a background at incumbent expert networks. Some firms that we’ve identified extra potential in are Infoquest (2023; ex-Dialectica), Reticula (2023; ex-Dialectica), Swissmen (2023; ex-Guidepoint), and ENCO Insights (2023; ex-Prosapient).

See a mapping of all expert networks started out of other firms here.

Regional breakdown

Another way to look at the market is by regional presence. Most expert networks aspire to have global coverage, but they all have strengths and weaknesses. Most firms are stronger in the regions where they started out, than overseas. We identify five firms as global leaders, with sufficiently strong global presence. Dialectica made the category for the first time this year.

“Regional champions” are expert networks with a strong foothold in their respective regions or industry verticals, while also offering global services. For example, Capvision and SixDegrees have a strong position in China, despite Capvision’s recent raids. Correspondingly, VisasQ is dominant in Japan and recently acquired Coleman, with its relative strength with US asset managers. Prosapient and Atheneum have significant market share in Europe (especially within consulting firms). Tegus and Alphasense Expert Insights have built strong presence in the coveted US public investment segment, and beyond.

Regional challengers and other small firms

Among the 100+ smaller expert networks, most have chosen one of three tracks: (1) serving a specific region, (2) industry segment, or (3) applying a different business model. We find a handful being particularly strong – these are the “regional challengers” separated from the larger “regional prospects” category.

Some networks have been around for a decade or more; others are brand new. Together, they make up the global expert network industry.

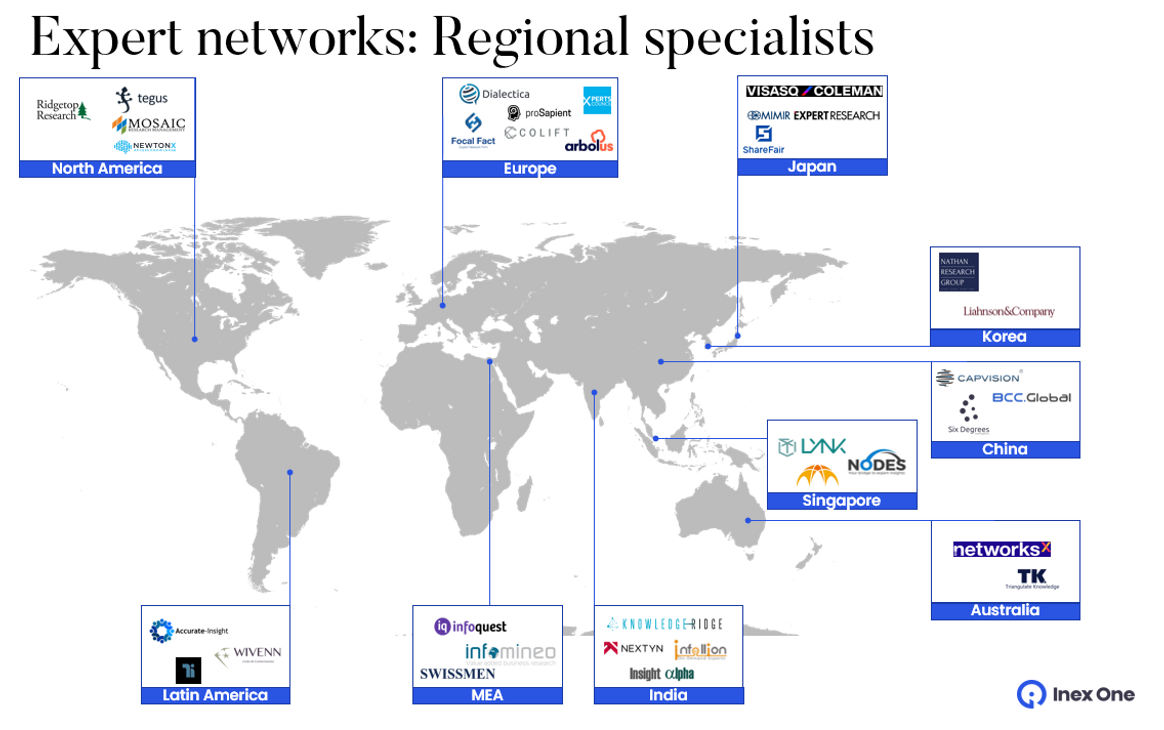

Expert networks specialized by region

Many expert networks focus on a particular region, where they have a stronger footprint than others. Notable firms are pictured below. Firms like VisasQ and Mimir are strong in Japan, whereas Lynk, Nodes, Liahnson each cover different parts of Southeast Asia. Infomineo and Infoquest have a rare focus on the Middle East, as do Accurate Insights and Wivenn in Brazil. Europe has a number of firms with a particular strength in their home market, such as Colift and EPH in Germany, Xperts Council in France and Prosapient, Arbolus and Focal Fact in the UK.

Who are the customers of expert networks?

Expert networks started out in the early 2000’s with serving the hedge fund community. The services were soon in demand also in the wider financial industry, reaching private equity firms, asset managers, banks and consultants. We estimated that about 4,500 firms use expert networks in early 2022. The market is driven by a few fundamental trends:

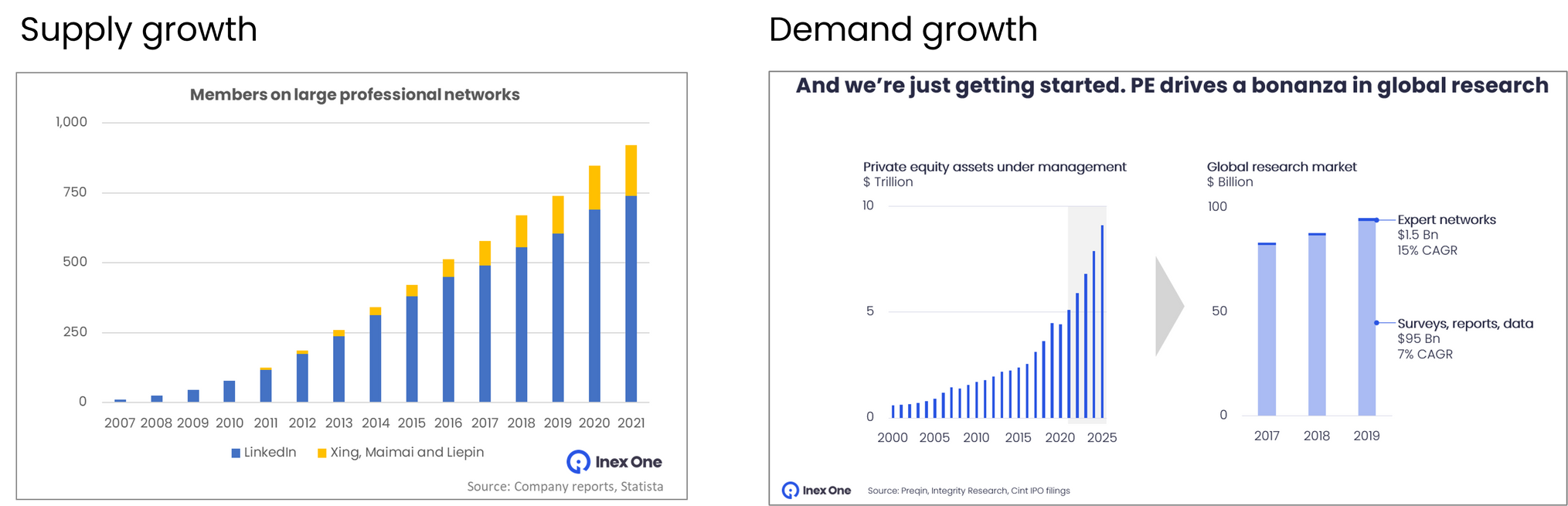

Increased supply - as more experts can be found online, and are increasingly open to the concept of micro-consulting.

Increased demand. 1) A phenomenal growth in private equity assets under management fuels spend on deal analysis by both PE firms and the consultants that they engage. 2) Corporate strategy teams are increasingly accessing expert networks to inform their decisions. 3) Market researchers have been repeatedly upset by mediocre B2C sample quality. They increasingly shift their attention and spending to the qualified B2B respondents of expert networks.

Expert network supply and demand - access to experts and a growing market of buyers (2nd slide is from our old funding deck)

Firms that predominantly serve consulting and PE firms (e.g. AlphaSights, Dialectica, Inex One and partners) are among the fastest-growing in the industry, compared to firms with a larger asset management business (e.g. GLG, Ridgetop and Coleman). That said, these same firms seem to have taken the biggest hit as consulting spend dropped off in 2022.

In recent years, the asset management segment has also shifted part of their spend to transcript libraries, driving strong growth for players offering those.

We split the market in four broad segments: consulting, asset management (including hedge funds, long only funds, SWFs, IMs and family offices), private equity, and corporates. In 2023, we estimated consulting to be the largest segment at 45%. For further detail, you may purchase the 2024 market sizing dataset here.

What is next for expert networks?

The expert network industry is continuously evolving. Since we discussed industry consolidation v. fragmentation in 2018, the fragmentation case has had the upper hand. Fears that the industry reaches maturity come and go as the industry swings from frantic growth to temporary (?) slowdowns.

The industry has kept growing through multiple economic cycles and crises. However, competitive pressure is evidently mounting for older networks:

Firstly, the ease of finding experts attracts new entrants to the market. This risks creating a fatigue both among experts (receiving too many identical requests) and among clients (receiving too many similar sales pitches), and margin-eroding competition as indicated in the GLG S-1.

Secondly, Inex One enables a more efficient market, driving business to high-performing expert networks, away from legacy operators. These firms are often specialists on certain geographies and industries, giving superior service quality to their clients.

At Inex One, we're excited about the growth of the expert network industry, and our contribution to making it efficient. Do you want to be part of this change? Read the reviews of Inex One, or contact us today!